Question: Finance Case Study Benajmin and Sarah Redding need help with a couple questions. Thank you! If someone could help me out with questions 5-10 that

Finance Case Study Benajmin and Sarah Redding need help with a couple questions. Thank you!

If someone could help me out with questions 5-10 that would be greatly appreciated. I am beyond confused. Thank you in advance!

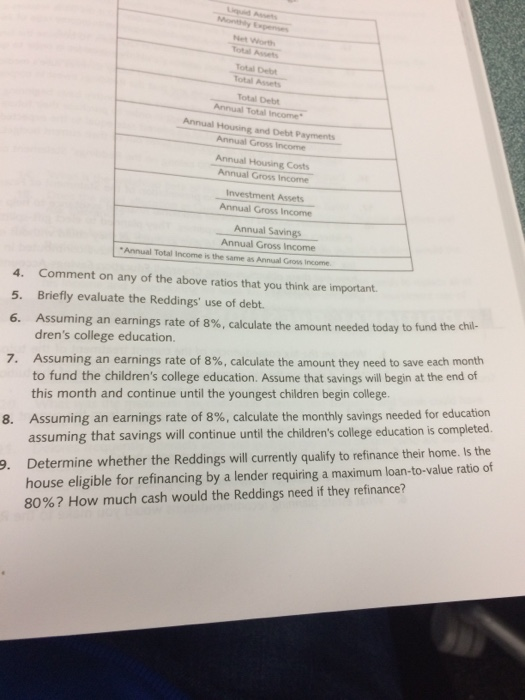

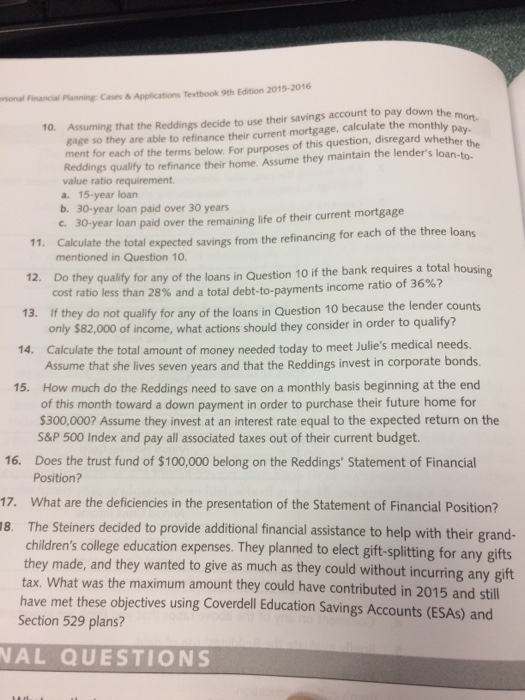

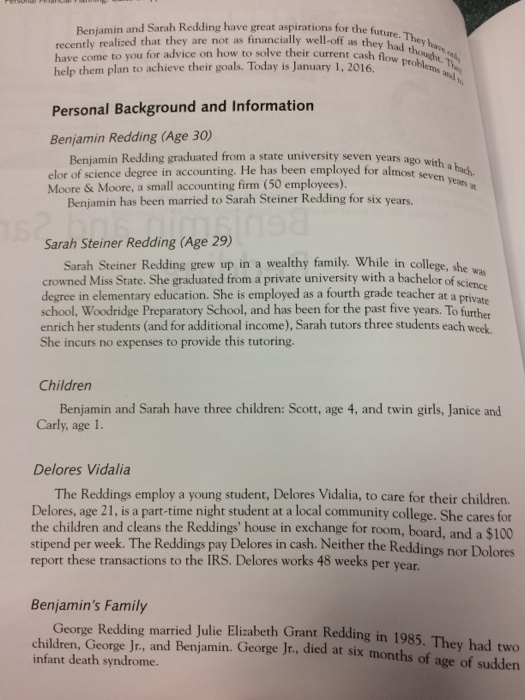

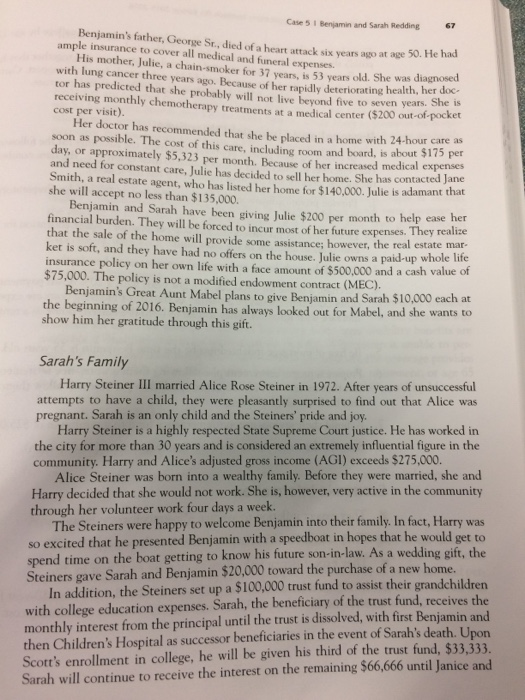

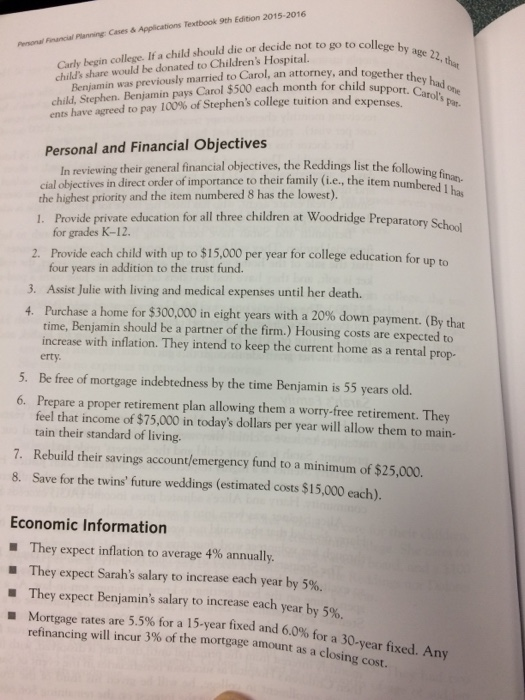

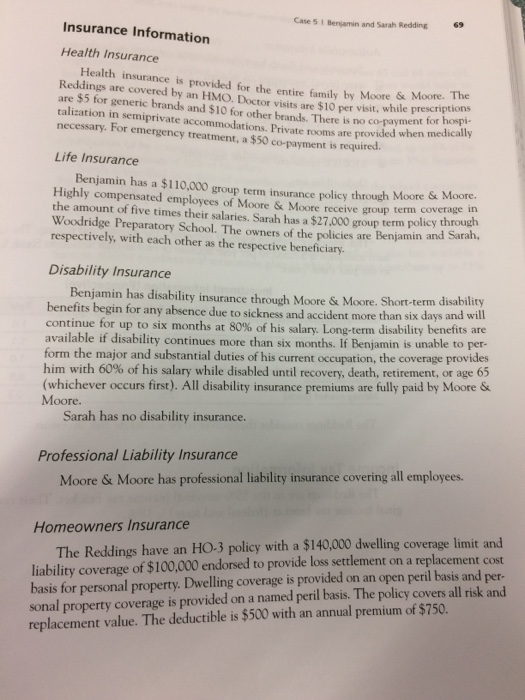

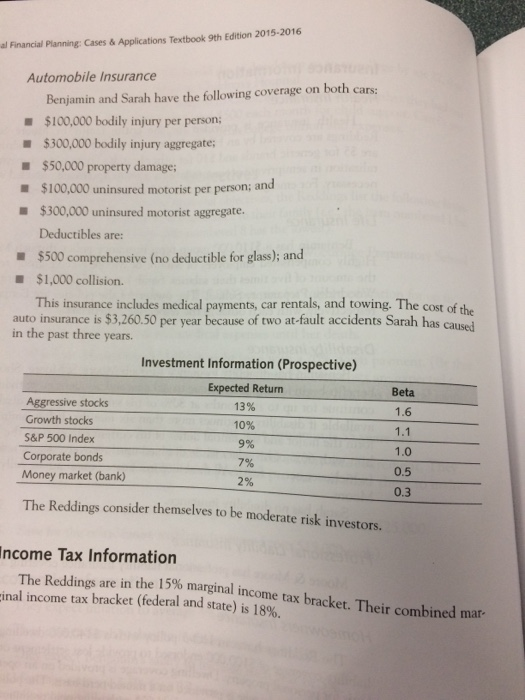

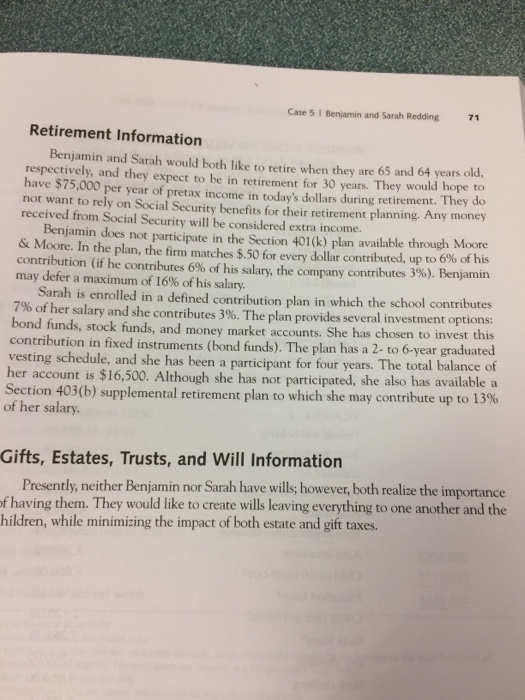

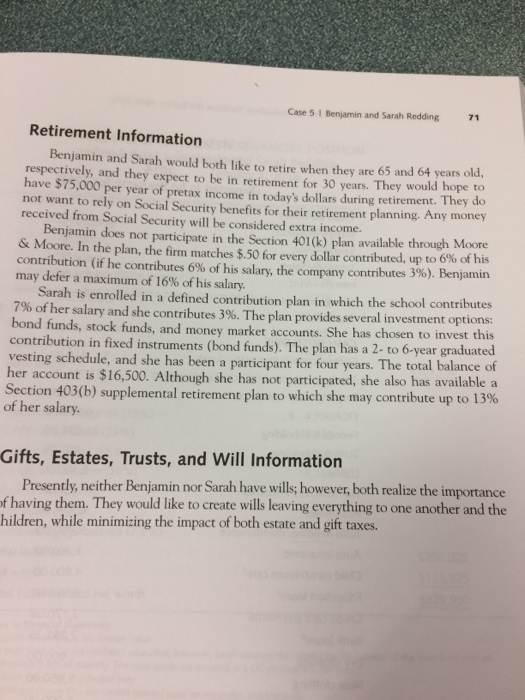

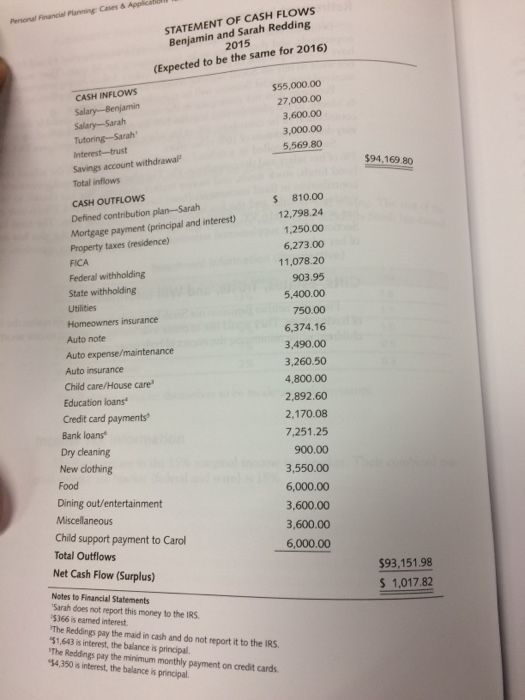

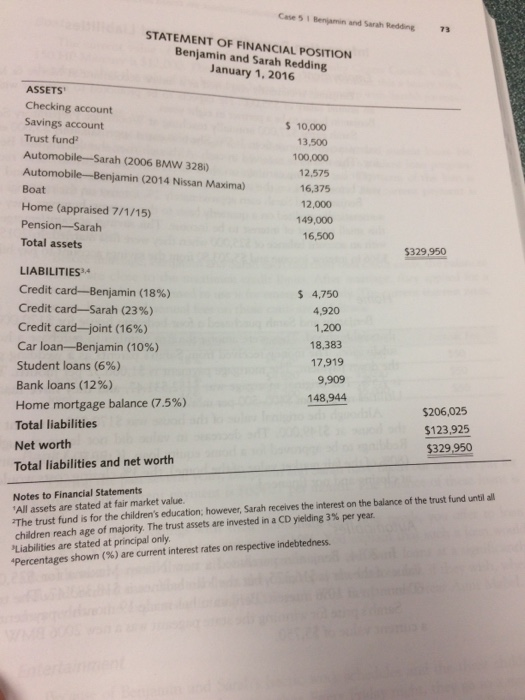

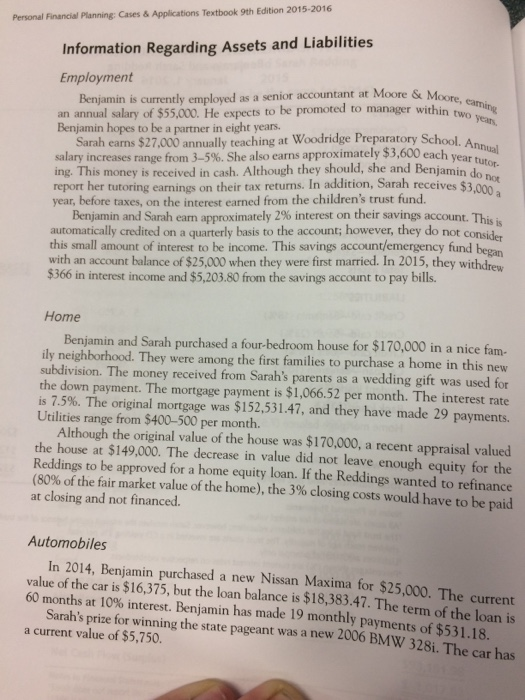

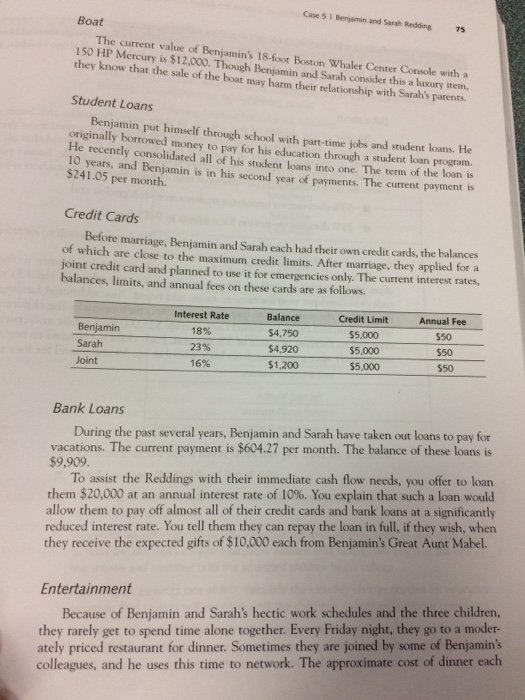

Net Worth Total Asser Total Det Total Assets Total Debt Annual Total Income Annual Housing and Debt Payments Annual Gross Income Annual Annual Gross Income Housing Costs Investment Assets Annual Gross Income Annual Savings Annual Gross Income Annual Total Income is the same as Annual Gros income. Comment on any of the above ratios that you think are important. Briefly evaluate the Reddings' use of debt. Assuming an earnings rate of 8%, calculate the amount needed today to fund the chi- dren's college education. Assuming an earnings rate of 8%, calculate the amount they need to save each month to fund the children's college education. Assume that savings will begin at the end of this month and continue until the youngest children begin college. 4. 5. 6. 7. Assuming an earnings rate of 8%, calculate the monthly savings needed for education assuming that savings will continue until the children's college education is completed. 8. Determine whether the Reddings will currently qualify to refinance their home. Is the house eligible for refinancing by a lender requiring a maximum loan-to-value ratio of 80% ? How much cash would the Reddings need if they refinance? 9. monal Financial Planning Cases& Applications Textbook 9th Edition 2015-2016 mort- 10. Assuming that the Reddings decide to use their savings account to pay down the gage so they are able to refinance their current mortgage, calculate the monthly the ment for each of the terms below. For purposes of this question, disregard whether to refinance their home. Assume they maintain the lenders value ratio requirement a. 15-year loan b. 30-year loan paid over 30 years 30-year loan paid over the remaining life of their current mortgage Calculate the total expected savings from the refinancing for each of the three loans 11. mentioned in Question 10. Do they qualify for any of the loans in Question 10 if the bank requires a total housing cost ratio less than 28% and a total debt-to-payments income ratio of 36%? If they do not qualify for any of the loans in Question 10 because the lender counts only $82,000 of income, what actions should they consider in order to qualify? 12. 13. 14. Calculate the total amount of money needed today to meet Julie's medical needs. Assume that she lives seven years and that the Reddings invest in corporate bonds. How much do the Reddings need to save on a monthly basis beginning at the end 300,000? Assume they invest at an interest rate equal to the expected return on the 15. of this month toward a down payment in order to purchase their future home for S&P 500 Index and pay all associated taxes out of their current budget Position? 16. Does the trust fund of $100,000 belong on the Reddings' Statement of Financial 17. What are the deficiencies in the presentation of the Statement of Financial Position? 8. The Steiners decided to provide additional financial assistance to help with their grand- children's college education expenses. They planned to elect gift-splitting for any gifts they made, and they wanted to give as much as they could without incurring any gift tax. What was the maximum amount they could have contributed in 2015 and still have met these objectives using Coverdell Education Savings Accounts (ESAs) and Section 529 plans? NAL QUESTIONS Benjamin and Sarah Redding have great aspirations for the future recently realized that they are not as financially well-off as they had hey a have come to you for advice on how to solve their current cash flow problicht. help them plan to achieve their goals. Today is January 1, 2016, proble Personal Background and Information Benjamin Redding (Age 30) Benjamin Redding graduated from a state university seven years ago with elor of science degree in accounting. He has been employed for almost seven ach years at Moore & Moore, a small accounting firm (50 employees). Benjamin has been married to Sarah Steiner Redding for six years. Sarah Steiner Redding (Age 29) degree in elementary education. She is employed as a fourth grade teacher at She incurs no expenses to provide this tutoring. Sarah Steiner Redding grew up in a wealthy family. While in college, she crowned Miss State. She graduated from a private university with a bachelor of kiehst school, Woodridge Preparatory School, and has been for the past five years. To further enrich her students (and for additional income), Sarah tutors three students each week science a private Children Benjamin and Sarah have three children: Scott, age 4, and twin girls, Janice and Carly, age 1. Delores Vidalia The Reddings employ a young student, Delores Vidalia, to care for their children. Delores, age 21, is a part-time night student at a local community college. She cares for the children and cleans the Reddings' house in exchange for room, board, and a $100 stipend per week. The Reddings pay Delores in cash. Neither the Reddinos or Dolores report these transactions to the IRS. Delores works 48 weeks per year. Benjamin's Family George Redding married Julie Elizabeth Grant Redding in 1985. They had two children, George Jr., and Benjamin. George Jr., died at six months of age of sudden infant death syndrome. Case 5 I Benjamin and Sarah Redding 67 Benjamin's father, George Sr., died of a heart attack six years ago ample insurance to cover all medical and funeral expenses at age 50. He had His mother, Julie, a chain-smoker for 37 with lung cancer three years ago. Because of her rapidly deteriorating tor has predicted years, is 53 years old. She was diagnosed health, her doc that she probably will not live beyond five to seven years. She is receiving monthly chemotherapy treatments at a medical center ($200 out-of-pocket cost per visit) Her doctor has recommended that she be placed in a home with 24-hour care soon as possible. The cost of this care, including room and board, is about $1 per day, or approximately $5,323 per month. Because of her increased medical expenses and need for constant care, Julie has decided to sell her home. She has contacted Jane Smith, a real estate agent, who has listed her home for $140,000. Julie is adamant that she will accept no less than $135,000 Benjamin and Sarah have been giving Julie $200 per month to help ease her financial burden. They will be forced to incur most of her future expenses. They realize that the sale of the home will provide some assistance; however, the real estate mar- ket is soft, and they have had no offers on the house. Julie owns a paid-up whole li insurance policy on her own life with a face amount of $500,000 and a cash value of $75,000. The policy is not a modified endowment contract (MEC) Benjamin's Great Aunt Mabel plans to give Benijamin and Sarah $10,000 each at how him her gratitude through this gift. the beginning of 2016. Benjamin has always looked out for Mabel, and she wants to Sarah's Family Harry Steiner III married Alice Rose Steiner in 1972. After years of unsuccessful attempts to have a child, they were pleasantly surprised to find out that Alice was the city for more than 30 years and is considered an extremely influential figure in the Harry decided that she would not work. She is, however, very active in the community so excited that he presented Benjamin with a speedboat in hopes that he would get to pregnant. Sarah is an only child and the Steiners' pride and jo Harry Steiner is a highly respected State Supreme Court justice. He has worked in community. Harry and Alice's adjusted gross income (AGI) exceeds $275,000 through her volunteer work four days a week spend time on the boat getting to know his future son-in-law. As a wedding Alice Steiner was born into a wealthy family. Before they were married, she and The Steiners were happy to welcome Benjamin into their family. In fact, Harry was gift, the Steiners gave Sarah and Benjamin $20,000 toward the purchase of a new hom with college education expenses. Sarah, the beneficiary of the trust fund, receives the monthly interest from the principal until the trust is dissolved, with first Benjamin then Children's Hospital as successor beneficiaries in the event of Sarah's death. U Scott's enrollment in college, he will be given his third of the trust fund, $33,333 In addition, the Steiners set up a $100,000 trust fund to assist their grandchildren Sarah will continue to receive the interest on the remaining $66,666 until Janice and Case 5 1 Benjamin and Sarah Redding 6 Insurance Information Health Insurance Health insurance is provided for the entire family by Moore & Moore. Reddings are covered by an HMO. Doctor visits are $10 per visit, are $5 for generic brands and $10 for other brands. There is no co-payment tof talization in semiprivate accommodations. P necessary. For emergency treatment, a $50 co-payment is required. while prescriptions rivate rooms are provided when medically Life Insurance Benja Highly compensated employees of Moore & Moore receive group term coverage in the amount of five times their salaries. Sarah has a $27.000 group term policy through Woodridge Preparatory School. The owners of the policies are Benjamin and Sara, respectively, with each other as the respective beneficiary. min has a $110,000 group term insurance policy through Moore & Moore. Disability Insurance Benjamin has disability insurance through Moore & Moore. Short term disability benefits begin for any absence due to sickness and accident more than six days and will continue for up to six months at 80% of his salary. Long-term disability benefits are available if disability continues more than six months. If Benjamin is unable to per form the major and substantial duties of his current occupation, the coverage provides him with 60% of his salary while disabled until recovery, death, retirement, or age 65 (whichever occurs first). All disability insurance premiums are fully paid by Moore & Moore. Sarah has no disability insurance. Professional Liability Insurance Moore & Moore has professional liability insurance covering all employees. Homeowners Insurance The Reddings have an HO.3 policy with a $140,000 dwelling coverage limit and liability coverage of $100,000 endorsed to provide loss settlement on a replacement cost basis for personal property. Dwelling coverage is provided on an open peril basis and per- sonal property coverage is provided on a named peril basis. The policy covers all risk and replacement value. The deductible is $500 with an annual premium of $750. l Financial Planning: Cases & Applications Textbook 9th Edition 2015-2016 Automobile Insurance Benjamin and Sarah have the following coverage on both cars: $100,000 bodily injury per person; $300,000 bodily injury aggregate; $50,000 property damage; $100,000 uninsured motorist per person; and $300,000 uninsured motorist aggregate. Deductibles are: $500 comprehensive (no deductible for glass); and $1,000 collision. This insurance includes medical payments, car rentals, and towing. The cost of the auto insurance is $3,260.50 per year because of two at-fault accidents Sarah has caused in the past three years. Investment Information (Prospective) Aggressive stocks Growth stocks S&P 500 Index Corporate bonds Money market (bank) Expected Return 13% 10% 9% 7% 2% Beta 1.6 1.1 1.0 0.5 0.3 The Reddings consider themselves to be moderate risk investors. ncome Tax Information The Reddings are in the 15% marginal income tax bracket. Their combined mar- inal income tax bracket (federal and state) is 18%. Case 5 Benjamin and Sarah Redding 71 Retirement Information Benjamin and Sarah would both like to retire when they are 65 and 64 years old, respectively, and they expect to be in retirement for 30 years. They would hope to have $75,000 per year of pretax income in today's dollars during retirement. They do not want to rely on Social Security benefits for their retirement planning. Any money received from Social Security will be considered extra income. Benjamin does not participate in the Section 401(k) plan available through Moore & Moore. In the plan, the firm matches $.50 for every dollar contributed, up to 6% of his contribution (if he contributes 6% of his salary, the company contributes 3%), Benjamin may defer a maximum of 16% of his salary. Sarah is enrolled in a defined contribution plan in which the school contributes 7% of her salary and she contributes 3%. The plan provides several investment options: bond funds, stock funds, and money market accounts. She has chosen to invest this contribution in fixed instruments (bond funds). The plan has a 2-to 6-year graduated vesting schedule, and she has been a participant for four years. The total balance of her account is $16,500. Although she has not participated, she also has available a Section 403(b) supplemental retirement plan to which she may contribute up to 13% of her salary. Gifts, Estates, Trusts, and Will Information Presently, neither Benjamin nor Sarah have wills; however, both realize the importance having them. They would like to create wills leaving everything to one another and th hildren, while minimizing the impact of both estate and gift taxes. Case 5 Benjamin and Sarah Redding 71 Retirement Information Benjamin and Sarah would both like to retire when they are 65 and 64 years old, respectively, and they expect to be in retirement for 30 years. They would hope to have $75,000 per year of pretax income in today's dollars during retirement. They do not want to rely on Social Security benefits for their retirement planning. Any money received from Social Security will be considered extra income. Benjamin does not participate in the Section 401(k) plan available through Moore & Moore. In the plan, the firm matches $.50 for every dollar contributed, up to 6% of his contribution (if he contributes 6% of his salary, the company contributes 3%), Benjamin may defer a maximum of 16% of his salary. Sarah is enrolled in a defined contribution plan in which the school contributes 7% of her salary and she contributes 3%. The plan provides several investment options: bond funds, stock funds, and money market accounts. She has chosen to invest this contribution in fixed instruments (bond funds). The plan has a 2-to 6-year graduated vesting schedule, and she has been a participant for four years. The total balance of her account is $16,500. Although she has not participated, she also has available a Section 403(b) supplemental retirement plan to which she may contribute up to 13% of her salary. Gifts, Estates, Trusts, and Will Information Presently, neither Benjamin nor Sarah have wills; however, both realize the importance having them. They would like to create wills leaving everything to one another and th hildren, while minimizing the impact of both estate and gift taxes. Persional Financial Planning Cases & Benjamin and Sarah Redding 2015 STATEMENT OF CASH FLOWS (Expected to be the same for 2016) $55,000.00 27,000.00 3,600.00 3,000.00 CASH INFLOWS Tutoring-Sarah Savings account withdrawaP 94,169.80 Total inflows CASH OUTFLOWS Defined contribution plan-Sarah Mortgage payment (principal and interest) Property taxes (residence) 810.00 12,798.24 1,250.00 6,273.00 11,078.20 903.95 5,400.00 750.00 6,374.16 3,490.00 3,260.50 4,800.00 2,892.60 2,170.08 7,251.25 900.00 3,550.00 6,000.00 3,600.00 3,600.00 6,000.00 Federal withholding State withholding Homeowners insurance Auto note Auto insurance Child care/House care Education loans Credit card payments Bank loans Dry cleaning New clothing Dining out/entertainment Child support payment to Carol Total Outflows Net Cash Flow (Surplus) $93,151.98 S 1,017.82 Notes to Financial Statements Sarah does not report this money to the IRS $366 is eamed interest The Reddings pay the maid in cash and do not report it to the IRS 51,643 is interest, the balance is principal. The Reddings pay the minimum monthly payment on credit cards 54.350 s interest, the balance is principal. Case 5 1 Benjamin and Sarah Redding 73 STATEMENT OF FINANCIAL POSITION Benjamin and Sarah Redding January 1, 2016 ASSETS Checking account Savings account Trust fund Automobile-Sarah (2006 BMW 328) Automobile-Benjamin (2014 Nissan Maxima) Boat Home (appraised 7/1/15) Pension-Sarah Total assets 10,000 13,500 100,000 12,575 16,375 12,000 149,000 16,500 329,950 LIABILITIES3 Credit card-Benjamin (1896) Credit card-Sarah (23 %) $4,750 4,920 1,200 18,383 17,919 9,909 148,944 Credit card-joint (16%) Car loan-Benjamin (10%) Student loans (6%) Bank loans (12%) Home mortgage balance (7.5%) Total liabilities $206,025 123,925 $329,950 Net worth Total liabilities and net worth Notes to Financial Statements All assets are stated at fair market value The trust fund is for the children's education, however, Sarah receives the interest on the balance of the trust fund until all children reach age of majority The trust assets are invested in a CD yelding 3% per year. Liabilities are stated at principal only Percentages shown (%) are current interest rates on respective indebtedness. Personal Financial Planning: Cases & Applications Textbook 9th Edition 2015-2016 Information Regarding Assets and Liabilities Employment within two years an annual salary of $55,000. He expects to be promoted to manager Benjamin hopes to be a partner in eight years. Ben jamin is currently employed as a senior accountant at Moore &Mo Sarah earns $27.000 annually teaching at Woodridge Preparatory School. A salary increases range from 3-5%. She also earns approximately $3,600 each yeart nual ing. This money is received in cash. Although they should, she and Benjamin do report her tutoring earnings on their tax returns. In addition, Sarah receives $3,000 year, before taxes, on the interest earned from the children's trust fund. year tutor Benjamin and Sarah earn approximately 2% interest on their savings account. This is automatically credited on a quarterly basis to the account; however, they do not consider this small amount of interest to be income. This savings account/emergency fund began with an account balance of $25,000 when they were first married. In 2015, they withdrew $366 in interest income and $5,203.80 from the savings account to pay bills. Home Benjamin and Sarah purchased a four bedroom house for $170,000 in a nice fam- ily neighborhood. They were among the first families to purchase a home in this new subdivision. The money received from Sarah's parents as a wedding gift was used for the down payment. The mortgage payment is $1,066.52 per month. The interest rate is 7.5%. The original mortgage was $152,531.47, and they have made 29 payments. Utilities range from $400-500 per month. Although the original value of the house was $170,000, a recent appraisal valued the house at $149,000. The decrease in value did not leave enough equity for the Reddings to be approved for a home equity loan. If the Reddings wanted to refinance (80% of the fair market value of the home), the 3% closing costs would have to be paid at closing and not financed. Automobiles In 2014, Benjamin purchased a new Nissan Maxima for $25,000. The 60 months at 10% interest Benjamin has made 19 monthly payments of $531.18. a current value of $5,750. current value of the car is $16,375, but the loan balance is $18,383.47. The term of the loan is Sarah's prize for winning the state pageant was a new 2006 BMW 328i. The car has Case 5 I Benjamin and Sarah Redding 75 Boat The current value of Benjamin's 18-foot Boston Whaler Center Console with a 150 HP Mercury is $12,000. Though Benjamin and Sarah consider this a luxury item they know that the sale of the boat may harm their relationship with Sarah's parents. Student Loans Benjamin put himself through school with part-time jobs and student loans. He originally borrowed money to pay for his education through a student loan program He recently consolidated all of his student loans into one. The term of the loan is 10 years, and Benjamin is in his second year of payments. The current payment is $241.05 per month. Credit Cards Before marriage, Benjamin and Sarah each had their own credit cards, the balances of which are close to the maximum credit limits. After marriage, they applied for a joint credit card and planned to use it for emergencies only. The current interest rates, balances, limits, and annual fees on these cards are as follows. Interest Rate 18% 23% 16% Balance $4,750 $4,920 $1,200 Credit Limit $5,000 Benjamin Sarah Joint Annual Fee $50 $50 $50 $5.000 $5,000 Bank Loans During the past several years, Benjamin and Sarah have taken out loans to pay for vacations. The current payment is $604.27 per month. The balance of these loans is $9,909 To assist the Reddings with their immediate cash flow needs, you offer to loar them $20,000 at an annual interest rate of 10%. You explain that such a loan would allow them to pay off almost all of their credit cards and bank loans at a significantly reduced interest rate. You tell them they can repay the loan in full, if they wish, when they receive the expected gifts of $10,000 each from Benjamin's Great Aunt Mabel. Entertainment Because of Benjamin and Sarah's hectic work schedules and the three children, they rarely get to spend time alone together. Every Friday night, they go to a moder- ately priced restaurant for dinner. Sometimes they are joined by some of Benjamin's colleagues, and he uses this time to network. The approximate cost of dinner each Net Worth Total Asser Total Det Total Assets Total Debt Annual Total Income Annual Housing and Debt Payments Annual Gross Income Annual Annual Gross Income Housing Costs Investment Assets Annual Gross Income Annual Savings Annual Gross Income Annual Total Income is the same as Annual Gros income. Comment on any of the above ratios that you think are important. Briefly evaluate the Reddings' use of debt. Assuming an earnings rate of 8%, calculate the amount needed today to fund the chi- dren's college education. Assuming an earnings rate of 8%, calculate the amount they need to save each month to fund the children's college education. Assume that savings will begin at the end of this month and continue until the youngest children begin college. 4. 5. 6. 7. Assuming an earnings rate of 8%, calculate the monthly savings needed for education assuming that savings will continue until the children's college education is completed. 8. Determine whether the Reddings will currently qualify to refinance their home. Is the house eligible for refinancing by a lender requiring a maximum loan-to-value ratio of 80% ? How much cash would the Reddings need if they refinance? 9. monal Financial Planning Cases& Applications Textbook 9th Edition 2015-2016 mort- 10. Assuming that the Reddings decide to use their savings account to pay down the gage so they are able to refinance their current mortgage, calculate the monthly the ment for each of the terms below. For purposes of this question, disregard whether to refinance their home. Assume they maintain the lenders value ratio requirement a. 15-year loan b. 30-year loan paid over 30 years 30-year loan paid over the remaining life of their current mortgage Calculate the total expected savings from the refinancing for each of the three loans 11. mentioned in Question 10. Do they qualify for any of the loans in Question 10 if the bank requires a total housing cost ratio less than 28% and a total debt-to-payments income ratio of 36%? If they do not qualify for any of the loans in Question 10 because the lender counts only $82,000 of income, what actions should they consider in order to qualify? 12. 13. 14. Calculate the total amount of money needed today to meet Julie's medical needs. Assume that she lives seven years and that the Reddings invest in corporate bonds. How much do the Reddings need to save on a monthly basis beginning at the end 300,000? Assume they invest at an interest rate equal to the expected return on the 15. of this month toward a down payment in order to purchase their future home for S&P 500 Index and pay all associated taxes out of their current budget Position? 16. Does the trust fund of $100,000 belong on the Reddings' Statement of Financial 17. What are the deficiencies in the presentation of the Statement of Financial Position? 8. The Steiners decided to provide additional financial assistance to help with their grand- children's college education expenses. They planned to elect gift-splitting for any gifts they made, and they wanted to give as much as they could without incurring any gift tax. What was the maximum amount they could have contributed in 2015 and still have met these objectives using Coverdell Education Savings Accounts (ESAs) and Section 529 plans? NAL QUESTIONS Benjamin and Sarah Redding have great aspirations for the future recently realized that they are not as financially well-off as they had hey a have come to you for advice on how to solve their current cash flow problicht. help them plan to achieve their goals. Today is January 1, 2016, proble Personal Background and Information Benjamin Redding (Age 30) Benjamin Redding graduated from a state university seven years ago with elor of science degree in accounting. He has been employed for almost seven ach years at Moore & Moore, a small accounting firm (50 employees). Benjamin has been married to Sarah Steiner Redding for six years. Sarah Steiner Redding (Age 29) degree in elementary education. She is employed as a fourth grade teacher at She incurs no expenses to provide this tutoring. Sarah Steiner Redding grew up in a wealthy family. While in college, she crowned Miss State. She graduated from a private university with a bachelor of kiehst school, Woodridge Preparatory School, and has been for the past five years. To further enrich her students (and for additional income), Sarah tutors three students each week science a private Children Benjamin and Sarah have three children: Scott, age 4, and twin girls, Janice and Carly, age 1. Delores Vidalia The Reddings employ a young student, Delores Vidalia, to care for their children. Delores, age 21, is a part-time night student at a local community college. She cares for the children and cleans the Reddings' house in exchange for room, board, and a $100 stipend per week. The Reddings pay Delores in cash. Neither the Reddinos or Dolores report these transactions to the IRS. Delores works 48 weeks per year. Benjamin's Family George Redding married Julie Elizabeth Grant Redding in 1985. They had two children, George Jr., and Benjamin. George Jr., died at six months of age of sudden infant death syndrome. Case 5 I Benjamin and Sarah Redding 67 Benjamin's father, George Sr., died of a heart attack six years ago ample insurance to cover all medical and funeral expenses at age 50. He had His mother, Julie, a chain-smoker for 37 with lung cancer three years ago. Because of her rapidly deteriorating tor has predicted years, is 53 years old. She was diagnosed health, her doc that she probably will not live beyond five to seven years. She is receiving monthly chemotherapy treatments at a medical center ($200 out-of-pocket cost per visit) Her doctor has recommended that she be placed in a home with 24-hour care soon as possible. The cost of this care, including room and board, is about $1 per day, or approximately $5,323 per month. Because of her increased medical expenses and need for constant care, Julie has decided to sell her home. She has contacted Jane Smith, a real estate agent, who has listed her home for $140,000. Julie is adamant that she will accept no less than $135,000 Benjamin and Sarah have been giving Julie $200 per month to help ease her financial burden. They will be forced to incur most of her future expenses. They realize that the sale of the home will provide some assistance; however, the real estate mar- ket is soft, and they have had no offers on the house. Julie owns a paid-up whole li insurance policy on her own life with a face amount of $500,000 and a cash value of $75,000. The policy is not a modified endowment contract (MEC) Benjamin's Great Aunt Mabel plans to give Benijamin and Sarah $10,000 each at how him her gratitude through this gift. the beginning of 2016. Benjamin has always looked out for Mabel, and she wants to Sarah's Family Harry Steiner III married Alice Rose Steiner in 1972. After years of unsuccessful attempts to have a child, they were pleasantly surprised to find out that Alice was the city for more than 30 years and is considered an extremely influential figure in the Harry decided that she would not work. She is, however, very active in the community so excited that he presented Benjamin with a speedboat in hopes that he would get to pregnant. Sarah is an only child and the Steiners' pride and jo Harry Steiner is a highly respected State Supreme Court justice. He has worked in community. Harry and Alice's adjusted gross income (AGI) exceeds $275,000 through her volunteer work four days a week spend time on the boat getting to know his future son-in-law. As a wedding Alice Steiner was born into a wealthy family. Before they were married, she and The Steiners were happy to welcome Benjamin into their family. In fact, Harry was gift, the Steiners gave Sarah and Benjamin $20,000 toward the purchase of a new hom with college education expenses. Sarah, the beneficiary of the trust fund, receives the monthly interest from the principal until the trust is dissolved, with first Benjamin then Children's Hospital as successor beneficiaries in the event of Sarah's death. U Scott's enrollment in college, he will be given his third of the trust fund, $33,333 In addition, the Steiners set up a $100,000 trust fund to assist their grandchildren Sarah will continue to receive the interest on the remaining $66,666 until Janice and Case 5 1 Benjamin and Sarah Redding 6 Insurance Information Health Insurance Health insurance is provided for the entire family by Moore & Moore. Reddings are covered by an HMO. Doctor visits are $10 per visit, are $5 for generic brands and $10 for other brands. There is no co-payment tof talization in semiprivate accommodations. P necessary. For emergency treatment, a $50 co-payment is required. while prescriptions rivate rooms are provided when medically Life Insurance Benja Highly compensated employees of Moore & Moore receive group term coverage in the amount of five times their salaries. Sarah has a $27.000 group term policy through Woodridge Preparatory School. The owners of the policies are Benjamin and Sara, respectively, with each other as the respective beneficiary. min has a $110,000 group term insurance policy through Moore & Moore. Disability Insurance Benjamin has disability insurance through Moore & Moore. Short term disability benefits begin for any absence due to sickness and accident more than six days and will continue for up to six months at 80% of his salary. Long-term disability benefits are available if disability continues more than six months. If Benjamin is unable to per form the major and substantial duties of his current occupation, the coverage provides him with 60% of his salary while disabled until recovery, death, retirement, or age 65 (whichever occurs first). All disability insurance premiums are fully paid by Moore & Moore. Sarah has no disability insurance. Professional Liability Insurance Moore & Moore has professional liability insurance covering all employees. Homeowners Insurance The Reddings have an HO.3 policy with a $140,000 dwelling coverage limit and liability coverage of $100,000 endorsed to provide loss settlement on a replacement cost basis for personal property. Dwelling coverage is provided on an open peril basis and per- sonal property coverage is provided on a named peril basis. The policy covers all risk and replacement value. The deductible is $500 with an annual premium of $750. l Financial Planning: Cases & Applications Textbook 9th Edition 2015-2016 Automobile Insurance Benjamin and Sarah have the following coverage on both cars: $100,000 bodily injury per person; $300,000 bodily injury aggregate; $50,000 property damage; $100,000 uninsured motorist per person; and $300,000 uninsured motorist aggregate. Deductibles are: $500 comprehensive (no deductible for glass); and $1,000 collision. This insurance includes medical payments, car rentals, and towing. The cost of the auto insurance is $3,260.50 per year because of two at-fault accidents Sarah has caused in the past three years. Investment Information (Prospective) Aggressive stocks Growth stocks S&P 500 Index Corporate bonds Money market (bank) Expected Return 13% 10% 9% 7% 2% Beta 1.6 1.1 1.0 0.5 0.3 The Reddings consider themselves to be moderate risk investors. ncome Tax Information The Reddings are in the 15% marginal income tax bracket. Their combined mar- inal income tax bracket (federal and state) is 18%. Case 5 Benjamin and Sarah Redding 71 Retirement Information Benjamin and Sarah would both like to retire when they are 65 and 64 years old, respectively, and they expect to be in retirement for 30 years. They would hope to have $75,000 per year of pretax income in today's dollars during retirement. They do not want to rely on Social Security benefits for their retirement planning. Any money received from Social Security will be considered extra income. Benjamin does not participate in the Section 401(k) plan available through Moore & Moore. In the plan, the firm matches $.50 for every dollar contributed, up to 6% of his contribution (if he contributes 6% of his salary, the company contributes 3%), Benjamin may defer a maximum of 16% of his salary. Sarah is enrolled in a defined contribution plan in which the school contributes 7% of her salary and she contributes 3%. The plan provides several investment options: bond funds, stock funds, and money market accounts. She has chosen to invest this contribution in fixed instruments (bond funds). The plan has a 2-to 6-year graduated vesting schedule, and she has been a participant for four years. The total balance of her account is $16,500. Although she has not participated, she also has available a Section 403(b) supplemental retirement plan to which she may contribute up to 13% of her salary. Gifts, Estates, Trusts, and Will Information Presently, neither Benjamin nor Sarah have wills; however, both realize the importance having them. They would like to create wills leaving everything to one another and th hildren, while minimizing the impact of both estate and gift taxes. Case 5 Benjamin and Sarah Redding 71 Retirement Information Benjamin and Sarah would both like to retire when they are 65 and 64 years old, respectively, and they expect to be in retirement for 30 years. They would hope to have $75,000 per year of pretax income in today's dollars during retirement. They do not want to rely on Social Security benefits for their retirement planning. Any money received from Social Security will be considered extra income. Benjamin does not participate in the Section 401(k) plan available through Moore & Moore. In the plan, the firm matches $.50 for every dollar contributed, up to 6% of his contribution (if he contributes 6% of his salary, the company contributes 3%), Benjamin may defer a maximum of 16% of his salary. Sarah is enrolled in a defined contribution plan in which the school contributes 7% of her salary and she contributes 3%. The plan provides several investment options: bond funds, stock funds, and money market accounts. She has chosen to invest this contribution in fixed instruments (bond funds). The plan has a 2-to 6-year graduated vesting schedule, and she has been a participant for four years. The total balance of her account is $16,500. Although she has not participated, she also has available a Section 403(b) supplemental retirement plan to which she may contribute up to 13% of her salary. Gifts, Estates, Trusts, and Will Information Presently, neither Benjamin nor Sarah have wills; however, both realize the importance having them. They would like to create wills leaving everything to one another and th hildren, while minimizing the impact of both estate and gift taxes. Persional Financial Planning Cases & Benjamin and Sarah Redding 2015 STATEMENT OF CASH FLOWS (Expected to be the same for 2016) $55,000.00 27,000.00 3,600.00 3,000.00 CASH INFLOWS Tutoring-Sarah Savings account withdrawaP 94,169.80 Total inflows CASH OUTFLOWS Defined contribution plan-Sarah Mortgage payment (principal and interest) Property taxes (residence) 810.00 12,798.24 1,250.00 6,273.00 11,078.20 903.95 5,400.00 750.00 6,374.16 3,490.00 3,260.50 4,800.00 2,892.60 2,170.08 7,251.25 900.00 3,550.00 6,000.00 3,600.00 3,600.00 6,000.00 Federal withholding State withholding Homeowners insurance Auto note Auto insurance Child care/House care Education loans Credit card payments Bank loans Dry cleaning New clothing Dining out/entertainment Child support payment to Carol Total Outflows Net Cash Flow (Surplus) $93,151.98 S 1,017.82 Notes to Financial Statements Sarah does not report this money to the IRS $366 is eamed interest The Reddings pay the maid in cash and do not report it to the IRS 51,643 is interest, the balance is principal. The Reddings pay the minimum monthly payment on credit cards 54.350 s interest, the balance is principal. Case 5 1 Benjamin and Sarah Redding 73 STATEMENT OF FINANCIAL POSITION Benjamin and Sarah Redding January 1, 2016 ASSETS Checking account Savings account Trust fund Automobile-Sarah (2006 BMW 328) Automobile-Benjamin (2014 Nissan Maxima) Boat Home (appraised 7/1/15) Pension-Sarah Total assets 10,000 13,500 100,000 12,575 16,375 12,000 149,000 16,500 329,950 LIABILITIES3 Credit card-Benjamin (1896) Credit card-Sarah (23 %) $4,750 4,920 1,200 18,383 17,919 9,909 148,944 Credit card-joint (16%) Car loan-Benjamin (10%) Student loans (6%) Bank loans (12%) Home mortgage balance (7.5%) Total liabilities $206,025 123,925 $329,950 Net worth Total liabilities and net worth Notes to Financial Statements All assets are stated at fair market value The trust fund is for the children's education, however, Sarah receives the interest on the balance of the trust fund until all children reach age of majority The trust assets are invested in a CD yelding 3% per year. Liabilities are stated at principal only Percentages shown (%) are current interest rates on respective indebtedness. Personal Financial Planning: Cases & Applications Textbook 9th Edition 2015-2016 Information Regarding Assets and Liabilities Employment within two years an annual salary of $55,000. He expects to be promoted to manager Benjamin hopes to be a partner in eight years. Ben jamin is currently employed as a senior accountant at Moore &Mo Sarah earns $27.000 annually teaching at Woodridge Preparatory School. A salary increases range from 3-5%. She also earns approximately $3,600 each yeart nual ing. This money is received in cash. Although they should, she and Benjamin do report her tutoring earnings on their tax returns. In addition, Sarah receives $3,000 year, before taxes, on the interest earned from the children's trust fund. year tutor Benjamin and Sarah earn approximately 2% interest on their savings account. This is automatically credited on a quarterly basis to the account; however, they do not consider this small amount of interest to be income. This savings account/emergency fund began with an account balance of $25,000 when they were first married. In 2015, they withdrew $366 in interest income and $5,203.80 from the savings account to pay bills. Home Benjamin and Sarah purchased a four bedroom house for $170,000 in a nice fam- ily neighborhood. They were among the first families to purchase a home in this new subdivision. The money received from Sarah's parents as a wedding gift was used for the down payment. The mortgage payment is $1,066.52 per month. The interest rate is 7.5%. The original mortgage was $152,531.47, and they have made 29 payments. Utilities range from $400-500 per month. Although the original value of the house was $170,000, a recent appraisal valued the house at $149,000. The decrease in value did not leave enough equity for the Reddings to be approved for a home equity loan. If the Reddings wanted to refinance (80% of the fair market value of the home), the 3% closing costs would have to be paid at closing and not financed. Automobiles In 2014, Benjamin purchased a new Nissan Maxima for $25,000. The 60 months at 10% interest Benjamin has made 19 monthly payments of $531.18. a current value of $5,750. current value of the car is $16,375, but the loan balance is $18,383.47. The term of the loan is Sarah's prize for winning the state pageant was a new 2006 BMW 328i. The car has Case 5 I Benjamin and Sarah Redding 75 Boat The current value of Benjamin's 18-foot Boston Whaler Center Console with a 150 HP Mercury is $12,000. Though Benjamin and Sarah consider this a luxury item they know that the sale of the boat may harm their relationship with Sarah's parents. Student Loans Benjamin put himself through school with part-time jobs and student loans. He originally borrowed money to pay for his education through a student loan program He recently consolidated all of his student loans into one. The term of the loan is 10 years, and Benjamin is in his second year of payments. The current payment is $241.05 per month. Credit Cards Before marriage, Benjamin and Sarah each had their own credit cards, the balances of which are close to the maximum credit limits. After marriage, they applied for a joint credit card and planned to use it for emergencies only. The current interest rates, balances, limits, and annual fees on these cards are as follows. Interest Rate 18% 23% 16% Balance $4,750 $4,920 $1,200 Credit Limit $5,000 Benjamin Sarah Joint Annual Fee $50 $50 $50 $5.000 $5,000 Bank Loans During the past several years, Benjamin and Sarah have taken out loans to pay for vacations. The current payment is $604.27 per month. The balance of these loans is $9,909 To assist the Reddings with their immediate cash flow needs, you offer to loar them $20,000 at an annual interest rate of 10%. You explain that such a loan would allow them to pay off almost all of their credit cards and bank loans at a significantly reduced interest rate. You tell them they can repay the loan in full, if they wish, when they receive the expected gifts of $10,000 each from Benjamin's Great Aunt Mabel. Entertainment Because of Benjamin and Sarah's hectic work schedules and the three children, they rarely get to spend time alone together. Every Friday night, they go to a moder- ately priced restaurant for dinner. Sometimes they are joined by some of Benjamin's colleagues, and he uses this time to network. The approximate cost of dinner each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts