Question: I need help with this project. I also need the formulas so I can see how it calculates. REAL ESTATE FINANCE & INVESTMENT ANALYSIS As

I need help with this project. I also need the formulas so I can see how it calculates.

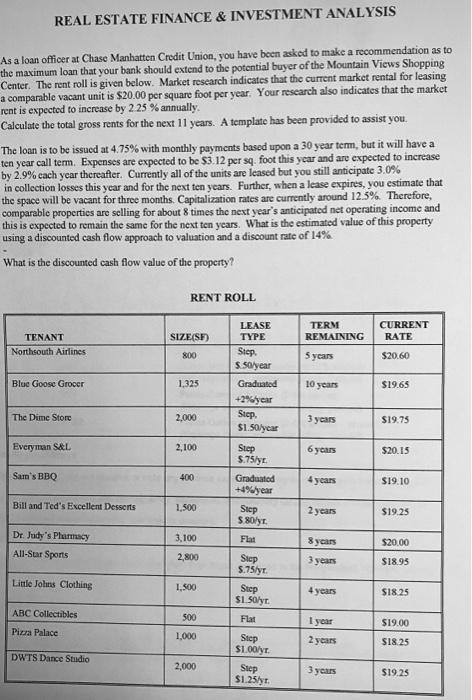

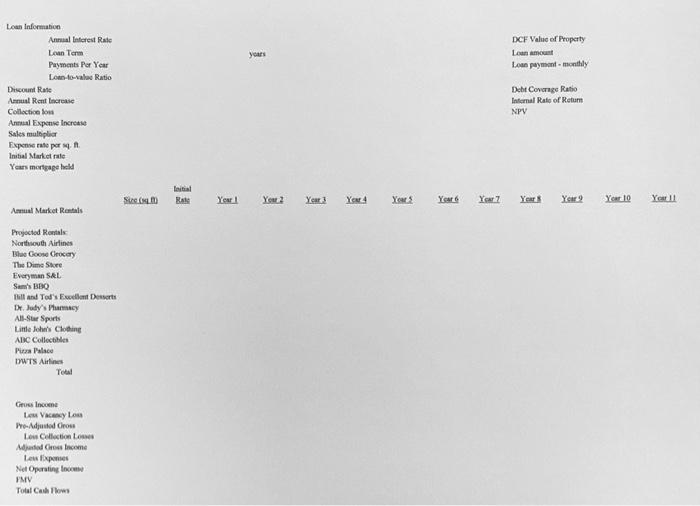

REAL ESTATE FINANCE & INVESTMENT ANALYSIS As a loan officer at Chase Manhatten Credit Union, you have been asked to make a recommendation as to the maximum loan that your bank should extend to the potential buyer of the Mountain Views Shopping Center. The rent roll is given below. Market research indicates that the current market rental for leasing a comparable vacant unit is $20.00 per square foot per year. Your research also indicates that the market rent is expected to increase by 2 25 % annually. Calculate the total gross rents for the next 11 years. A template has been provided to assist you. The loan is to be issued at 4.75% with monthly payments based upon a 30 year term, but it will have a ten year call term. Expenses are expected to be 53.12 per sq. foot this year and are expected to increase by 2.9% cach year thereafter. Currently all of the units are leased but you still anticipate 3.0% in collection losses this year and for the next ten years. Further, when a lease expires, you estimate that the space will be vacant for three months. Capitalization rates are currently around 12.5%. Therefore, comparable properties are selling for about 8 times the next year's anticipated net operating income and this is expected to remain the same for the next ten years. What is the estimated value of this property using a discounted cash flow approach to valuation and a discount rate of 14% What is the discounted cash flow value of the property? RENT ROLL TERM REMAINING CURRENT RATE SIZE(SE) TENANT NorthSouth Airlines 800 5 years $20.60 LEASE TYPE Step 5.50/year Graduated +29/year Step $1.50/year Blue Goose Grocer 1,325 10 years $19.65 The Dime Store 2,000 3 years $19.75 Everyman S&L 2,100 6 years $20.15 Sam's BBO Step 5.75ly Graduated +4%/year 400 $19.10 Bill and Ted's Excellent Desserts 1,500 Step $ 80yr 2 years $19.25 Dr. Judy's Plamacy All-Sur Sports Flat 8 years $20.00 3.100 2,800 Step 5.75lyr. 3 years $18.95 Little Jolins Clothing 1,500 Step $1.50yr. 4 years $18.25 ABC Collectibles 500 Flat 1 year $19.00 Piura Palace 1.000 2 years $18.25 DWTS Dance Studio Step $1.00lyr. Step $1.25tyr. 2,000 3 years $19.25 years DCF Value of Property Loan amount Lom payment monthly Loan Information Annual Inforest Rate Len Term Payments Por Year Low-to-value Ratio Discount Rate Annual Rent Increase Collection Annual Expense Increase Sales multiplier Expense rate por 1 Initial Market rate Years mortgage like Debt Coverage Ratio Infomal Rate of Return NPV Intel Ste ( Yes 2 Year Yer 4 Years Years Yox Years Year 2 Your 10 Year 11 Annual Market Rentals Proyected as Northsouth Airlines Blue Goose Geocary The Dime Store Everyman SRL Sam's BBQ Holland Tod's Exo Desserts Dr. Jody my All-Star Sports Little John's Clothing ABC Collectibles PuraPalace DWTS Airlines To Gross Income Le Voy Low ProAutodrom Low Collection Le Address Income Le lips Net Operating In PMY Total Cash REAL ESTATE FINANCE & INVESTMENT ANALYSIS As a loan officer at Chase Manhatten Credit Union, you have been asked to make a recommendation as to the maximum loan that your bank should extend to the potential buyer of the Mountain Views Shopping Center. The rent roll is given below. Market research indicates that the current market rental for leasing a comparable vacant unit is $20.00 per square foot per year. Your research also indicates that the market rent is expected to increase by 2 25 % annually. Calculate the total gross rents for the next 11 years. A template has been provided to assist you. The loan is to be issued at 4.75% with monthly payments based upon a 30 year term, but it will have a ten year call term. Expenses are expected to be 53.12 per sq. foot this year and are expected to increase by 2.9% cach year thereafter. Currently all of the units are leased but you still anticipate 3.0% in collection losses this year and for the next ten years. Further, when a lease expires, you estimate that the space will be vacant for three months. Capitalization rates are currently around 12.5%. Therefore, comparable properties are selling for about 8 times the next year's anticipated net operating income and this is expected to remain the same for the next ten years. What is the estimated value of this property using a discounted cash flow approach to valuation and a discount rate of 14% What is the discounted cash flow value of the property? RENT ROLL TERM REMAINING CURRENT RATE SIZE(SE) TENANT NorthSouth Airlines 800 5 years $20.60 LEASE TYPE Step 5.50/year Graduated +29/year Step $1.50/year Blue Goose Grocer 1,325 10 years $19.65 The Dime Store 2,000 3 years $19.75 Everyman S&L 2,100 6 years $20.15 Sam's BBO Step 5.75ly Graduated +4%/year 400 $19.10 Bill and Ted's Excellent Desserts 1,500 Step $ 80yr 2 years $19.25 Dr. Judy's Plamacy All-Sur Sports Flat 8 years $20.00 3.100 2,800 Step 5.75lyr. 3 years $18.95 Little Jolins Clothing 1,500 Step $1.50yr. 4 years $18.25 ABC Collectibles 500 Flat 1 year $19.00 Piura Palace 1.000 2 years $18.25 DWTS Dance Studio Step $1.00lyr. Step $1.25tyr. 2,000 3 years $19.25 years DCF Value of Property Loan amount Lom payment monthly Loan Information Annual Inforest Rate Len Term Payments Por Year Low-to-value Ratio Discount Rate Annual Rent Increase Collection Annual Expense Increase Sales multiplier Expense rate por 1 Initial Market rate Years mortgage like Debt Coverage Ratio Infomal Rate of Return NPV Intel Ste ( Yes 2 Year Yer 4 Years Years Yox Years Year 2 Your 10 Year 11 Annual Market Rentals Proyected as Northsouth Airlines Blue Goose Geocary The Dime Store Everyman SRL Sam's BBQ Holland Tod's Exo Desserts Dr. Jody my All-Star Sports Little John's Clothing ABC Collectibles PuraPalace DWTS Airlines To Gross Income Le Voy Low ProAutodrom Low Collection Le Address Income Le lips Net Operating In PMY Total Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts