Question: I need help with this question as soon as possible. I am stuck on the first part and the last part and I have attached

I need help with this question as soon as possible. I am stuck on the first part and the last part and I have attached the screenshots for the problem.

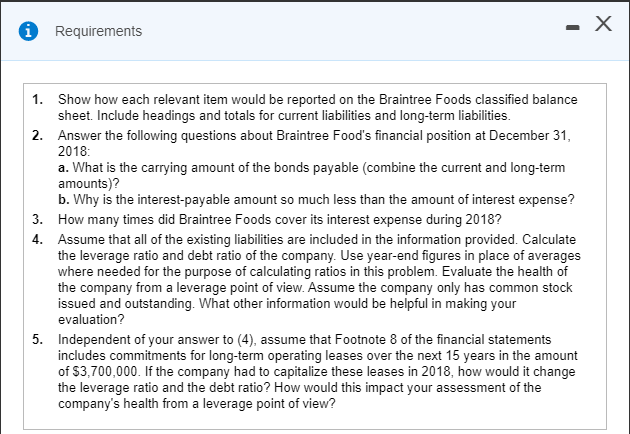

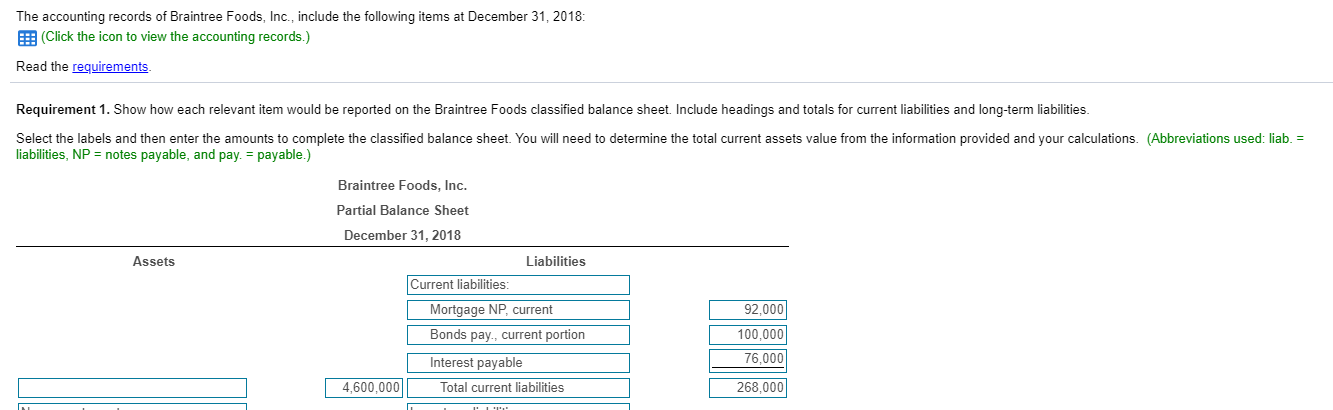

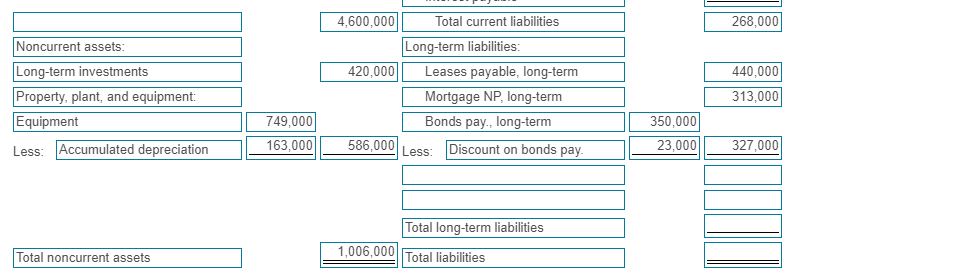

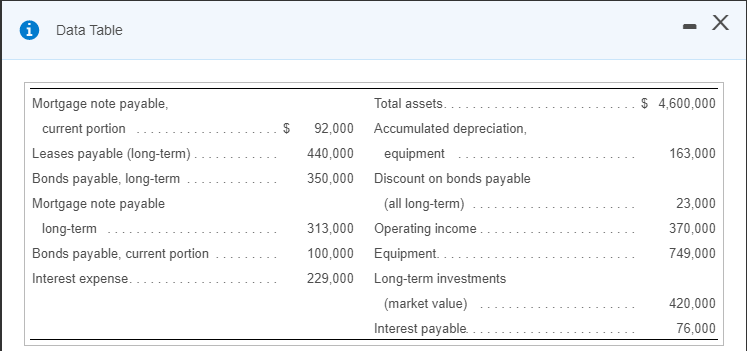

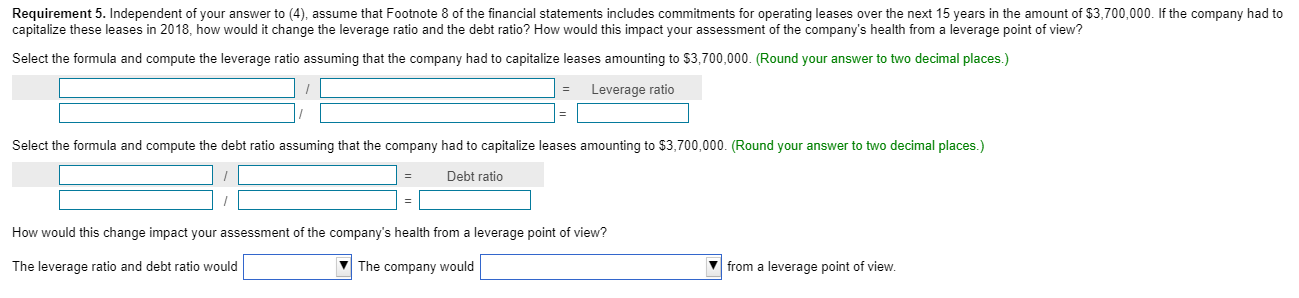

* Requirements - X 1. Show how each relevant item would be reported on the Braintree Foods classified balance sheet. Include headings and totals for current liabilities and long-term liabilities. 2. Answer the following questions about Braintree Food's financial position at December 31, 2018: a. What is the carrying amount of the bonds payable (combine the current and long-term amounts)? b. Why is the interest-payable amount so much less than the amount of interest expense? How many times did Braintree Foods cover its interest expense during 2018? 4. Assume that all of the existing liabilities are included in the information provided. Calculate the leverage ratio and debt ratio of the company. Use year-end figures in place of averages where needed for the purpose of calculating ratios in this problem. Evaluate the health of the company from a leverage point of view. Assume the company only has common stock issued and outstanding. What other information would be helpful in making your evaluation? Independent of your answer to (4), assume that Footnote 8 of the financial statements includes commitments for long-term operating leases over the next 15 years in the amount of $3,700,000. If the company had to capitalize these leases in 2018, how would it change the leverage ratio and the debt ratio? How would this impact your assessment of the company's health from a leverage point of view? The accounting records of Braintree Foods, Inc., include the following items at December 31, 2018: (Click the icon to view the accounting records.) Read the requirements. Requirement 1. Show how each relevant item would be reported on the Braintree Foods classified balance sheet. Include headings and totals for current liabilities and long-term liabilities Select the labels and then enter the amounts to complete the classified balance sheet. You will need to determine the total current assets value from the information provided and your calculations. (Abbreviations used: liab. = liabilities, NP = notes payable, and pay. = payable.) Braintree Foods, Inc. Partial Balance Sheet December 31, 2018 Assets Liabilities Current liabilities: Mortgage NP, current Bonds pay., current portion 92,000 100,000 76,000 Interest payable Total current liabilities | 4,600,000 268,000 268,000 Noncurrent assets: Long-term investments Property, plant, and equipment: Equipment Tees Accumulated depreciation 4,600,000 Total current liabilities Long-term liabilities: 420,000 Leases payable, long-term Mortgage NP, long-term Bonds pay., long-term 586,000 Less: Discount on bonds pay. 440,000 313,000 350,000 _23,000||_ | 163,000|| 327,000| Total long-term liabilities 1,006,000 Total noncurrent assets Total liabilities i Data Table - X Total assets.............. .......... $ 4,600,000 92,000 440,000 350,000 163,000 Mortgage note payable, current portion .....................$ Leases payable (long-term)................... Bonds payable, long-term ....... Mortgage note payable long-term Bonds payable, current portion ......... Interest expense. 313,000 100,000 229,000 Accumulated depreciation, equipment. Discount on bonds payable (all long-term) Operating income. Equipment. Long-term investments (market value) Interest payable...... 23,000 370,000 749,000 420,000 76.000 Requirement 5. Independent of your answer to (4), assume that Footnote 8 of the financial statements includes commitments for operating leases over the next 15 years in the amount of $3,700,000. If the company had to capitalize these leases in 2018, how would it change the leverage ratio and the debt ratio? How would this impact your assessment of the company's health from a leverage point of view? Select the formula and compute the leverage ratio assuming that the company had to capitalize leases amounting to $3,700,000. (Round your answer to two decimal places.) = Leverage ratio Select the formula and compute the debt ratio assuming that the company had to capitalize leases amounting to $3,700,000. (Round your answer to two decimal places.) = Debt ratio How would this change impact your assessment of the company's health from a leverage point of view? The leverage ratio and debt ratio would The company would from a leverage point of view. * Requirements - X 1. Show how each relevant item would be reported on the Braintree Foods classified balance sheet. Include headings and totals for current liabilities and long-term liabilities. 2. Answer the following questions about Braintree Food's financial position at December 31, 2018: a. What is the carrying amount of the bonds payable (combine the current and long-term amounts)? b. Why is the interest-payable amount so much less than the amount of interest expense? How many times did Braintree Foods cover its interest expense during 2018? 4. Assume that all of the existing liabilities are included in the information provided. Calculate the leverage ratio and debt ratio of the company. Use year-end figures in place of averages where needed for the purpose of calculating ratios in this problem. Evaluate the health of the company from a leverage point of view. Assume the company only has common stock issued and outstanding. What other information would be helpful in making your evaluation? Independent of your answer to (4), assume that Footnote 8 of the financial statements includes commitments for long-term operating leases over the next 15 years in the amount of $3,700,000. If the company had to capitalize these leases in 2018, how would it change the leverage ratio and the debt ratio? How would this impact your assessment of the company's health from a leverage point of view? The accounting records of Braintree Foods, Inc., include the following items at December 31, 2018: (Click the icon to view the accounting records.) Read the requirements. Requirement 1. Show how each relevant item would be reported on the Braintree Foods classified balance sheet. Include headings and totals for current liabilities and long-term liabilities Select the labels and then enter the amounts to complete the classified balance sheet. You will need to determine the total current assets value from the information provided and your calculations. (Abbreviations used: liab. = liabilities, NP = notes payable, and pay. = payable.) Braintree Foods, Inc. Partial Balance Sheet December 31, 2018 Assets Liabilities Current liabilities: Mortgage NP, current Bonds pay., current portion 92,000 100,000 76,000 Interest payable Total current liabilities | 4,600,000 268,000 268,000 Noncurrent assets: Long-term investments Property, plant, and equipment: Equipment Tees Accumulated depreciation 4,600,000 Total current liabilities Long-term liabilities: 420,000 Leases payable, long-term Mortgage NP, long-term Bonds pay., long-term 586,000 Less: Discount on bonds pay. 440,000 313,000 350,000 _23,000||_ | 163,000|| 327,000| Total long-term liabilities 1,006,000 Total noncurrent assets Total liabilities i Data Table - X Total assets.............. .......... $ 4,600,000 92,000 440,000 350,000 163,000 Mortgage note payable, current portion .....................$ Leases payable (long-term)................... Bonds payable, long-term ....... Mortgage note payable long-term Bonds payable, current portion ......... Interest expense. 313,000 100,000 229,000 Accumulated depreciation, equipment. Discount on bonds payable (all long-term) Operating income. Equipment. Long-term investments (market value) Interest payable...... 23,000 370,000 749,000 420,000 76.000 Requirement 5. Independent of your answer to (4), assume that Footnote 8 of the financial statements includes commitments for operating leases over the next 15 years in the amount of $3,700,000. If the company had to capitalize these leases in 2018, how would it change the leverage ratio and the debt ratio? How would this impact your assessment of the company's health from a leverage point of view? Select the formula and compute the leverage ratio assuming that the company had to capitalize leases amounting to $3,700,000. (Round your answer to two decimal places.) = Leverage ratio Select the formula and compute the debt ratio assuming that the company had to capitalize leases amounting to $3,700,000. (Round your answer to two decimal places.) = Debt ratio How would this change impact your assessment of the company's health from a leverage point of view? The leverage ratio and debt ratio would The company would from a leverage point of view

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts