Question: i need help with this question BUS 101-Exam 1-Fall 2019 Account Assets Llabilities Equity Revenue Expense Withdrawals Increased by Debit Credit Credit Credit Debit Debit

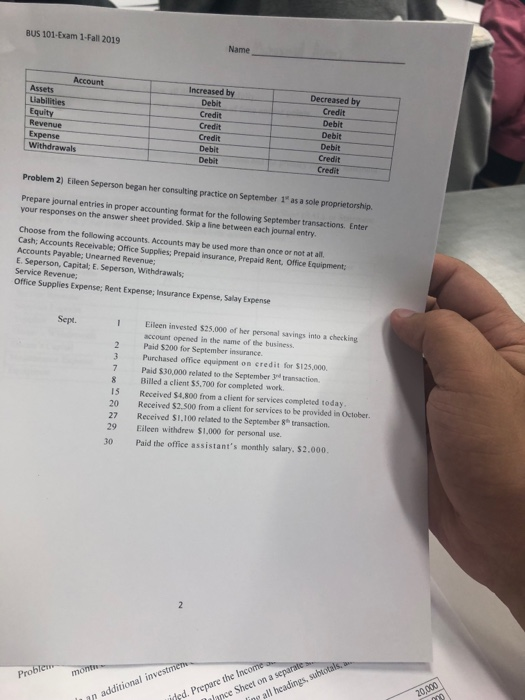

BUS 101-Exam 1-Fall 2019 Account Assets Llabilities Equity Revenue Expense Withdrawals Increased by Debit Credit Credit Credit Debit Debit Decreased by Credit Debit Debit Debit Credit Credit Problem 2) Eileen Seperson began her consulting practice on September 1" as a sole proprietorship. Prepare journal entries in proper accounting format for the following September transactions Enter your responses on the answer sheet provided. Skip a line between each journal entry. Choose from the following accounts. Accounts may be used more than once or not at all Cash; Accounts Receivable: Office Supplies: Prepaid insurance, Prepaid Rent, Office Equipment; Accounts Payable; Unearned Revenue: E. Seperson, Capital, E. Seperson, withdrawals; Service Revenue, Office Supplies Expense, Rent Expense; Insurance Expense, Salay Expense Sept. 8 Eileen invested $25.000 of her personal savings in a checking account opened in the name of the business Paid 5200 for September insurance Purchased office equipment on credit for $125.000 Paid $30,000 related to the September transaction Billed a client 55,700 for completed work. Received $4,800 from a client for services completed today. Received $2.500 from a client for services to be provided in October Received $1.100 related to the September transaction Eileen withdrew $1,000 for personal use. Paid the office assistant's monthly salary, 52.000 27 29 30 20.000 Problem itional investmen Prepare the Income ince Sheet on a separate all headings, subtotal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts