Question: Take a look at the pic and need a solution Instructions - Luxury Spas, Inc. started their business on May 1, 2020. For each transactions

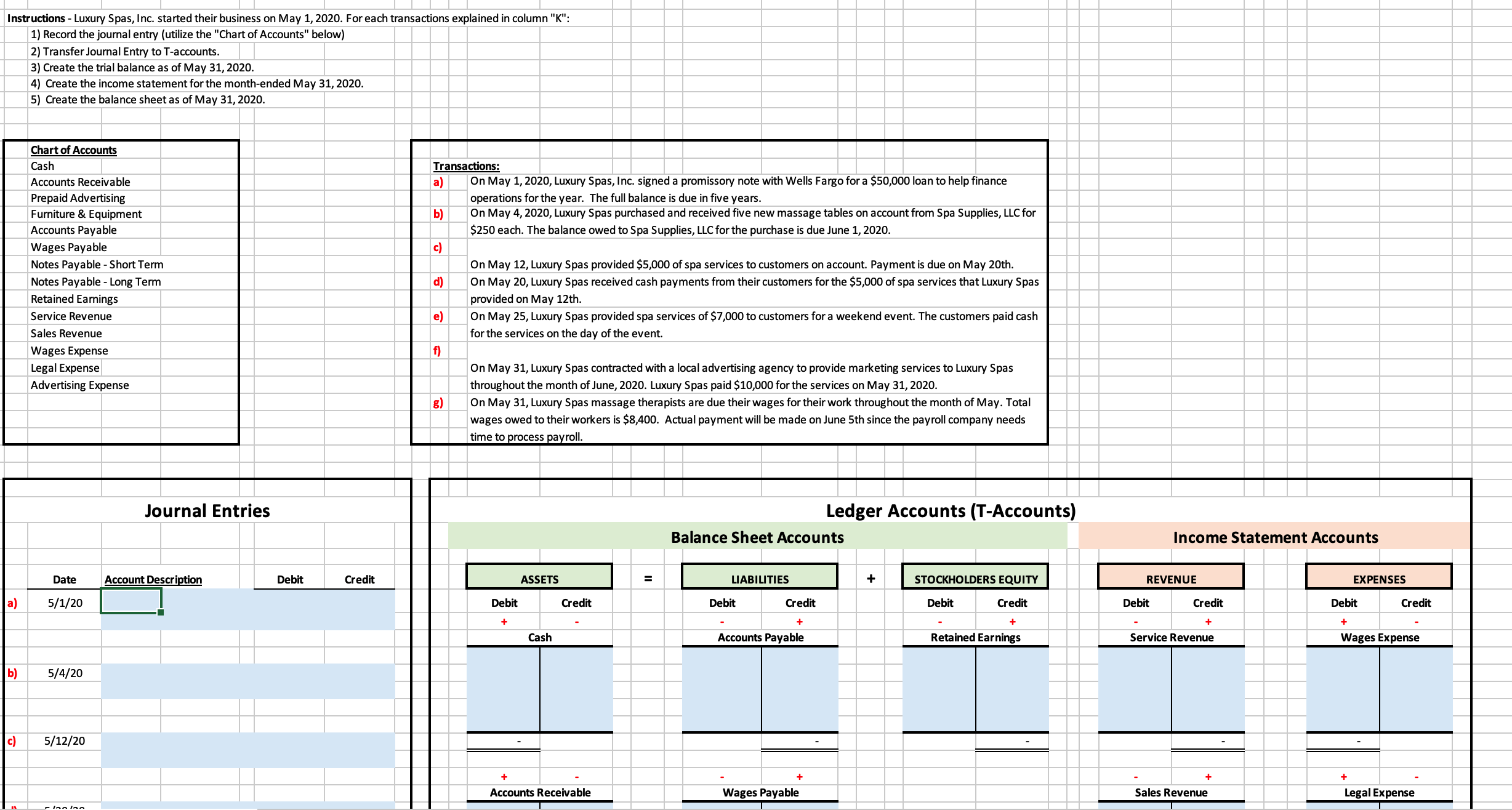

Instructions - Luxury Spas, Inc. started their business on May 1, 2020. For each transactions explained in column "K": 1) Record the joumal entry (utilize the "Chart of Accounts" below) 2) Transfer Joumal Entry to T-accounts. 3) Create the trial balance as of May 31, 2020. 4) Create the income statement for the month-ended May 31, 2020. 5) Create the balance sheet as of May 31, 2020. Chart of Accounts Cash Accounts Receivable Prepaid Advertising Fumiture & Equipment Accounts Payable Wages Payable Notes Payable - Short Term Notes Payable - Long Term Retained Eamings Service Revenue Sales Revenue Wages Expense Legal Expense Advertising Expense Journal Entries Transactions: a) d) g) Credit On May 1, 2020, Luxury Spas, Inc. signed a promissory note with Wells Fargo for a $50,000 loan to help finance operations for the year. The full balance is due in five years. On May 4, 2020, Luxury Spas purchased and received five new massage tables on account from Spa Supplies, LLC for $250 each. The balance owed to Spa Supplies, LLC for the purchase is due June 1, 2020. On May 12, Luxury Spas provided $5,000 of spa services to customers on account. Payment is due on May 20th. On May 20, Luxury Spas received cash payments from their customers for the $5,000 of spa services that Luxury Spas provided on May 12th. On May 25, Luxury Spas provided spa services of $7,000 to customers for a weekend event. The customers paid cash for the services on the day of the event. On May 31, Luxury Spas contracted with a local advertising agency to provide marketing services to Luxury Spas throughout the month of June, 2020. Luxury Spas paid $10,000 for the services on May 31, 2020. On May 31, Luxury Spas massage therapists are due their wages for their work throughout the month of May. Total wages owed to their workers is $8,400. Actual payment will be made on June 5th since the payroll company needs time to rocess a roll. ASSETS Ledger Accounts (T-Accounts) Income Statement Accounts a) b) c) Date 5/1/20 5/4/20 5/12/20 Account Description Debit Balance Sheet Accounts LIABILITIES STOCKHOLDERS EQUITY REVENUE EXPENSES Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Cash Accounts Receivable Accounts Payable Wages Payable Retained Earnings Service Revenue Sales Revenue Wages Expense Legal Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts