Question: I need help with this question in 10 min Genetics Engineering is considering the purchase of some new equipment that will cost $300,000 installed. The

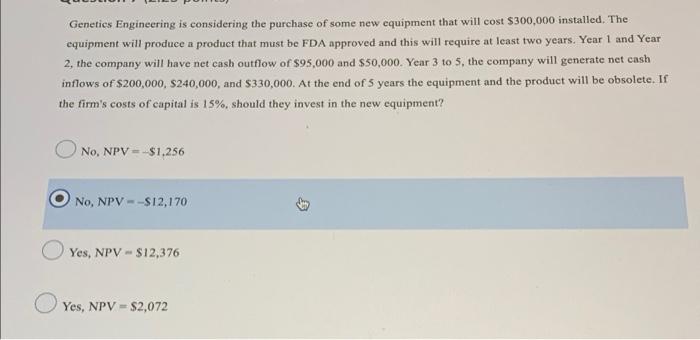

Genetics Engineering is considering the purchase of some new equipment that will cost $300,000 installed. The equipment will produce a product that must be FDA approved and this will require at least two years. Year 1 and Year 2, the company will have net cash outflow of $95,000 and $50,000. Year 3 to 5, the company will generate net cash inflows of $200,000, $240,000, and $330,000. At the end of 5 years the equipment and the product will be obsolete. If the firm's costs of capital is 15%, should they invest in the new equipment? No. NPV = $1,256 No, NPV --$12,170 Yes, NPV $12,376 Yes, NPV = $2,072

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts