Question: Question 5 (2.25 points) Genetics Engineering is considering the purchase of some new equipment that will cost $320,000 installed. The equipment will produce a product

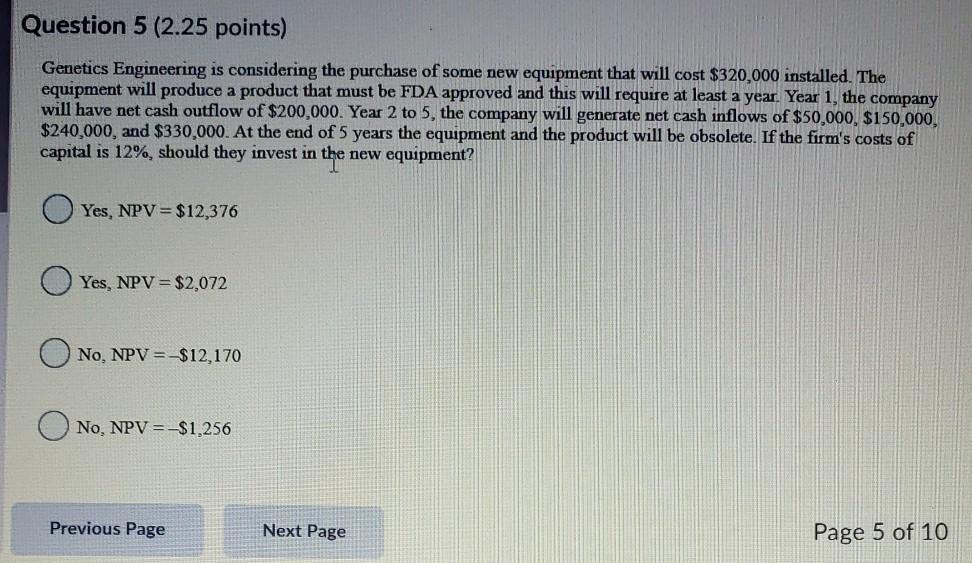

Question 5 (2.25 points) Genetics Engineering is considering the purchase of some new equipment that will cost $320,000 installed. The equipment will produce a product that must be FDA approved and this will require at least a year Year 1, the company will have net cash outflow of $200,000. Year 2 to 5, the company will generate net cash inflows of $50,000, $150,000, $240,000, and $330,000. At the end of 5 years the equipment and the product will be obsolete. If the firm's costs of capital is 12%, should they invest in the new equipment? Yes, NPV = $12,376 Yes, NPV = $2,072 No, NPV =-$12,170 No, NPV =-$1,256 Previous Page Next Page Page 5 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts