Question: i need help with this question in 10 min please Time Left: 1:52:21 Cecere Djane: Attempt -- You are 25 years old today, and plan

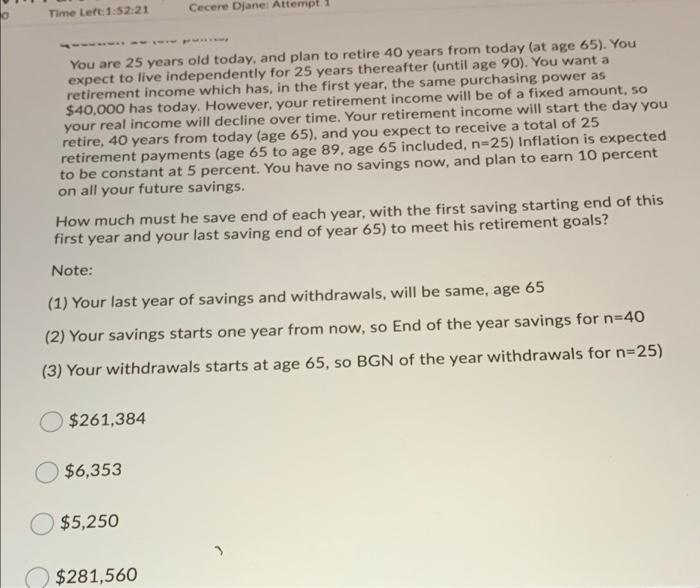

Time Left: 1:52:21 Cecere Djane: Attempt -- You are 25 years old today, and plan to retire 40 years from today (at age 65). You expect to live independently for 25 years thereafter (until age 90). You want a retirement income which has, in the first year, the same purchasing power as $40,000 has today. However, your retirement income will be of a fixed amount, so your real income will decline over time. Your retirement income will start the day you retire, 40 years from today (age 65), and you expect to receive a total of 25 retirement payments (age 65 to age 89. age 65 included, n=25) Inflation is expected to be constant at 5 percent. You have no savings now, and plan to earn 10 percent on all your future savings. How much must he save end of each year, with the first saving starting end of this first year and your last saving end of year 65) to meet his retirement goals? Note: (1) Your last year of savings and withdrawals, will be same, age 65 (2) Your savings starts one year from now, so End of the year savings for n=40 (3) Your withdrawals starts at age 65, so BGN of the year withdrawals for n=25) $261,384 $6,353 $5,250 $281,560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts