Question: I need help with this question. Please note that the depreciation of the hotel is $12,000 per year. The annual salary of George is 60,000

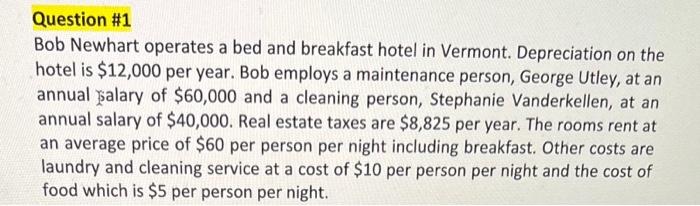

Question \#1 Bob Newhart operates a bed and breakfast hotel in Vermont. Depreciation on the hotel is $12,000 per year. Bob employs a maintenance person, George Utley, at an annual ralary of $60,000 and a cleaning person, Stephanie Vanderkellen, at an annual salary of $40,000. Real estate taxes are $8,825 per year. The rooms rent at an average price of $60 per person per night including breakfast. Other costs are laundry and cleaning service at a cost of $10 per person per night and the cost of food which is $5 per person per night

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts