Question: I need help with this question, please show the computing process,thank you so much. 4. A Corp. began operations in January 2021. A sells one

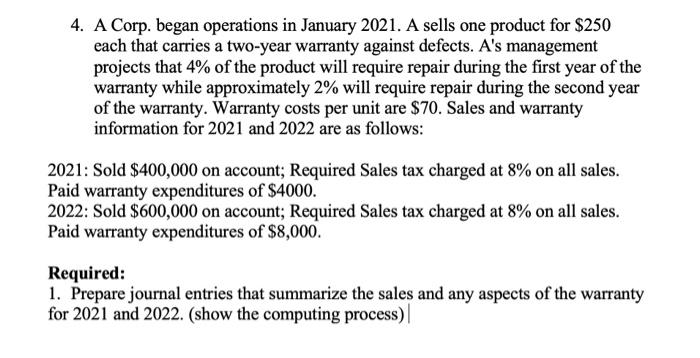

4. A Corp. began operations in January 2021. A sells one product for $250 each that carries a two-year warranty against defects. A's management projects that 4% of the product will require repair during the first year of the warranty while approximately 2% will require repair during the second year of the warranty. Warranty costs per unit are $70. Sales and warranty information for 2021 and 2022 are as follows: 2021: Sold $400,000 on account; Required Sales tax charged at 8% on all sales. Paid warranty expenditures of $4000. 2022: Sold $600,000 on account; Required Sales tax charged at 8% on all sales. Paid warranty expenditures of $8,000. Required: 1. Prepare journal entries that summarize the sales and any aspects of the warranty for 2021 and 2022. (show the computing process)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts