Question: I need help with this question please! Suppose the risk-free rate is 2.80% and an analyst assumes a market risk premium of 7.32%. Firm A

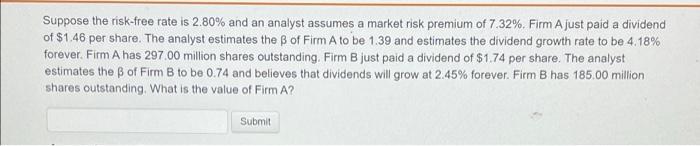

Suppose the risk-free rate is 2.80% and an analyst assumes a market risk premium of 7.32%. Firm A just paid a dividend of $1.46 per share. The analyst estimates the B of Firm A to be 1.39 and estimates the dividend growth rate to be 4.18% forever. Firm A has 297.00 million shares outstanding, Firm B just paid a dividend of $1.74 per share. The analyst estimates the of Firm B to be 0.74 and believes that dividends will grow at 2.45% forever. Firm B has 185.00 million shares outstanding. What is the value of Firm A? Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts