Question: I need help with this question. The second picture was my answer, however, it is wrong because I was told that my calculations must start

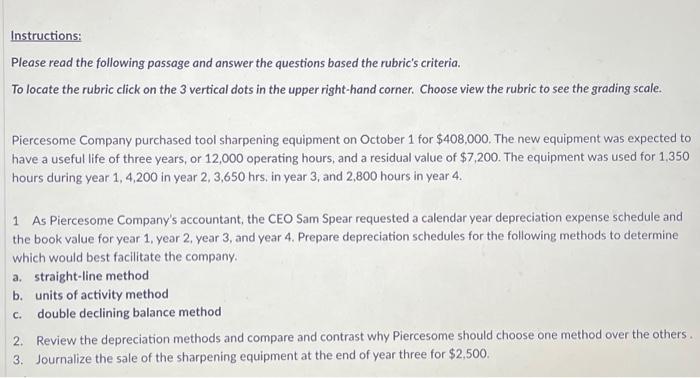

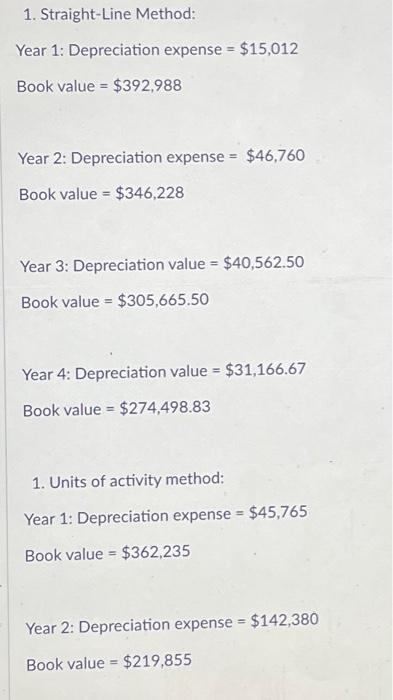

Instructions: Please read the following passage and answer the questions based the rubric's criteria. To locate the rubric click on the 3 vertical dots in the upper right-hand corner. Choose view the rubric to see the grading scale. Piercesome Company purchased tool sharpening equipment on October 1 for $408,000. The new equipment was expected to have a useful life of three years, or 12,000 operating hours, and a residual value of $7,200. The equipment was used for 1,350 hours during year 1,4,200 in year 2,3,650 hrs, in year 3 , and 2,800 hours in year 4. 1 As Piercesome Company's accountant, the CEO Sam Spear requested a calendar year depreciation expense schedule and the book value for year 1, year 2 , year 3 , and year 4. Prepare depreciation schedules for the following methods to determine which would best facilitate the company. a. straight-line method b. units of activity method c. double declining balance method 2. Review the depreciation methods and compare and contrast why Piercesome should choose one method over the others 3. Journalize the sale of the sharpening equipment at the end of year three for $2,500. 1. Straight-Line Method: Year 1: Depreciation expense =$15,012 Book value =$392,988 Year 2: Depreciation expense =$46,760 Book value =$346,228 Year 3: Depreciation value =$40,562.50 Book value =$305,665.50 Year 4: Depreciation value =$31,166.67 Book value =$274,498.83 1. Units of activity method: Year 1: Depreciation expense =$45,765 Book value =$362,235 Year 2: Depreciation expense =$142,380 Book value =$219,855

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts