Question: I need help with this tax problem: Here is what I need based on the information provided in the 5 images: you will compute the

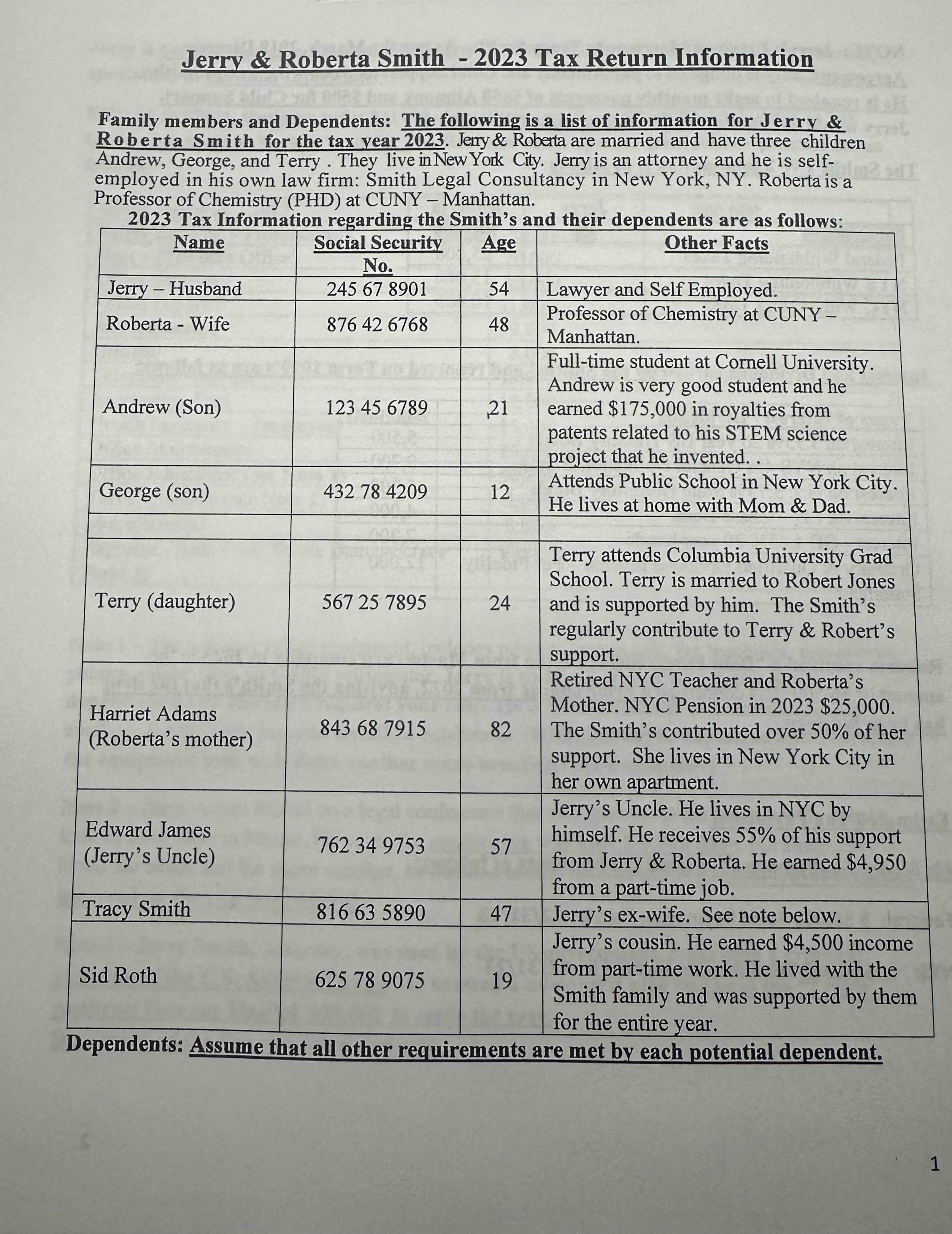

I need help with this tax problem: Here is what I need based on the information provided in the images: you will compute the Taxable Income, Tax Liability and the Tax Results for the YearAlos include the notes that are shown on the images that provided important information for the taxbale income calculation.

I do not need to know the dependent!!!!

Here are the rest of the information that did not fit on the images:

Note Contribution of Property: The painting and sculpture were appraised by a reputable company. MrSmith believes that the Estimated FMV should be $and not $

as declared by the appraisal company?

Gambling losses $see Note

Note Gambling Losses: MrSmith enjoys gambling and he considers himself to be a "Doctor of the Craps Table". During Jerry won $and incurred losses of $

His net gambling losses amounted to SAfter his summer winning streak, he has been constantly losing!

Note Child & Dependent Care Expenses and Child Care Credit : The Smith's want to claim "Child & Dependent Care Expenses" and the Child Care Credit. During the Smiths' spent $on Child Care expenses for their son George. Compute the amount of Child Care expenses allowed and Child Tax Credit allowed.

Note Education Credits: The Smith's spent $for tuition at Cornell University and $for Campus Housing. MrSmith would like to take advantage of the Education Credits available for his son Andrew.

Note Sale of Tribeca Apartment. In Jerry Smith purchased a two bedroom condominium apartment in Tribeca for Sin order to be close to his NYoffice In Jerrys Mother needed a new place to live in NYC and Jerry sold her his old apartment for $The apartment has a FMV of SJerry decided that he could use the loss to reduce his taxable income. Shortly thereafter, Jerry purchased another condominium nearby, in the new tower on Murray Street.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock