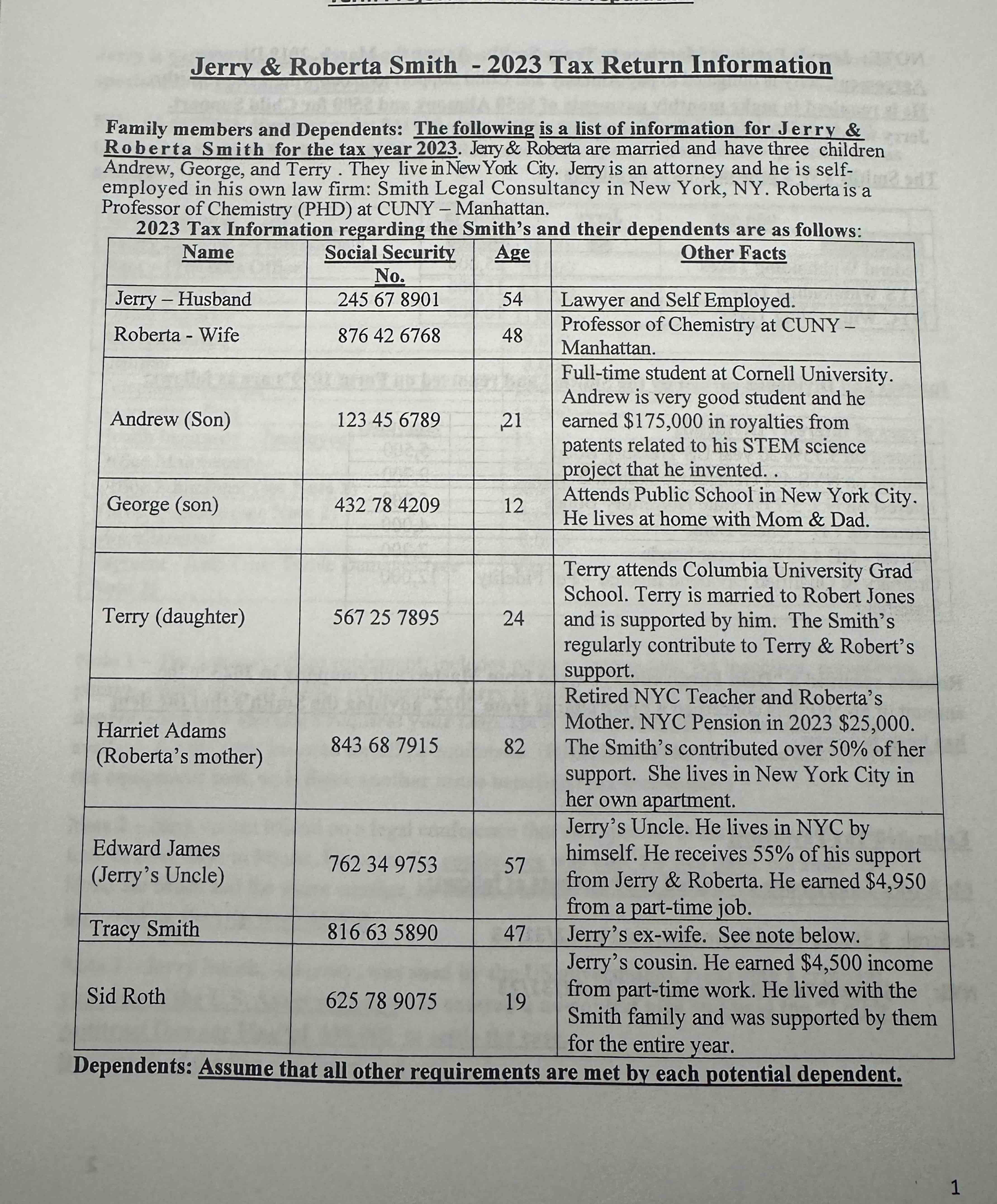

Question: I need help with this tax problem: Here is what I need based on the information provided in the 5 images: you will compute the

I need help with this tax problem: Here is what I need based on the information provided in the images: you will compute the Taxable Income, Tax Liability and the Tax Results for the Year, based upon the Tax Formula and Use the following categories:

Gross Income

Sch C: Net Income Net Loss

Net Capital Gains Losses

Deductions for AGI,

Adiusted Gross Income AGI

Itemized Deductions or Standard Deduction,

Taxable Income,

Tax Liability

Tax Due or Amount of Refund.

Here are the rest of the information that did not had space on the images:Donations of Property:

Paintings & Sculpture: see Note

Cost $

FMV Appraisal

Note Contribution of Property: The painting and sculpture were appraised by a reputable company. Mr Smith believes that the Estimated FMV should be $ and not $ as declared by the appraisal company?

Other Expenses $

Gambling losses see Note

Note Gambling Losses: Mr Smith enjoys gambling and he considers himself to be a "Doctor of the Craps Table". During Jerry won $ and incurred losses of $

His net gambling losses amounted to S After his summer winning streak, he has

been constantly losing!

Note Child & Dependent Care Expenses and Child Care Credit : The Smith's want to claim "Child & Dependent Care Expenses" and the Child Care Credit. During the Smiths' spent $ on Child Care expenses for their son George.

Compute the amount of Child Care expenses allowed and Child Tax Credit allowed.

Note Education Credits: The Smith's spent $ for tuition at Cornell University and $ for Campus Housing. Mr Smith would like to take advantage of the Education Credits available for his son Andrew.

Note Sale of Tribeca Apartment. In Jerry Smith purchased a two bedroom condominium apartment in Tribeca for S in order to be close to his NY office. In Jerry's Mother needed a new place to live in NYC and Jerry sold her his old apartment for $ The apartment has a FMV of S Jerry decided that he could use the loss to reduce his taxable income. Shortly thereafter, Jerry purchased another condominium nearby, in the new tower on Murray Street.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock