Question: I need help with thos fama-french three factor model question You are trying to evaluate a fund's performance. You run the so-called Famo-French three-factor model

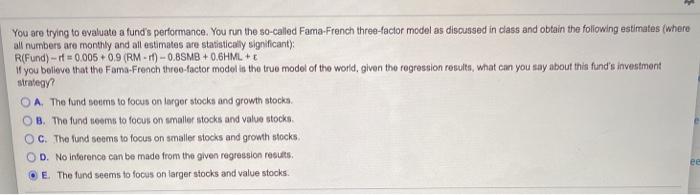

You are trying to evaluate a fund's performance. You run the so-called Famo-French three-factor model as discussed in class and obtain the following estimates (where all numbers are monthly and allestimates are statistically significant); R(Fund) - 0.005+0.9 (RM-r) - 0.85MB+0.6HML + + you believe that the Fama-French throw-factor model is the true model of the world, given the regression results, what can you say about this fund's investment strategy? A. The fund sooms to focus on targer stocks and growth stocks B. The fund noorm to focus on smaller stocks and value stock OC. The fund seems to focus on smaller stocks and growth stocks OD. No inference can be made from the given regression results, E. The fund seems to focus on larger stocks and value stocks. ee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts