Question: i need help writing a memo You are to submit a memo to the VP Finance regarding Part 4 of the question: are there ethics

i need help writing a memo

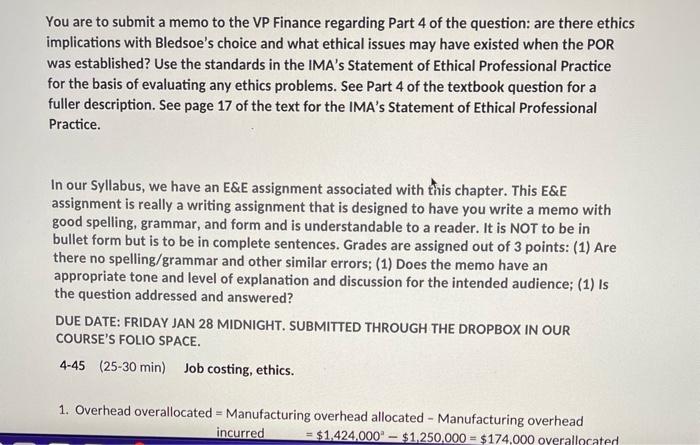

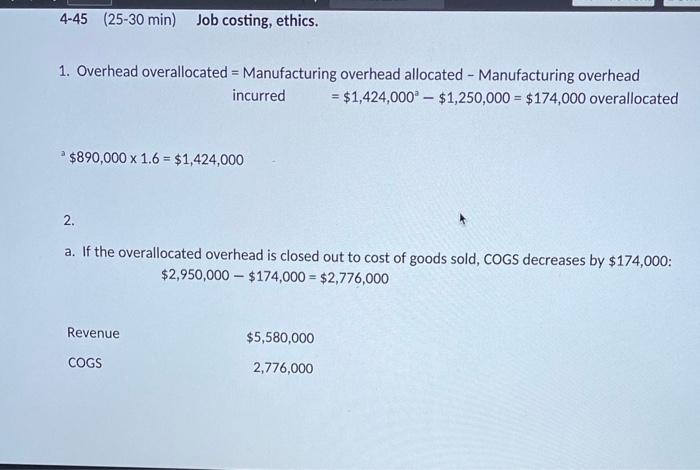

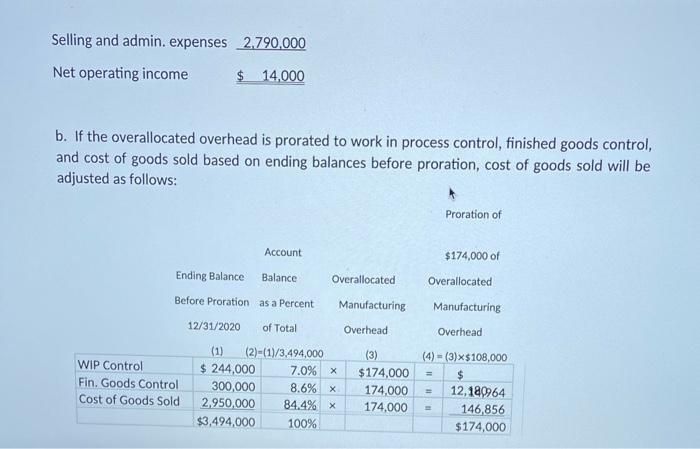

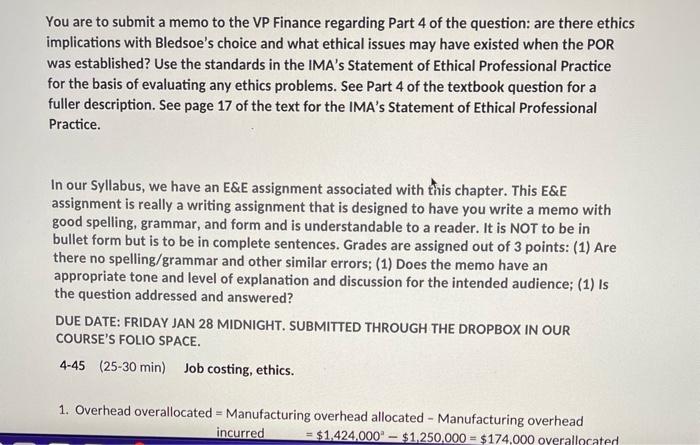

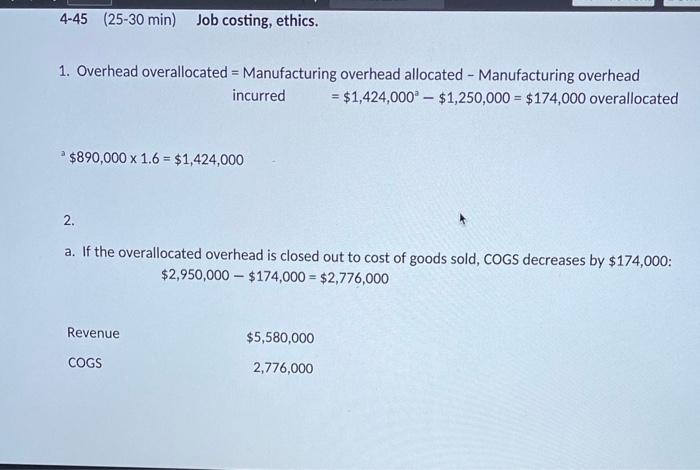

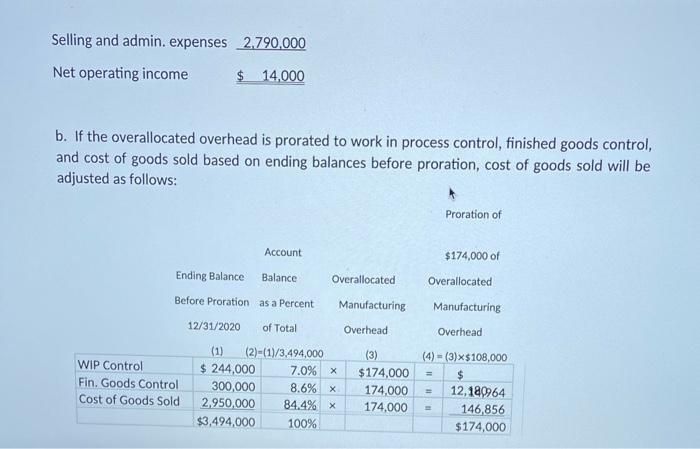

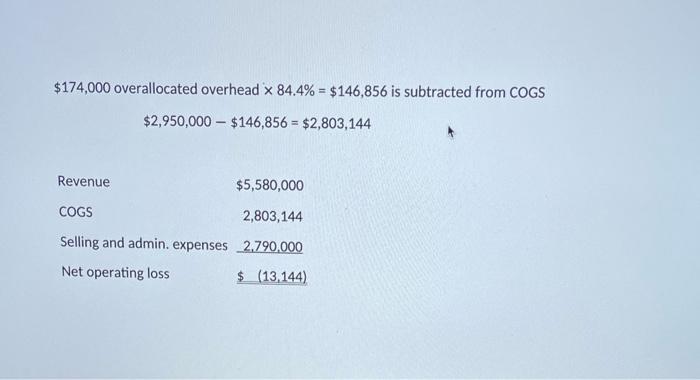

You are to submit a memo to the VP Finance regarding Part 4 of the question: are there ethics implications with Bledsoe's choice and what ethical issues may have existed when the POR was established? Use the standards in the IMA's Statement of Ethical Professional Practice for the basis of evaluating any ethics problems. See Part 4 of the textbook question for a fuller description. See page 17 of the text for the IMA's Statement of Ethical Professional Practice. In our Syllabus, we have an E&E assignment associated with this chapter. This E&E assignment is really a writing assignment that is designed to have you write a memo with good spelling, grammar, and form and is understandable to a reader. It is NOT to be in bullet form but is to be in complete sentences. Grades are assigned out of 3 points: (1) Are there no spelling/grammar and other similar errors; (1) Does the memo have an appropriate tone and level of explanation and discussion for the intended audience; (1) Is the question addressed and answered? DUE DATE: FRIDAY JAN 28 MIDNIGHT. SUBMITTED THROUGH THE DROPBOX IN OUR COURSE'S FOLIO SPACE. 4-45 (25-30 min) Job costing, ethics. 1. Overhead overallocated - Manufacturing overhead allocated - Manufacturing overhead incurred = $1.424.000'-- $1.250.000 = $174.000 overallocated 4-45 (25-30 min) Job costing, ethics. 1. Overhead overallocated = Manufacturing overhead allocated - Manufacturing overhead incurred = $1,424,000 - $1,250,000 = $174,000 overallocated $890,000 x 1.6 = $1,424,000 2. a. If the overallocated overhead is closed out to cost of goods sold, COGS decreases by $174,000: $2,950,000 --- $174,000 = $2,776,000 Revenue $5,580,000 COGS 2,776,000 Selling and admin. expenses 2,790,000 Net operating income $ 14,000 b. If the overallocated overhead is prorated to work in process control, finished goods control, and cost of goods sold based on ending balances before proration, cost of goods sold will be adjusted as follows: Proration of Account $174,000 of Overallocated Overallocated Ending Balance Balance Before Proration as a Percent Manufacturing Manufacturing 12/31/2020 of Total Overhead Overhead WIP Control Fin. Goods Control Cost of Goods Sold (1) (2)-(1/3,494,000 $ 244,000 7.0% X 300,000 8.6% 2,950,000 84.4% X $3,494,000 100% (3) $174,000 174,000 174,000 (4) = (3)>$108,000 $ 12,180964 146,856 $174,000 $174,000 overallocated overhead X 84.4% = $146,856 is subtracted from COGS $2,950,000 - $146,856 = $2,803,144 Revenue $5,580,000 COGS 2,803,144 Selling and admin. expenses 2.790,000 Net operating loss $ (13,144) You are to submit a memo to the VP Finance regarding Part 4 of the question: are there ethics implications with Bledsoe's choice and what ethical issues may have existed when the POR was established? Use the standards in the IMA's Statement of Ethical Professional Practice for the basis of evaluating any ethics problems. See Part 4 of the textbook question for a fuller description. See page 17 of the text for the IMA's Statement of Ethical Professional Practice. In our Syllabus, we have an E&E assignment associated with this chapter. This E&E assignment is really a writing assignment that is designed to have you write a memo with good spelling, grammar, and form and is understandable to a reader. It is NOT to be in bullet form but is to be in complete sentences. Grades are assigned out of 3 points: (1) Are there no spelling/grammar and other similar errors; (1) Does the memo have an appropriate tone and level of explanation and discussion for the intended audience; (1) Is the question addressed and answered? DUE DATE: FRIDAY JAN 28 MIDNIGHT. SUBMITTED THROUGH THE DROPBOX IN OUR COURSE'S FOLIO SPACE. 4-45 (25-30 min) Job costing, ethics. 1. Overhead overallocated - Manufacturing overhead allocated - Manufacturing overhead incurred = $1.424.000'-- $1.250.000 = $174.000 overallocated 4-45 (25-30 min) Job costing, ethics. 1. Overhead overallocated = Manufacturing overhead allocated - Manufacturing overhead incurred = $1,424,000 - $1,250,000 = $174,000 overallocated $890,000 x 1.6 = $1,424,000 2. a. If the overallocated overhead is closed out to cost of goods sold, COGS decreases by $174,000: $2,950,000 --- $174,000 = $2,776,000 Revenue $5,580,000 COGS 2,776,000 Selling and admin. expenses 2,790,000 Net operating income $ 14,000 b. If the overallocated overhead is prorated to work in process control, finished goods control, and cost of goods sold based on ending balances before proration, cost of goods sold will be adjusted as follows: Proration of Account $174,000 of Overallocated Overallocated Ending Balance Balance Before Proration as a Percent Manufacturing Manufacturing 12/31/2020 of Total Overhead Overhead WIP Control Fin. Goods Control Cost of Goods Sold (1) (2)-(1/3,494,000 $ 244,000 7.0% X 300,000 8.6% 2,950,000 84.4% X $3,494,000 100% (3) $174,000 174,000 174,000 (4) = (3)>$108,000 $ 12,180964 146,856 $174,000 $174,000 overallocated overhead X 84.4% = $146,856 is subtracted from COGS $2,950,000 - $146,856 = $2,803,144 Revenue $5,580,000 COGS 2,803,144 Selling and admin. expenses 2.790,000 Net operating loss $ (13,144)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock