Question: I need more detailed answer. The given one only contains final results, no calculating process. The accounting profit before tax of She Said Ltd for

I need more detailed answer. The given one only contains final results, no calculating process.

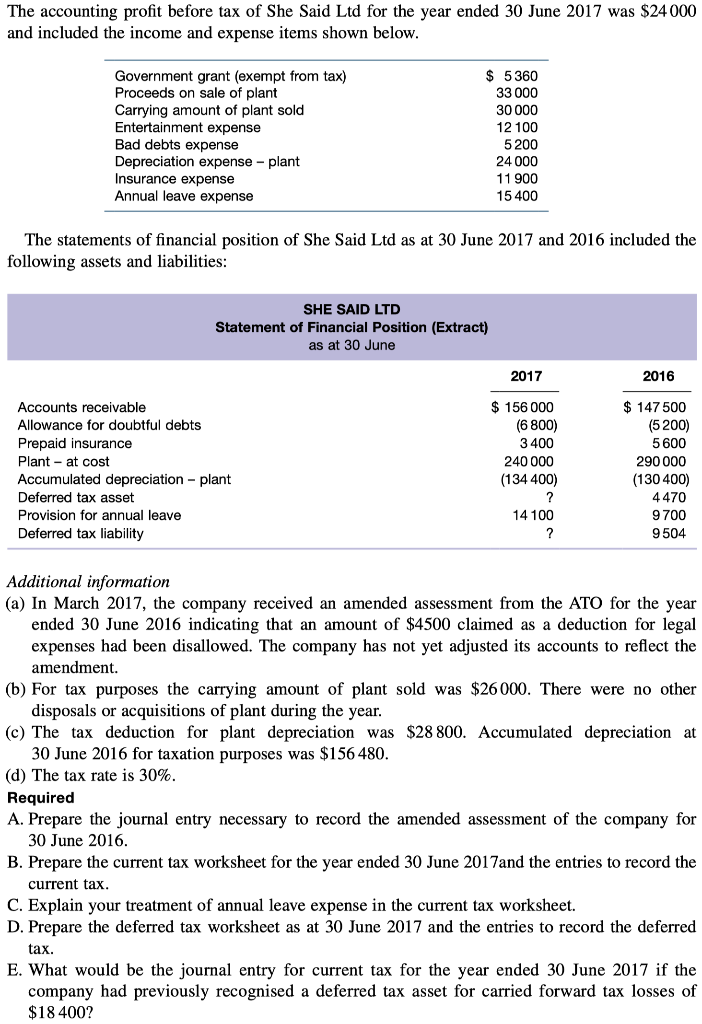

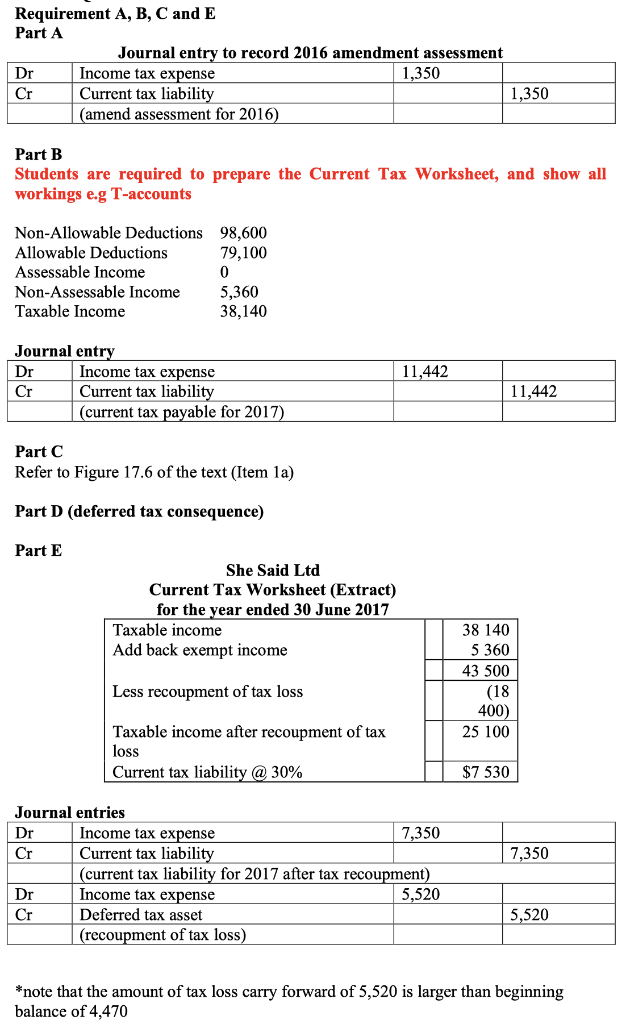

The accounting profit before tax of She Said Ltd for the year ended 30 June 2017 was $24000 and included the income and expense items shown below. The statements of financial position of She Said Ltd as at 30 June 2017 and 2016 included the following assets and liabilities: Additional information (a) In March 2017, the company received an amended assessment from the ATO for the year ended 30 June 2016 indicating that an amount of $4500 claimed as a deduction for legal expenses had been disallowed. The company has not yet adjusted its accounts to reflect the amendment. (b) For tax purposes the carrying amount of plant sold was $26000. There were no other disposals or acquisitions of plant during the year. (c) The tax deduction for plant depreciation was $28800. Accumulated depreciation at 30 June 2016 for taxation purposes was $156480. (d) The tax rate is 30%. Required A. Prepare the journal entry necessary to record the amended assessment of the company for 30 June 2016. B. Prepare the current tax worksheet for the year ended 30 June 2017and the entries to record the current tax. C. Explain your treatment of annual leave expense in the current tax worksheet. D. Prepare the deferred tax worksheet as at 30 June 2017 and the entries to record the deferred tax. E. What would be the journal entry for current tax for the year ended 30 June 2017 if the company had previously recognised a deferred tax asset for carried forward tax losses of $18400? Requirement A,B,C and E Part A Journal entrv to record 2016 amendment assessment Part B Students are required to prepare the Current Tax Worksheet, and show all workings e.g T-accounts Part C Refer to Figure 17.6 of the text (Item 1a) Part D (deferred tax consequence) Part E She Said Ltd Current Tax Worksheet (Extract) for the vear ended 30 June 2017 *note that the amount of tax loss carry forward of 5,520 is larger than beginning balance of 4,470 The accounting profit before tax of She Said Ltd for the year ended 30 June 2017 was $24000 and included the income and expense items shown below. The statements of financial position of She Said Ltd as at 30 June 2017 and 2016 included the following assets and liabilities: Additional information (a) In March 2017, the company received an amended assessment from the ATO for the year ended 30 June 2016 indicating that an amount of $4500 claimed as a deduction for legal expenses had been disallowed. The company has not yet adjusted its accounts to reflect the amendment. (b) For tax purposes the carrying amount of plant sold was $26000. There were no other disposals or acquisitions of plant during the year. (c) The tax deduction for plant depreciation was $28800. Accumulated depreciation at 30 June 2016 for taxation purposes was $156480. (d) The tax rate is 30%. Required A. Prepare the journal entry necessary to record the amended assessment of the company for 30 June 2016. B. Prepare the current tax worksheet for the year ended 30 June 2017and the entries to record the current tax. C. Explain your treatment of annual leave expense in the current tax worksheet. D. Prepare the deferred tax worksheet as at 30 June 2017 and the entries to record the deferred tax. E. What would be the journal entry for current tax for the year ended 30 June 2017 if the company had previously recognised a deferred tax asset for carried forward tax losses of $18400? Requirement A,B,C and E Part A Journal entrv to record 2016 amendment assessment Part B Students are required to prepare the Current Tax Worksheet, and show all workings e.g T-accounts Part C Refer to Figure 17.6 of the text (Item 1a) Part D (deferred tax consequence) Part E She Said Ltd Current Tax Worksheet (Extract) for the vear ended 30 June 2017 *note that the amount of tax loss carry forward of 5,520 is larger than beginning balance of 4,470

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts