Question: i need only correct answers without any exolain only correct choice i need only correct choice without explain (Testbank) CHAPTER 1 CONCEPTUAL FRAMEWORK FOR FINANCIAL

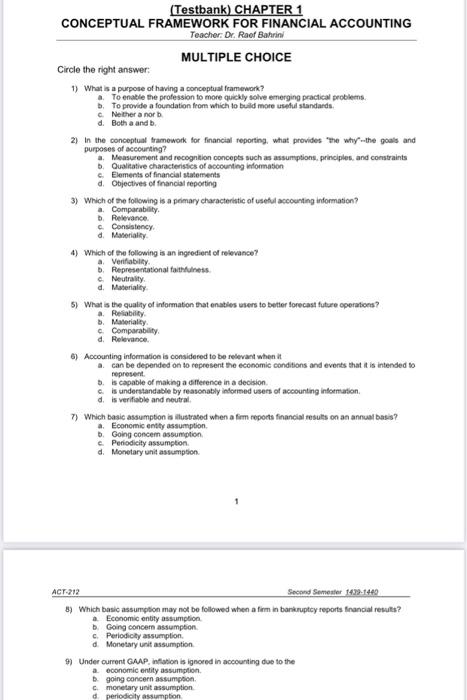

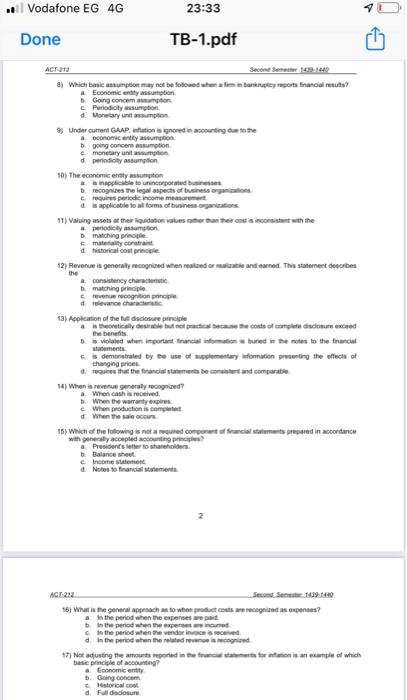

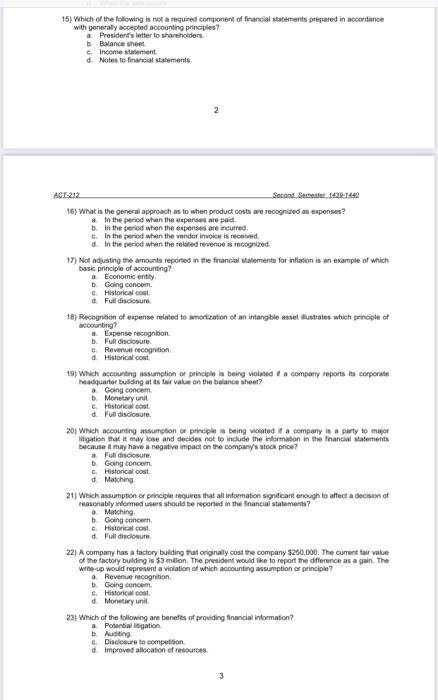

(Testbank) CHAPTER 1 CONCEPTUAL FRAMEWORK FOR FINANCIAL ACCOUNTING Teacher: Dr. Raof Bahrini MULTIPLE CHOICE Circle the right answer: 1) What is a purpose of having a conceptual framework? To enable the profession to more quickly solve emerging practical problems b. To provide a foundation from which to build more useful standards c. Neither a norb d. Botha and b. 2) In the conceptun tramework for financial reporting, what provides the why the goals and purposes of accounting? Measurement and recognition concepts such as assumptions, principles and constraints Qualitative characteristics of accounting information c. Elements of financial statements d. Objectives of financial reporting 3) Which of the following is a primary characteristic of useful accounting information? a Comparability, Relevance. Consistency d. Materially 4) Which of the following is an ingredient of relevance? a Verifiability Representational faithfulness . Neutrality d. Materiality 5) What is the quality of information that enables users to better forecast future operations? a Reliability 5. Materiality Comparability d. Relevance 6) Accounting information is considered to be relevant when it can be depended on to represent the economic conditions and events that it is intended to represent is capable of making a difference in a decision is understandable by reasonably informed users of accounting information d.is verifiable and neutral 7) Which basic assumption is illustrated when a firm reports financial resuts on an annual basis? a. Economic entity assumption Going concern assumption c. Periodicity assumption d. Monetary unit assumption ACT 212 Second Semester 1429-1449 5) Which basic assumption may not be followed when a fiemien bankruptcy reports financial results? Economic entity assumption Going concern assumption c. Periodicty assumption d. Monetary unit assumption 9) Under current GAAP. Inflation is ignored in accounting due to the a economic entity assumption going concern assumption C monetary unit assumption d periodicity assumption .Vodafone EG 4G 23:33 Done TB-1.pdf ACT 212 Second Semester 1029 1040 2) Which basic sumption may not be followedbankruptcy reports financial results Economic entity assumption Going conception Periodily assumption d Monetary units 9) Under current GAAP. Wion is not in uting to the conomic entity asumo e monetary unit sumption going concernsumption d. periodily assumption 10) The economicettato #inapplicable to incorporated recognces the legal aspects of business organizations res periodic income measurement ds applicable to all forms of business organization 11) Valuing assets at their liquidation values rather than her cuts inconsistent with the #periodicty stumption matching price may contain d historical controle 12) Revenue is generally recognised when realized or state and earned This statement describes the consistency characteristic matching principle e recognition principle drelevance characters 13) Application of the disclosure principle theoretically but notice the cost of completedor exced the benefits violated when important than woontured in the notes to the financial statements demonstrated by the use of supplementary Womation presenting the effects of changing prices requires that the financial statements de content and comparable 14) When is revenue generally recognised? When cash received b. When the warranty expires When production is completed d. When the 15) Which of the following is not required component of financial statements prepared in accordance with generally accepted accounting principles? a President's letter to shareholders Balance sheet Income Notes to financial statements ACT 212 Second Set 10.40 15) What is the general approach as to when productos recognized as expenses? a. In the period when the expenses are paid In the period when the expenses and in the period when the vendinice roved d. In the period when the related rewed 17) Not adjusting the amounts reported in the facts for info is an example of which basic principle of accounting a Economic entity . Going concem Historical.com d. Fullosure 15) Which of the following is not a required component of financial statements prepared in accordance with generally accepted accounting principles? a President's letter to shareholders Balance sheet Income statement d. Notes to financial statements 2 ACT-212 16) What is the general approach as to when product costs are recognized as expenses? # In the period when the expenses are paid In the period when the expenses are incurred c. In the period when the vendor Invoice is received d. In the period when the related revenue is recognized 17) Not adjusting the amounts reported in the financial statements for inflation is an example of which baske principle of accounting? a Economic entily b. Going concer Historical cost Full discosure 18) Recognition of expense related to amortization of an intangible asset illustrates which seinciele of accounting Expense recognition Puidhiclosure Revenue recognition Historical 19) Which accounting assumption or principle is being violated a company reports is corporate headquarter bulong at as far value on the balance sheet? Going concern Monetary unit. Historical d. Ful disclosure 20) Which accounting assumption or principles being violated a company is a party to major migration may lose and decides not to include the wormation in the financial statements Decause I may have a negative impact on the company's stock price? # Full disclosure Going concern c. Historical cost Matching 21) Which assumption of principle recures that all information confiant enough to affect a decision of users should be reported the statements? Matching b. Going concern 6. Historical cost d Fuldadosure 22) A company has a factory building that originally cost the company $250.000. The current fair value of the factory buildings $3 milion. The president would like to report the difference as a gain. The write-up would represent a violation of which accounting assumption or principle? Revenue recognition Going concer e Historical cost Monetary unit. 23) Which of the benefits of providing financial information? ton c. Disclosure to competition Improved allocation of resources 3 (Testbank) CHAPTER 1 CONCEPTUAL FRAMEWORK FOR FINANCIAL ACCOUNTING Teacher: Dr. Raof Bahrini MULTIPLE CHOICE Circle the right answer: 1) What is a purpose of having a conceptual framework? To enable the profession to more quickly solve emerging practical problems b. To provide a foundation from which to build more useful standards c. Neither a norb d. Botha and b. 2) In the conceptun tramework for financial reporting, what provides the why the goals and purposes of accounting? Measurement and recognition concepts such as assumptions, principles and constraints Qualitative characteristics of accounting information c. Elements of financial statements d. Objectives of financial reporting 3) Which of the following is a primary characteristic of useful accounting information? a Comparability, Relevance. Consistency d. Materially 4) Which of the following is an ingredient of relevance? a Verifiability Representational faithfulness . Neutrality d. Materiality 5) What is the quality of information that enables users to better forecast future operations? a Reliability 5. Materiality Comparability d. Relevance 6) Accounting information is considered to be relevant when it can be depended on to represent the economic conditions and events that it is intended to represent is capable of making a difference in a decision is understandable by reasonably informed users of accounting information d.is verifiable and neutral 7) Which basic assumption is illustrated when a firm reports financial resuts on an annual basis? a. Economic entity assumption Going concern assumption c. Periodicity assumption d. Monetary unit assumption ACT 212 Second Semester 1429-1449 5) Which basic assumption may not be followed when a fiemien bankruptcy reports financial results? Economic entity assumption Going concern assumption c. Periodicty assumption d. Monetary unit assumption 9) Under current GAAP. Inflation is ignored in accounting due to the a economic entity assumption going concern assumption C monetary unit assumption d periodicity assumption .Vodafone EG 4G 23:33 Done TB-1.pdf ACT 212 Second Semester 1029 1040 2) Which basic sumption may not be followedbankruptcy reports financial results Economic entity assumption Going conception Periodily assumption d Monetary units 9) Under current GAAP. Wion is not in uting to the conomic entity asumo e monetary unit sumption going concernsumption d. periodily assumption 10) The economicettato #inapplicable to incorporated recognces the legal aspects of business organizations res periodic income measurement ds applicable to all forms of business organization 11) Valuing assets at their liquidation values rather than her cuts inconsistent with the #periodicty stumption matching price may contain d historical controle 12) Revenue is generally recognised when realized or state and earned This statement describes the consistency characteristic matching principle e recognition principle drelevance characters 13) Application of the disclosure principle theoretically but notice the cost of completedor exced the benefits violated when important than woontured in the notes to the financial statements demonstrated by the use of supplementary Womation presenting the effects of changing prices requires that the financial statements de content and comparable 14) When is revenue generally recognised? When cash received b. When the warranty expires When production is completed d. When the 15) Which of the following is not required component of financial statements prepared in accordance with generally accepted accounting principles? a President's letter to shareholders Balance sheet Income Notes to financial statements ACT 212 Second Set 10.40 15) What is the general approach as to when productos recognized as expenses? a. In the period when the expenses are paid In the period when the expenses and in the period when the vendinice roved d. In the period when the related rewed 17) Not adjusting the amounts reported in the facts for info is an example of which basic principle of accounting a Economic entity . Going concem Historical.com d. Fullosure 15) Which of the following is not a required component of financial statements prepared in accordance with generally accepted accounting principles? a President's letter to shareholders Balance sheet Income statement d. Notes to financial statements 2 ACT-212 16) What is the general approach as to when product costs are recognized as expenses? # In the period when the expenses are paid In the period when the expenses are incurred c. In the period when the vendor Invoice is received d. In the period when the related revenue is recognized 17) Not adjusting the amounts reported in the financial statements for inflation is an example of which baske principle of accounting? a Economic entily b. Going concer Historical cost Full discosure 18) Recognition of expense related to amortization of an intangible asset illustrates which seinciele of accounting Expense recognition Puidhiclosure Revenue recognition Historical 19) Which accounting assumption or principle is being violated a company reports is corporate headquarter bulong at as far value on the balance sheet? Going concern Monetary unit. Historical d. Ful disclosure 20) Which accounting assumption or principles being violated a company is a party to major migration may lose and decides not to include the wormation in the financial statements Decause I may have a negative impact on the company's stock price? # Full disclosure Going concern c. Historical cost Matching 21) Which assumption of principle recures that all information confiant enough to affect a decision of users should be reported the statements? Matching b. Going concern 6. Historical cost d Fuldadosure 22) A company has a factory building that originally cost the company $250.000. The current fair value of the factory buildings $3 milion. The president would like to report the difference as a gain. The write-up would represent a violation of which accounting assumption or principle? Revenue recognition Going concer e Historical cost Monetary unit. 23) Which of the benefits of providing financial information? ton c. Disclosure to competition Improved allocation of resources 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts