Question: i need part 2 & 3 . please answer it right or let an expert answer. Intro You just took out a 15-year traditional fixed-rate

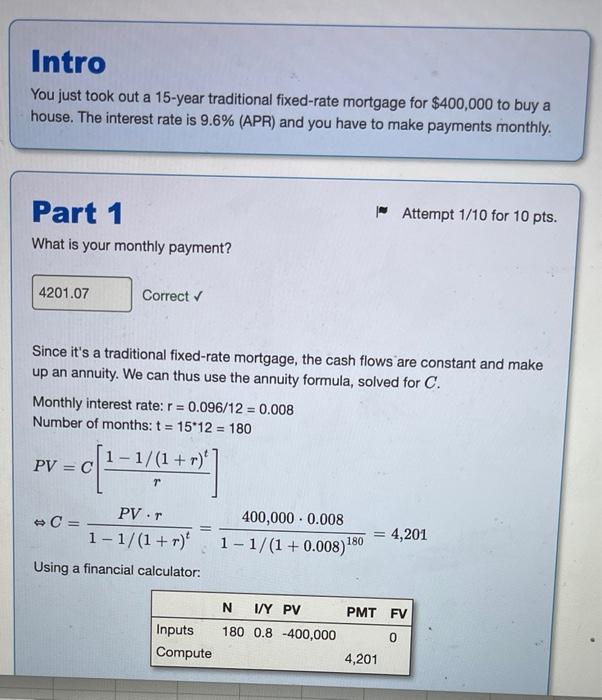

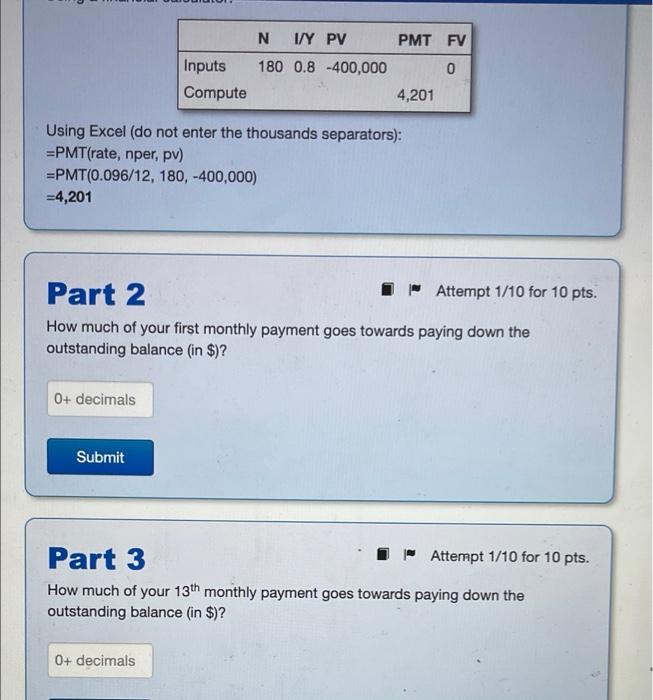

Intro You just took out a 15-year traditional fixed-rate mortgage for $400,000 to buy a house. The interest rate is 9.6% (APR) and you have to make payments monthly. Attempt 1/10 for 10 pts. Part 1 What is your monthly payment? 4201.07 Correct Since it's a traditional fixed-rate mortgage, the cash flows are constant and make up an annuity. We can thus use the annuity formula, solved for C. Monthly interest rate: r = 0.096/12 = 0.008 Number of months: t = 1512 = 180 -1/(1+r)] PV = C - 0[/+7 T PVT 400,000 0.008 1-1/(1+0.008) = 4,201 C= 1-1/(1+r) Using a financial calculator: 180 PMT FV N I/Y PV 180 0.8 -400,000 Inputs Compute 0 4,201 PMT FV N I/Y PV 180 0.8 -400,000 0 Inputs Compute 4,201 Using Excel (do not enter the thousands separators): =PMT(rate, nper, pv) =PMT(0.096/12, 180, -400,000) -4,201 Part 2 I Attempt 1/10 for 10 pts. How much of your first monthly payment goes towards paying down the outstanding balance (in $)? 0+ decimals Submit Part 3 Attempt 1/10 for 10 pts. How much of your 13th monthly payment goes towards paying down the outstanding balance (in $)? 0+ decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts