Question: You have recently been contacted to assist a new client with understanding her income for the 2021 tax year. The clients name is Lauren Free

You have recently been contacted to assist a new client with understanding her income for the 2021 tax year. The clients name is Lauren Free and she is a midwife who is employed by Moreton Health. She has come to you to seek advice about which receipts received could potentially be assessable for the 30 June 2021 tax year.

During the 2020/21 tax year Lauren received a weekly salary of $1850, an annual uniform allowance of $400 paid to her, and $300 reimbursed by Moreton Health (her employer) for the payment she made for annual membership to the Australian Primary Health Care Nurses Association.

During the 2020/21 income year Lauren assisted with the delivery of over 250 babies. One of those deliveries was a set of triplets. The parents of the triplets were so thankful to Lauren for the care and compassion she gave them during the birth that they gifted her a $100 Myer voucher to say thank you. Lauren had only met Fred and Lily (the parents) on the day that the triplets were born, as their usual midwife was on holidays.

When Lauren was offered the position at Moreton Health, she was asked to agree to a term in her contract that prevents her from working as a midwife in another Brisbane hospital for a period of 2 years once her employment ends. Lauren signed the contract and was paid $10,000 in respect of term in the contract.

On 4 April 2021, Lauren sustained a back injury at work from lifting something very heavy. She was unable to work for a substantial period of time. Lauren claimed workers compensation for a 5 week period from the time that the injury occurred. The Workers compensation details are as follows;

Workers' compensation payments to replace lost income (for 5 weeks) $9,250

Unfortunately for Lauren, Workers Compensation did not cover all of the costs related to her rehabilitation. Therefore, Lauren entered into a damages claim against Moreton Health to recover these costs. Lauren and Moreton Health reached an agreement during court mediation proceedings. This agreement resulted in Lauren being paid a sum of money for her personal injury and suffering on 31 May 2021. The details of this payment are detailed below;

Court awarded damages resulting from a personal injury claim $4,000

On 10 November 2020, Lauren received an unfranked dividend of $600 from the ANZ bank. Lauren also received $20,000 on 1 September 2020 for royalty income from sales of a children's book that she wrote in 2017.

Lauren won $2,000 playing bingo at the local bowls club when she took her grandma out for dinner on 5 March, 2021.

Required:

Explain to Lauren in your professional opinion as to whether each of the receipts mentioned above constitute income under s6-5 of the ITAA97. There is no need to consider the source of the income or when it was derived, just discuss whether the receipts are ordinary income or not. Ensure that you apply the relevant law to the facts.

Note to Students: The format of your answer should follow the steps outlined in your Study Guide ( - the steps are amalgamated below). Your answer should apply the primary sources of law discussed in the lecture about Study Guide Chapter Two - Assessable Income. That is, ensure you refer to legislative references and case law where applicable.

IDENTIFYING WHETHER A RECEIPT WILL BE ASSESSABLE UNDER s 6-5 ITAA97:

Step 1: Is there a legislative definition of 'ordinary income' under the ITAA?

Step 2: Is there case law that defines 'ordinary income'?

Consider the common law characteristics of ordinary income - have these

been met on the balance?

Does the receipt fit into any of the known categories of ordinary income:

Step 2(a): Are any of the receipts 'income from personal exertion'?

Step 2(b): Are any of the receipts 'income from property'?

Step 2(c): Are any of the receipts 'income from business'?

Step 3: Are any of the receipts exempt or non-assessable non-exempt income?

Step 4: Are any of the receipts a kind of statutory income? The statutory provision usually prevails.

Any receipts that do not fit into the any of the above categories will not be a kind of assessable income.

part 2.

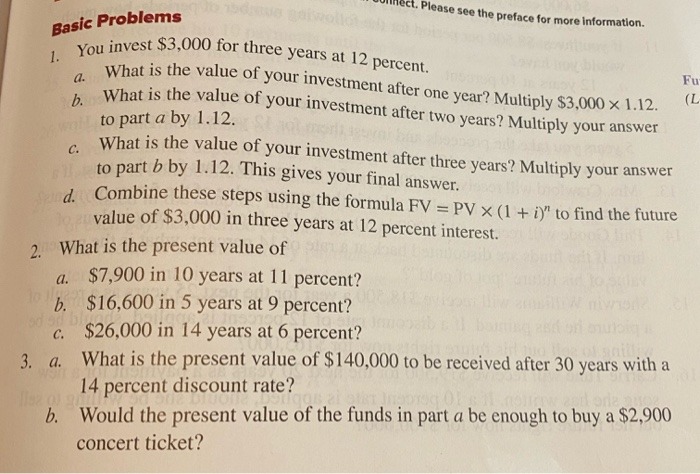

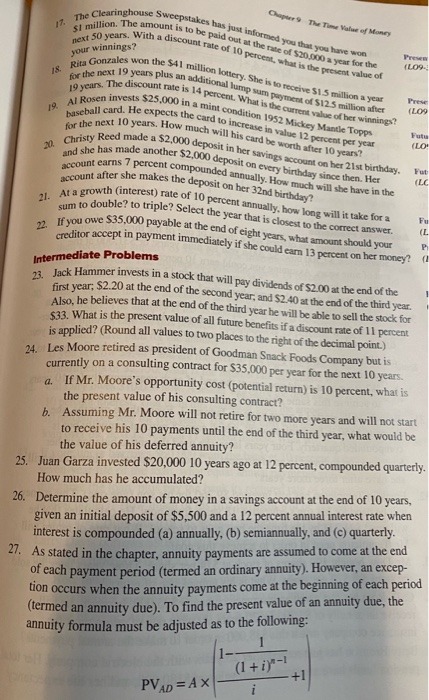

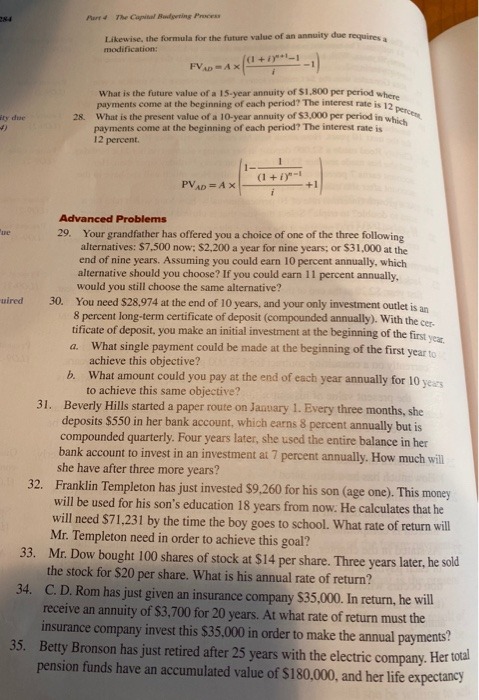

fect. Please see the preface for more information. Basic Problems 1. You invest $3,000 for three years at 12 percent. Fu What is the value of your investment after one year? Multiply $3,000 x 1.12. (L What is the value of your investment after two years? Multiply your answer well to part a by 1.12. What is the value of your investment after three years? Multiply your answer to part b by 1.12. This gives your final answer. d. Combine these steps using the formula FV = PV x (1 + 0)" to find the future Jo eu value of $3,000 in three years at 12 percent interest. 2. What is the present value of a. $7,900 in 10 years at 11 percent? b. $16,600 in 5 years at 9 percent? c. $26,000 in 14 years at 6 percent? 3. a. What is the present value of $140,000 to be received after 30 years with a 14 percent discount rate? b. Would the present value of the funds in part a be enough to buy a $2,900 concert ticket?Chapters The Ther Value of Money The Clearinghouse Sweepstakes has just informed you that you have 41 million. The amount is to be paid out at the rate of $20.000 a year for the your winnings? next 50 years. With a discount rate of 10 percent, what is the present value to LO9. e Rita Gonzales won the $41 million lottery. She is to receive $1.5 million an for the next 19 years plus an additional lump sum payment of $12 5 million intel 19 years. The discount rate is 14 percent. What is the current value of her winning 19 Al Rosen invests $25.000 in a mint condition 1952 Mickey Mantle Topp" baseball card. He expects the card to increase in value 12 percent per year for the next 10 years. How much will his card be worth after 10 years Futu (LO 20. Christy Reed made a $2,000 deposit in her savings account on her 21st birthday. and she has made another $2,000 deposit on every birthday since then. Her Fut account earns 7 percent compounded annually. How much will she have in the (LC account after she makes the deposit on her 32nd birthday? 21. At a growth (interest) rate of 10 percent annually. how long will it take for a sum to double? to triple? Select the year that is closest to the correct answer. Fu 72. If you owe $35.000 payable at the end of eight years, what amount should your creditor accept in payment immediately if she could earn 13 percent on her money? Intermediate Problems 23. Jack Hammer invests in a stock that will pay dividends of $2.00 at the end of the first year; $2.20 at the end of the second year, and $2.40 at the end of the third year. Also, he believes that at the end of the third year he will be able to sell the stock for $33. What is the present value of all future benefits if a discount rate of 11 percent is applied? (Round all values to two places to the right of the decimal point.) 24. Les Moore retired as president of Goodman Snack Foods Company but is currently on a consulting contract for $35,000 per year for the next 10 years. a. If Mr. Moore's opportunity cost (potential return) is 10 percent, what is the present value of his consulting contract? b. Assuming Mr. Moore will not retire for two more years and will not start to receive his 10 payments until the end of the third year, what would be the value of his deferred annuity? 25. Juan Garza invested $20,000 10 years ago at 12 percent, compounded quarterly. How much has he accumulated? 26. Determine the amount of money in a savings account at the end of 10 years, given an initial deposit of $5,500 and a 12 percent annual interest rate when interest is compounded (a) annually, (b) semiannually, and (c) quarterly. 27. As stated in the chapter, annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). However, an excep tion occurs when the annuity payments come at the beginning of each period (termed an annuity due). To find the present value of an annuity due, the annuity formula must be adjusted as to the following: 1 (1 + i)"-1 +1 PVAD = AX iFurr 4 The Capital Badgering Process Likewise. the formula for the future value of an annuity due requires ; modification: FVADAX (+1)"-1 2-1 What is the future value of a 15-year annuity of $1.800 per period where Payments come at the beginning of each period? The interest rate is 12 percy ity dur 28. What is the present value of a 10-year annuity of $3,000 per period in which payments come at the beginning of each period? The interest rate is 12 percent. PVAD = A X +1 Advanced Problems 29. Your grandfather has offered you a choice of one of the three following alternatives: $7.500 now: $2,200 a year for nine years; or $31,000 at the end of nine years. Assuming you could earn 10 percent annually, which alternative should you choose? If you could earn 11 percent annually, would you still choose the same alternative? wired 30. You need $28,974 at the end of 10 years, and your only investment outlet is an 8 percent long-term certificate of deposit (compounded annually). With the cer- tificate of deposit. you make an initial investment at the beginning of the first year. 4. What single payment could be made at the beginning of the first year to achieve this objective? b. What amount could you pay at the end of each year annually for 10 years to achieve this same objective? 31. Beverly Hills started a paper route on January 1. Every three months, she deposits $550 in her bank account, which earns 8 percent annually but is compounded quarterly. Four years later, she used the entire balance in her bank account to invest in an investment at 7 percent annually. How much will she have after three more years? 32. Franklin Templeton has just invested $9,260 for his son (age one). This money will be used for his son's education 18 years from now. He calculates that he will need $71,231 by the time the boy goes to school. What rate of return will Mr. Templeton need in order to achieve this goal? 33. Mr. Dow bought 100 shares of stock at $14 per share. Three years later, he sold the stock for $20 per share. What is his annual rate of return? 34. C. D. Rom has just given an insurance company $35,000. In return, he will receive an annuity of $3,700 for 20 years. At what rate of return must the insurance company invest this $35,000 in order to make the annual payments? 35. Betty Bronson has just retired after 25 years with the electric company. Her total pension funds have an accumulated value of $180,000, and her life expectancy