Question: i need question 20 please It is July 16. A company has a stock portfolio worth $50 million. The beta of the stock portfolio is

i need question 20 please

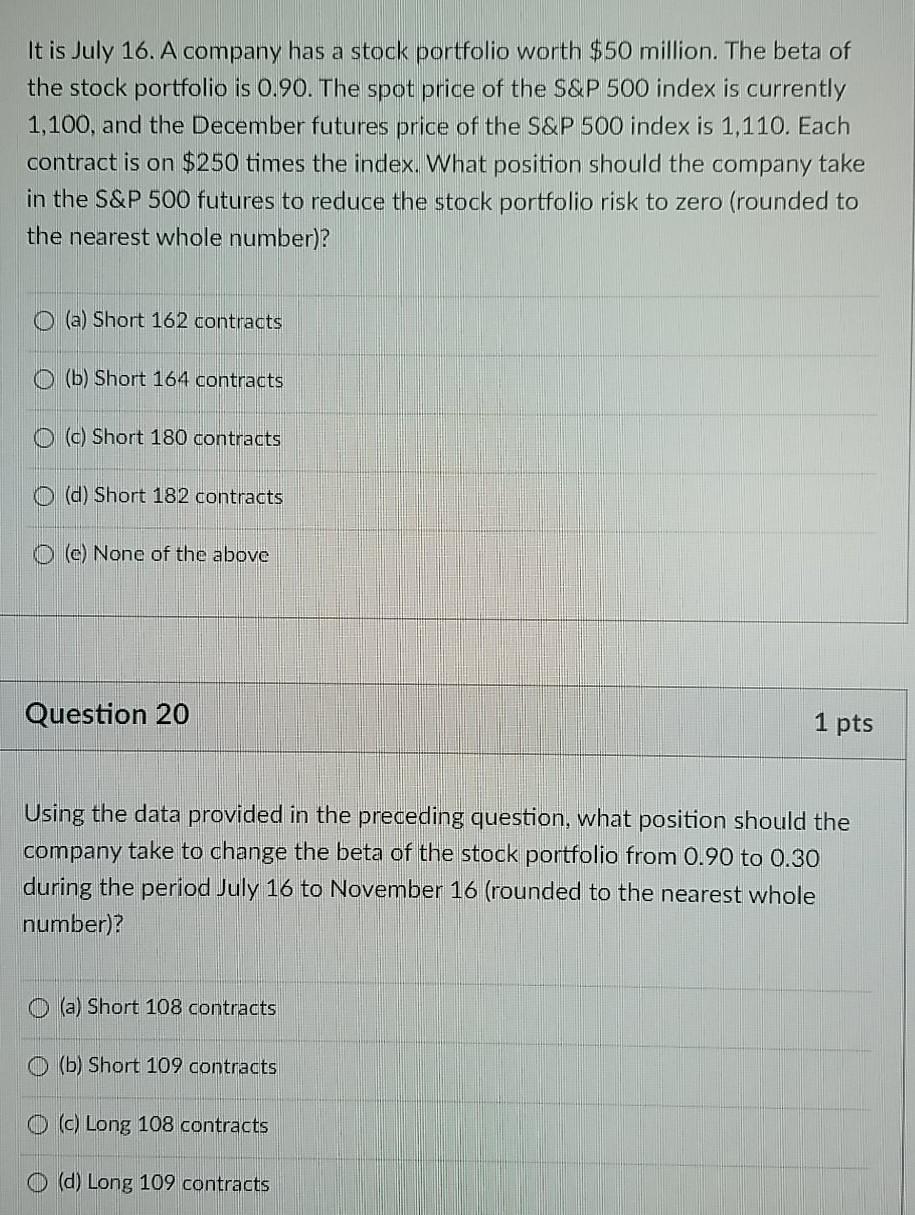

It is July 16. A company has a stock portfolio worth $50 million. The beta of the stock portfolio is 0.90. The spot price of the S&P 500 index is currently 1,100, and the December futures price of the S&P 500 index is 1,110. Each contract is on $250 times the index. What position should the company take in the S&P 500 futures to reduce the stock portfolio risk to zero (rounded to the nearest whole number)? (a) Short 162 contracts O (b) Short 164 contracts O (c) Short 180 contracts (d) Short 182 contracts 0 (c) None of the above Question 20 1 pts Using the data provided in the preceding question, what position should the company take to change the beta of the stock portfolio from 0.90 to 0.30 during the period July 16 to November 16 (rounded to the nearest whole number)? (a) Short 108 contracts (b) Short 109 contracts O (c) Long 108 contracts O (d) Long 109 contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts