Question: i've been waiting for 3 hours for a response to my question a) Suppose we are on April 21. A company has an equity portfolio

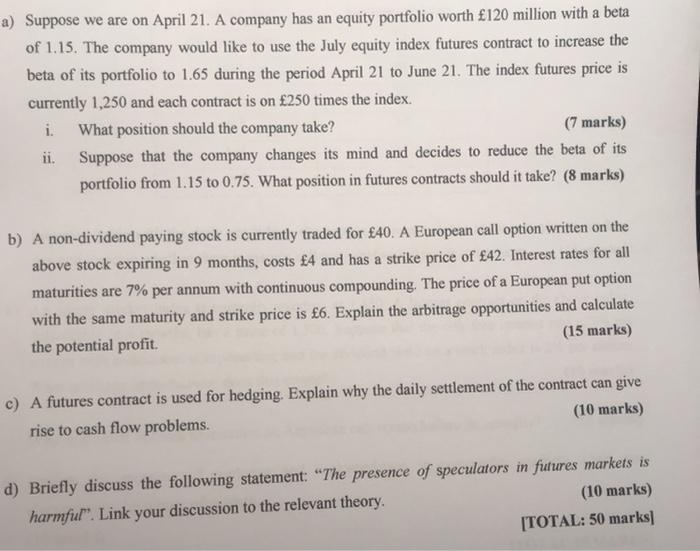

a) Suppose we are on April 21. A company has an equity portfolio worth 120 million with a beta of 1.15. The company would like to use the July equity index futures contract to increase the beta of its portfolio to 1.65 during the period April 21 to June 21. The index futures price is currently 1,250 and each contract is on 250 times the index. i. What position should the company take? (7 marks) ii. Suppose that the company changes its mind and decides to reduce the beta of its portfolio from 1.15 to 0.75. What position in futures contracts should it take? (8 marks) b) A non-dividend paying stock is currently traded for 40. A European call option written on the above stock expiring in 9 months, costs 4 and has a strike price of 42. Interest rates for all maturities are 7% per annum with continuous compounding. The price of a European put option with the same maturity and strike price is 6. Explain the arbitrage opportunities and calculate the potential profit. (15 marks) c) A futures contract is used for hedging. Explain why the daily settlement of the contract can give rise to cash flow problems. (10 marks) d) Briefly discuss the following statement: "The presence of speculators in futures markets is harmful". Link your discussion to the relevant theory. (10 marks) [TOTAL: 50 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts