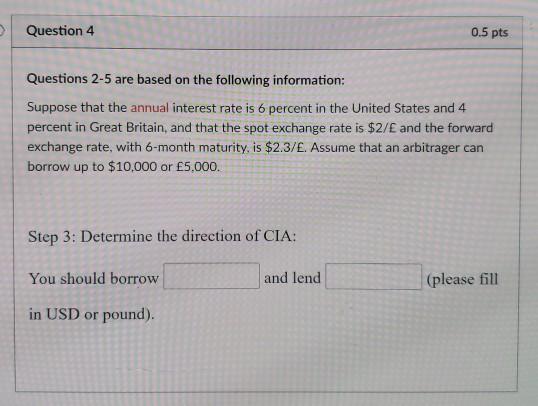

Question: I need question #4 for this posting, I am posting all these parts separately but including all questions for context. Question 2 0.5 pts Questions

I need question #4 for this posting, I am posting all these parts separately but including all questions for context.

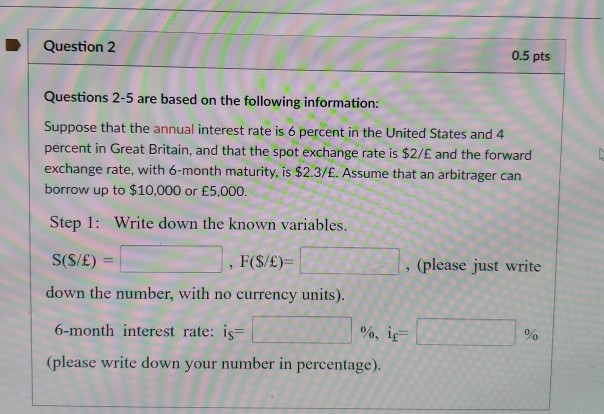

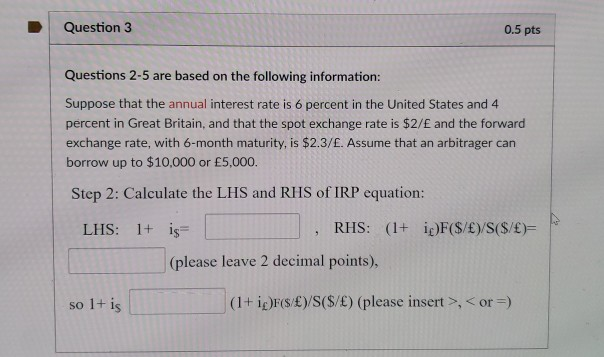

Question 2 0.5 pts Questions 2-5 are based on the following information: Suppose that the annual interest rate is 6 percent in the United States and 4 percent in Great Britain, and that the spot exchange rate is $2/E and the forward exchange rate, with 6-month maturity, is $2.3/E. Assume that an arbitrager can borrow up to $10,000 or 5,000. Step 1: Write down the known variables. , F(S/E)= (please just write down the number, with no currency units). 6-month interest rate. IS- (please write down your number in percentage). Question 3 0.5 pts Questions 2-5 are based on the following information: Suppose that the annual interest rate is 6 percent in the United States and 4 percent in Great Britain, and that the spot exchange rate is $2/E and the forward exchange rate, with 6-month maturity, is $2.3/E. Assume that an arbitrager can borrow up to $10,000 or 5,000. Step 2: Calculate the LHS and RHS of IRP equation LHS: 1+ is (please leave 2 decimal points), so 1+ is (1 + iJF($E)/S($/E) (please insert >,

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts