Question: I need question #5 for this posting, I am posting all these parts separately but including all questions for context. This is the question I

I need question #5 for this posting, I am posting all these parts separately but including all questions for context.

This is the question I need answer for: Question #5 parts a and b! Please/thanks

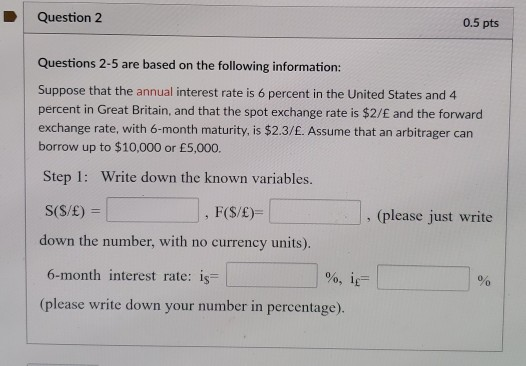

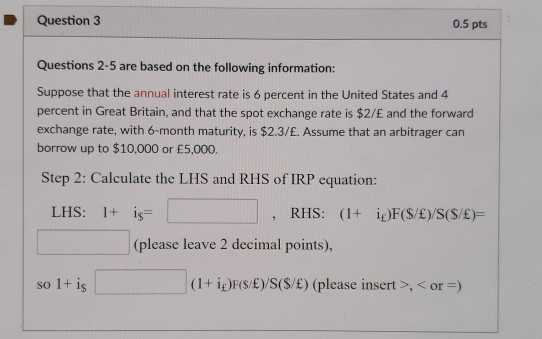

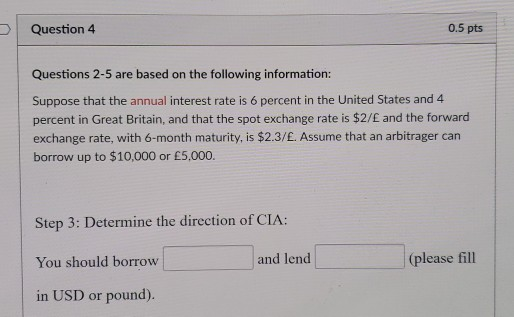

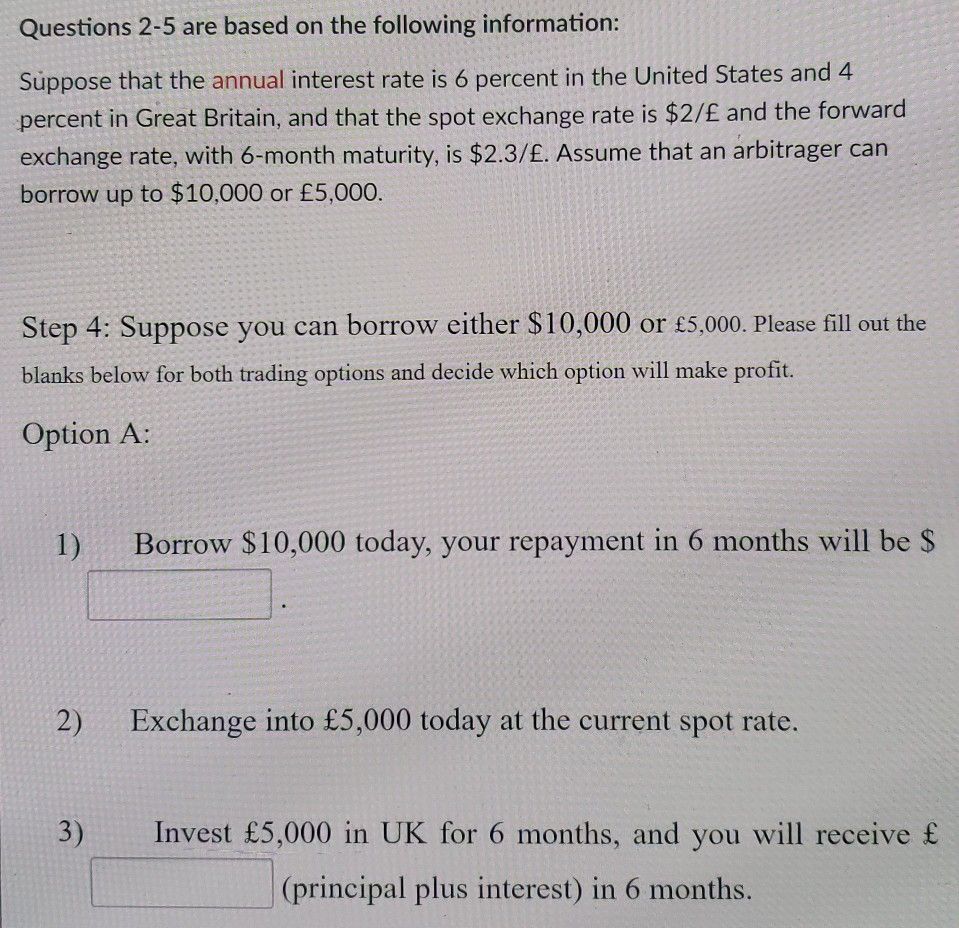

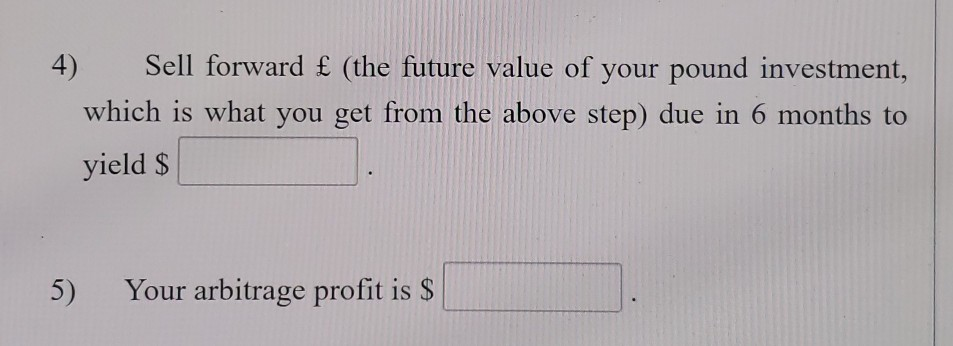

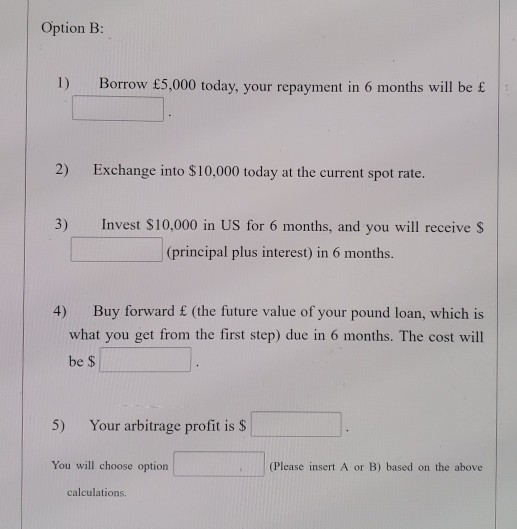

Question 2 0.5 pts Questions 2-5 are based on the following information: Suppose that the annual interest rate is 6 percent in the United States and 4 percent in Great Britain, and that the spot exchange rate is $2/E and the forward exchange rate, with 6-month maturity, is $2.3/E. Assume that an arbitrager can borrow up to $10,000 or 5,000. Step 1: Write down the known variables. S(S/E) , (please just write down the number, with no currency units). 6-month interest rate: is (please write down your number in percentage) %, ir D Question 3 0.5 pts Questions 2-5 are based on the following information Suppose that the annual interest rate is 6 percent in the United States and 4 percent in Great Britain, and that the spot exchange rate is $2/E and the forward exchange rate, with 6-month maturity, is $2.3/E. Assume that an arbitrager can borrow up to $10,000 or 5,000. Step 2: Calculate the LHS and RHS of IRP equation: LHS: I+ is- I (please leave 2 decimal points), so 1+ is (I+ ig)F(S/E)/S(S/E) (please insert >,or Question 4 0.5 pts Questions 2-5 are based on the following information: Suppose that the annual interest rate is 6 percent in the United States and 4 percent in Great Britain, and that the spot exchange rate is $2/E and the forward exchange rate, with 6-month maturity, is $2.3/E. Assume that an arbitrager can borrow up to $10,000 or 5.000. Step 3: Determine the direction of CIA You should borrow in USD or pound) and lend (please fill Questions 2-5 are based on the following information: Suppose that the annual interest rate is 6 percent in the United States and 4 percent in Great Britain, and that the spot exchange rate is $2/ and the forward exchange rate, with 6-month maturity, is $2.3/E. Assume that an arbitrager can borrow up to $10,000 or 5,000. Step 4: Suppose you can borrow either $10,000 or s,000. Please fill out the blanks below for both trading options and decide which option will make profit. Option A: 1) Borrow $10,000 today, your repayment in 6 months will be S 2) Exchange into 5,000 today at the current spot rate. 3) Invest 5,000 in UK for 6 months, and you will receive (principal plus interest) in 6 months. Sell forward (the future value of your pound investment, which is what you get from the above step) due in 6 months to yield S 4) 5) Your arbitrage profit is S Option B: 1) Borrow 5,000 today, your repayment in 6 months will be 2) Exchange into $10,000today at the current spot rate. 3) Invest $10,000 in US for 6 months, and you will receive S (principal plus interest) in 6 months 4) Buy forward f (the future value of your pound loan, which is be $ 5) Your arbitrage profit is $ You will choose option (Please insert A or B) based on the above calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts