Question: i need requirement 1 and 2. (absorption costing and variable costing). its the same question different parts so please answer both parts Abany, Inc, planned

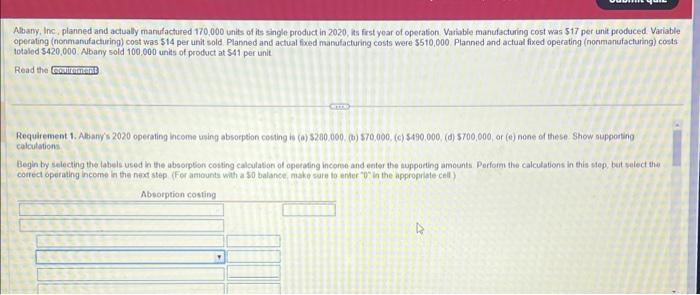

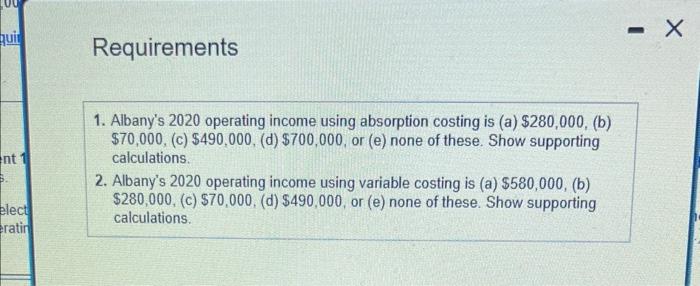

Abany, Inc, planned and actualy manufactured 170,000 units of its single product in 2020 , its frst yoar of operation. Vatiable manufacturing cost was $17 per unit peoduced Variable operating (nonmanufacturing) cost was $14 per unit sold. Planned and actual fixed manufacturing costs were \$510,000. Planned and actual fixed operating (normanufacturing) costs totaled $420,000. Abany sold 100,000 units of product at $41 per unit Read the calculations Begin by selecting the labels used in the aboorpton costing calculation of operating incorse and enter the nuppoting amounts. Perform the calculations in this step. bet salect the coerect operating incoms in the next step. (For aniounts with a 50 balance, make sure to enter 0 in the appropiate cell) Operating income Albany's 2020 operating income using absorption costing is A. $280,000. B. $70,000. C. $490,000. D. $700,000. E. none of these. Requirements 1. Albany's 2020 operating income using absorption costing is (a) $280,000, (b) $70,000, (c) $490,000, (d) $700,000, or (e) none of these. Show supporting calculations. 2. Albany's 2020 operating income using variable costing is (a) $580,000, (b) $280,000, (c) $70,000, (d) $490,000, or (e) none of these. Show supporting calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts