Question: please don't send previous answer which is already given on chegg ... if you send that answer I'll give you down thumb... please do it

please don't send previous answer which is already given on chegg ... if you send that answer I'll give you down thumb... please do it urgently and I'll give you up thumb

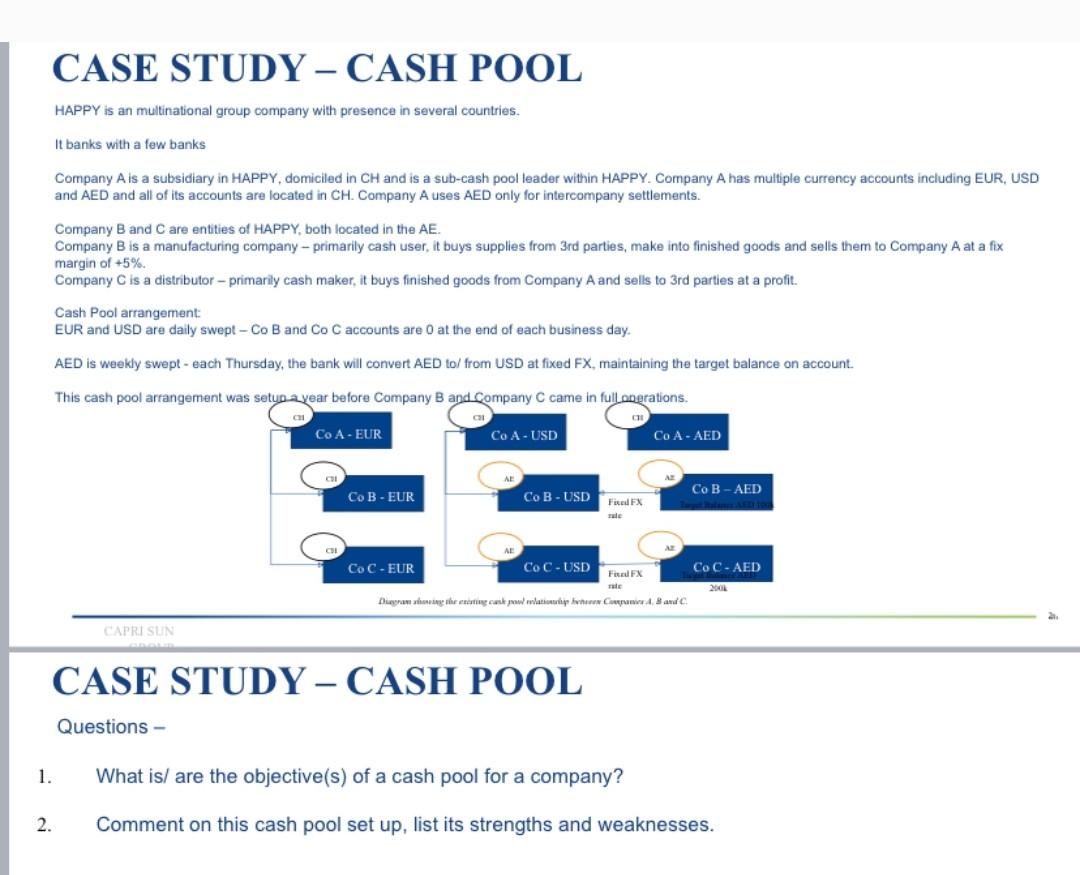

HAPPY is an multinational group company with presence in several countries. It banks with a few banks Company A is a subsidiary in HAPPY, domiciled in CH and is a sub-cash pool leader within HAPPY. Company A has multiple currency accounts including EUR, USD and AED and all of its accounts are located in CH. Company A uses AED only for intercompany settlements. Company B and C are entities of HAPPY, both located in the AE. Company B is a manufacturing company - primarily cash user, it buys supplies from 3rd parties, make into finished goods and sells them to Company A at a fix margin of +5%. Company C is a distributor - primarily cash maker, it buys finished goods from Company A and sells to 3rd parties at a profit. Cash Pool arrangement: EUR and USD are daily swept - Co B and Co C accounts are 0 at the end of each business day. AED is weekly swept - each Thursday, the bank will convert AED tol from USD at fixed FX, maintaining the target balance on account. This cash pool arrangement was setyp ayear before Company B and Company C came in fullonerations. CAPRI SINN CASE STUDY - CASH POOL Questions - 1. What is/ are the objective(s) of a cash pool for a company? 2. Comment on this cash pool set up, list its strengths and weaknesses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts