Question: i need requirement 8 with calculations and formulas Please Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you

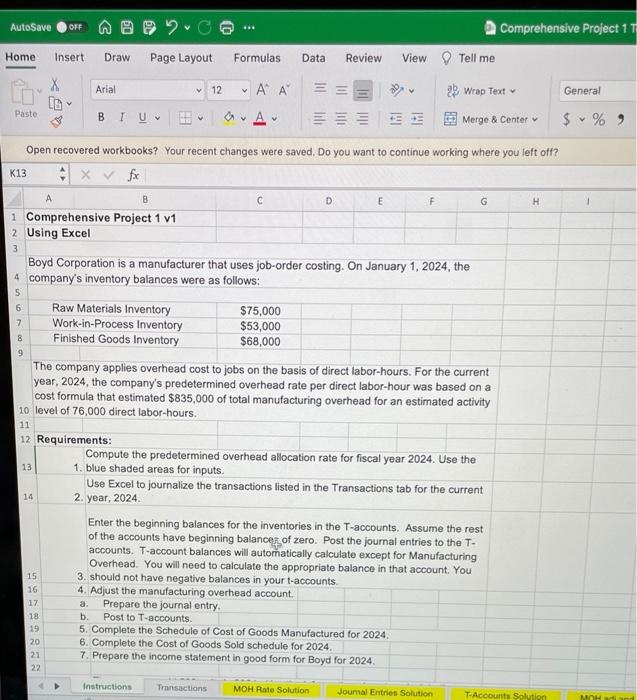

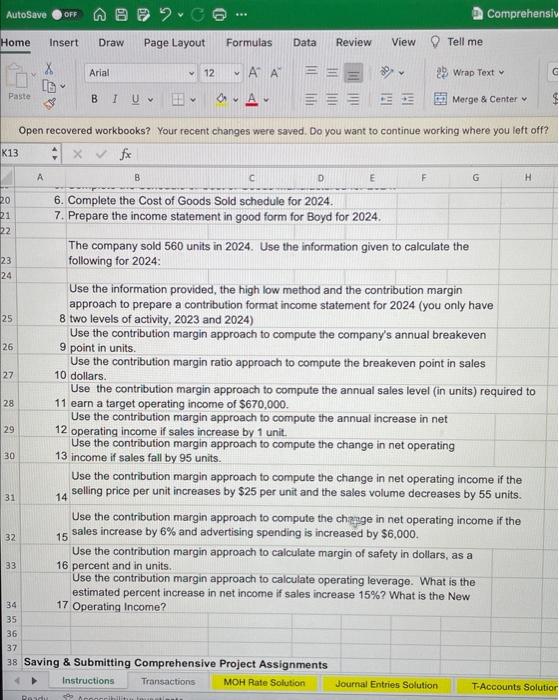

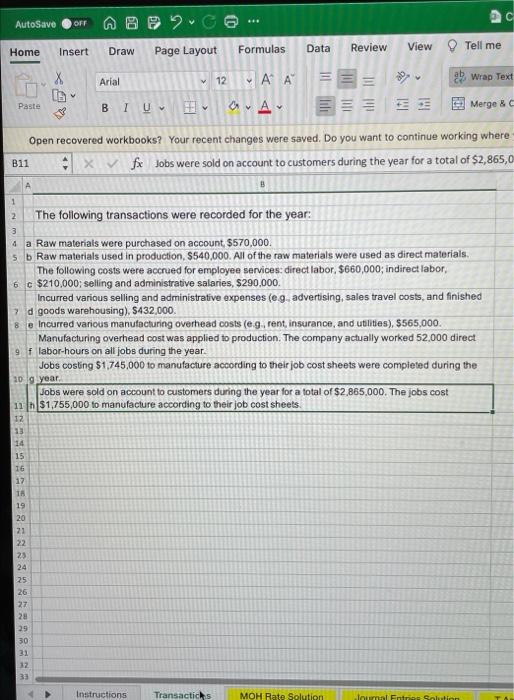

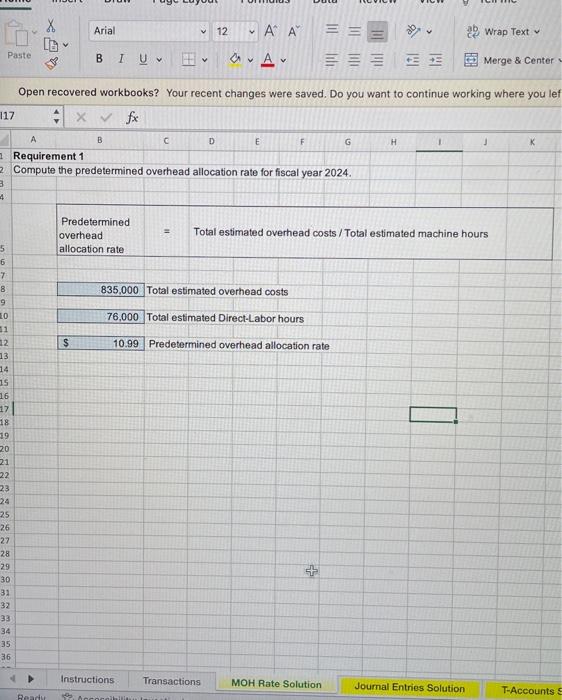

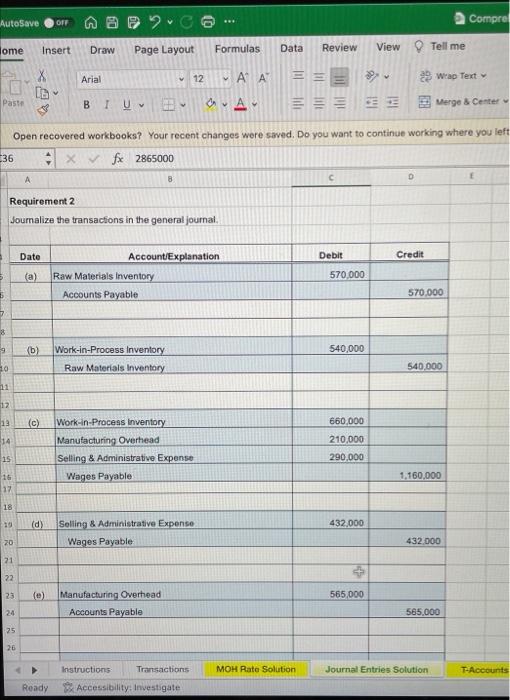

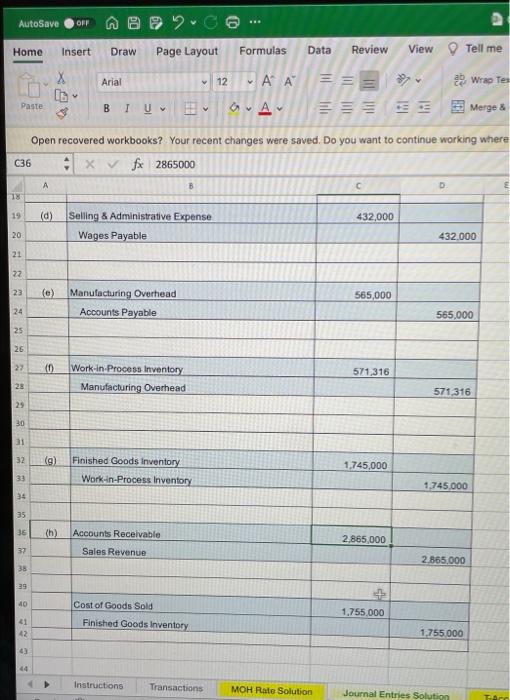

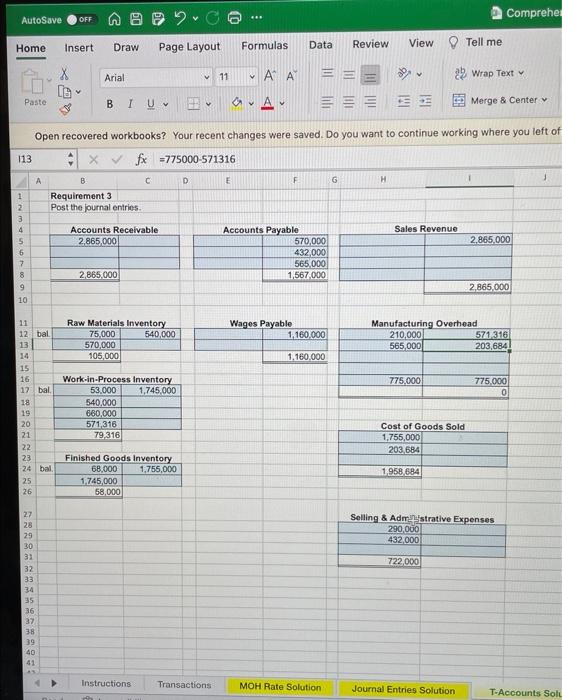

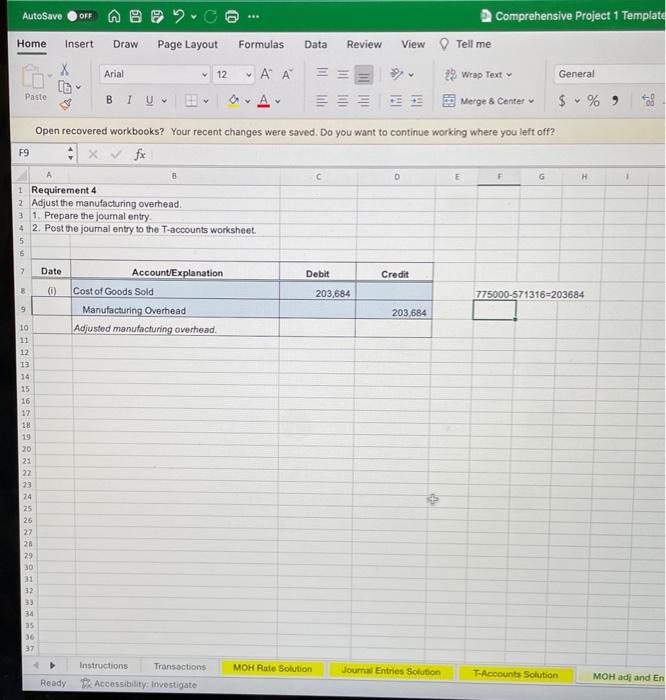

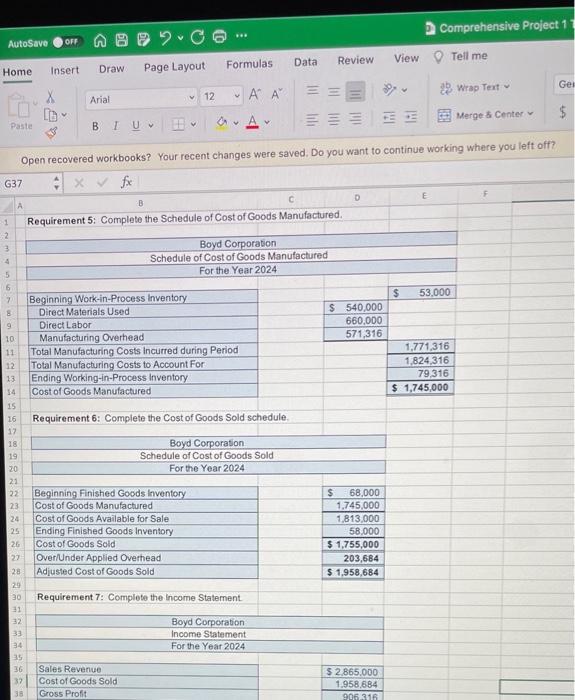

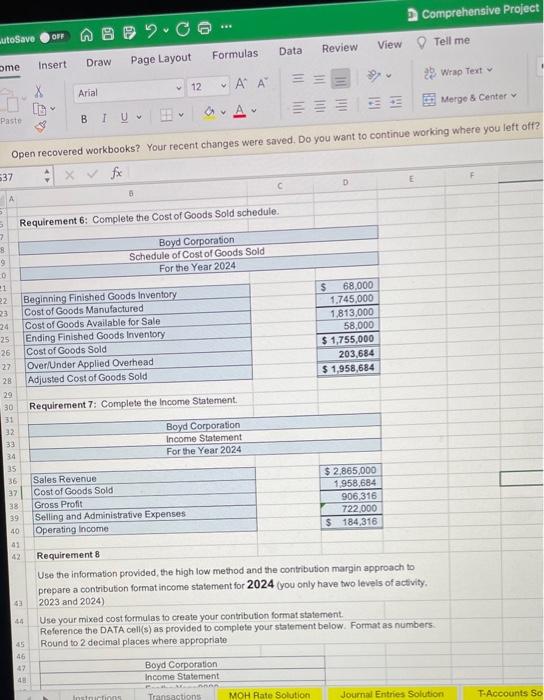

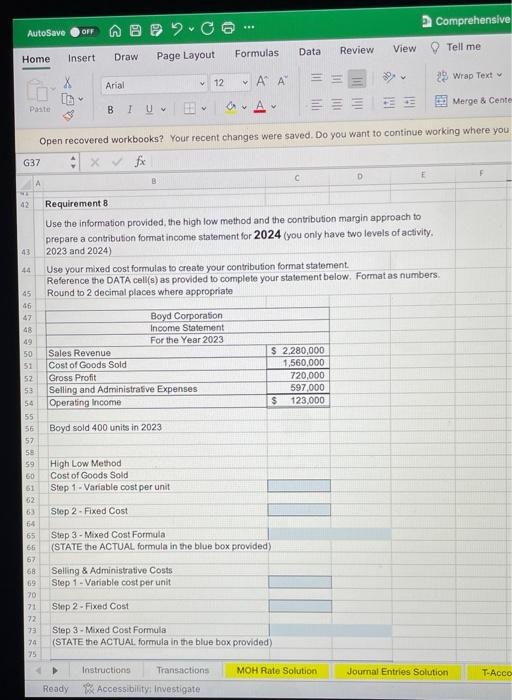

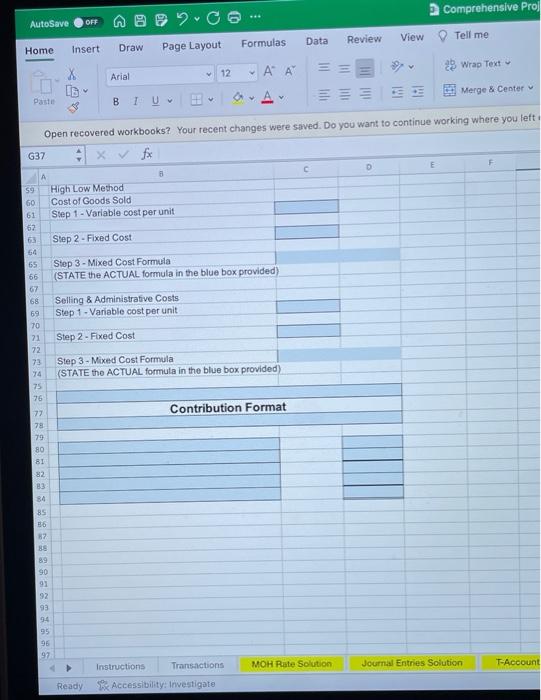

Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? \begin{tabular}{|ll} \hline A 13 & fx \end{tabular} 4 company's inventory balances were as follows: year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $835,000 of total manufacturing overhead for an estimated activity 10 level of 76,000 direct labor-hours. 12 Requirements: Requirements: 1. blue shaded areas for inputs. Use Excel to journalize the transactions listed in the Transactions tab for the current 2. year, 2024 . Enter the beginning balances for the inventories in the T-accounts. Assume the rest of the accounts have beginning balances of zero. Post the journal entries to the Taccounts. T-acoount balances will automatically calculate except for Manufacturing Overhead. You will need to calculate the appropriate balance in that account. You 3. should not have negative balances in your t-accounts. 4. Adjust the manufacturing overhead account. a. Prepare the journal entry. b. Post to T-accounts. 5. Complete the Schedule of Cost of Goods Manufactured for 2024 . 6. Complete the Cost of Goods Sold schedule for 2024. 7. Prepare the income statement in good form for Boyd for 2024. Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? 6. Complete the Cost of Goods Sold schedule for 2024. 7. Prepare the income statement in good form for Boyd for 2024. The company sold 560 units in 2024. Use the information given to calculate the following for 2024 : Use the information provided, the high low method and the contribution margin approach to prepare a contribution format income statement for 2024 (you only have 8 two levels of activity, 2023 and 2024) Use the contribution margin approach to compute the company's annual breakeven 9 point in units. Use the contribution margin ratio approach to compute the breakeven point in sales 10 dollars. Use the contribution margin approach to compute the annual sales level (in units) required to 11 earn a target operating income of $670,000. Use the contribution margin approach to compute the annual increase in net 12 operating income if sales increase by 1 unit. Use the contribution margin approach to compute the change in net operating 13 income if sales fall by 95 units. Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $25 per unit and the sales volume decreases by 55 units. Use the contribution margin approach to compute the chazge in net operating income if the 15 sales increase by 6% and advertising spending is increased by $6,000. Use the contribution margin approach to calculate margin of safety in dollars, as a 16 percent and in units. Use the contribution margin approach to calculate operating leverage. What is the estimated percent increase in net income if sales increase 15% ? What is the New 17 Operating Income? Saving \& Submitting Comprehensive Project Assignments - Instructions Transactions MOH Rate Solution Journal Entries Solution T-Accounts Solutior B11 fx jobs were sold on account to customers during the year for a total of $2,865,0 \begin{tabular}{l|l} \hline 1 & A \\ 2 & The following transactions were recorded for the year: \end{tabular} 4 a Raw materials were purchased on account, $570,000. 5. Raw materials used in production, $540,000. All of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, $660,000; indirect labor, 6. c $210,000; selling and administrative salaries, $290,000. Incurred various selling and administrative expenses (e g- advertising, sales travel costs, and finished 7 a goods warehousing). $432,000. 7 d goods warehousing), 5432,000 . 8. Incurred various manutacturing overhead cosis (e.g. rent, insurance, and utitites), $565,000. Manufacturing overhead cost was applied to production. The company actually worked 52,000 direct 9 f labor-hours on all jobs during the year. Jobs cosling $1,745,000 to manufacture according to their job cost sheets were completed during the 20.9 year. Jobs were sold on account to customers during the year for a total of $2,865,000. The jobs cost 11 in $1,755,000 to manulacture according to their job cost sheets. 12. 13 14 15 16 in 19 20 21 22 24 24 25 25 26 27 27 28 29 3 30 31 32 33 Instructions Transactichs MOH Rate Solution Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you lef \begin{tabular}{l} 117 \\ \hline Requirement 1 \\ Compute the pre \end{tabular} fx Compute the predetermined overhead allocation rate for fiscal year 2024. \begin{tabular}{l} Predeterminedoverheadallocationrate= Total estimated overhead costs / Total estimated machine hours \\ \hline \end{tabular} \begin{tabular}{|l|l|l} \hline S & 10.99 & Predetermined overhead allocation rate \\ \hline \end{tabular} Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left Requirement 2 Soumalize the transacfions in the general journal. Open recovered workbooks? Your recent changes were saved. Do you want to continue working where Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left of Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Home Insert Draw Page Layout Formulas Data Review View 9 Tell me Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Requirement 5: Complete the Schedule of Cost of Goods Manufactured. Requirement 6: Complete the Cost of Goods Sold schedule. Requirement 7: Complete the Income Statement. ito Cfivity. Use your mixed cost formulas to create your contribution format statement. Reference the DATA cell(s) as provided to complete your statement below. Format as numbers. Found to 2 decimal places where appropriate Use the information provided, the high low method and the contribution margin approach to prepare a contribusion format income statement for 2024 (you only have two levels of activity. 2023 and 2024) Use your mixed cost formulas to create your contribution format statement. Reference the DATA cell(s) as provided to complete your statement below. Format as numbers. Round to 2 decimal places where appropriate Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? \begin{tabular}{|ll} \hline A 13 & fx \end{tabular} 4 company's inventory balances were as follows: year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $835,000 of total manufacturing overhead for an estimated activity 10 level of 76,000 direct labor-hours. 12 Requirements: Requirements: 1. blue shaded areas for inputs. Use Excel to journalize the transactions listed in the Transactions tab for the current 2. year, 2024 . Enter the beginning balances for the inventories in the T-accounts. Assume the rest of the accounts have beginning balances of zero. Post the journal entries to the Taccounts. T-acoount balances will automatically calculate except for Manufacturing Overhead. You will need to calculate the appropriate balance in that account. You 3. should not have negative balances in your t-accounts. 4. Adjust the manufacturing overhead account. a. Prepare the journal entry. b. Post to T-accounts. 5. Complete the Schedule of Cost of Goods Manufactured for 2024 . 6. Complete the Cost of Goods Sold schedule for 2024. 7. Prepare the income statement in good form for Boyd for 2024. Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? 6. Complete the Cost of Goods Sold schedule for 2024. 7. Prepare the income statement in good form for Boyd for 2024. The company sold 560 units in 2024. Use the information given to calculate the following for 2024 : Use the information provided, the high low method and the contribution margin approach to prepare a contribution format income statement for 2024 (you only have 8 two levels of activity, 2023 and 2024) Use the contribution margin approach to compute the company's annual breakeven 9 point in units. Use the contribution margin ratio approach to compute the breakeven point in sales 10 dollars. Use the contribution margin approach to compute the annual sales level (in units) required to 11 earn a target operating income of $670,000. Use the contribution margin approach to compute the annual increase in net 12 operating income if sales increase by 1 unit. Use the contribution margin approach to compute the change in net operating 13 income if sales fall by 95 units. Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $25 per unit and the sales volume decreases by 55 units. Use the contribution margin approach to compute the chazge in net operating income if the 15 sales increase by 6% and advertising spending is increased by $6,000. Use the contribution margin approach to calculate margin of safety in dollars, as a 16 percent and in units. Use the contribution margin approach to calculate operating leverage. What is the estimated percent increase in net income if sales increase 15% ? What is the New 17 Operating Income? Saving \& Submitting Comprehensive Project Assignments - Instructions Transactions MOH Rate Solution Journal Entries Solution T-Accounts Solutior B11 fx jobs were sold on account to customers during the year for a total of $2,865,0 \begin{tabular}{l|l} \hline 1 & A \\ 2 & The following transactions were recorded for the year: \end{tabular} 4 a Raw materials were purchased on account, $570,000. 5. Raw materials used in production, $540,000. All of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, $660,000; indirect labor, 6. c $210,000; selling and administrative salaries, $290,000. Incurred various selling and administrative expenses (e g- advertising, sales travel costs, and finished 7 a goods warehousing). $432,000. 7 d goods warehousing), 5432,000 . 8. Incurred various manutacturing overhead cosis (e.g. rent, insurance, and utitites), $565,000. Manufacturing overhead cost was applied to production. The company actually worked 52,000 direct 9 f labor-hours on all jobs during the year. Jobs cosling $1,745,000 to manufacture according to their job cost sheets were completed during the 20.9 year. Jobs were sold on account to customers during the year for a total of $2,865,000. The jobs cost 11 in $1,755,000 to manulacture according to their job cost sheets. 12. 13 14 15 16 in 19 20 21 22 24 24 25 25 26 27 27 28 29 3 30 31 32 33 Instructions Transactichs MOH Rate Solution Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you lef \begin{tabular}{l} 117 \\ \hline Requirement 1 \\ Compute the pre \end{tabular} fx Compute the predetermined overhead allocation rate for fiscal year 2024. \begin{tabular}{l} Predeterminedoverheadallocationrate= Total estimated overhead costs / Total estimated machine hours \\ \hline \end{tabular} \begin{tabular}{|l|l|l} \hline S & 10.99 & Predetermined overhead allocation rate \\ \hline \end{tabular} Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left Requirement 2 Soumalize the transacfions in the general journal. Open recovered workbooks? Your recent changes were saved. Do you want to continue working where Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left of Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Home Insert Draw Page Layout Formulas Data Review View 9 Tell me Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Requirement 5: Complete the Schedule of Cost of Goods Manufactured. Requirement 6: Complete the Cost of Goods Sold schedule. Requirement 7: Complete the Income Statement. ito Cfivity. Use your mixed cost formulas to create your contribution format statement. Reference the DATA cell(s) as provided to complete your statement below. Format as numbers. Found to 2 decimal places where appropriate Use the information provided, the high low method and the contribution margin approach to prepare a contribusion format income statement for 2024 (you only have two levels of activity. 2023 and 2024) Use your mixed cost formulas to create your contribution format statement. Reference the DATA cell(s) as provided to complete your statement below. Format as numbers. Round to 2 decimal places where appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts