Question: I need solution for these. hope for reply as soon as possible 266 Part 3 Financial Assets 1 423, repectively Calculate the new portfolio's required

I need solution for these. hope for reply as soon as possible

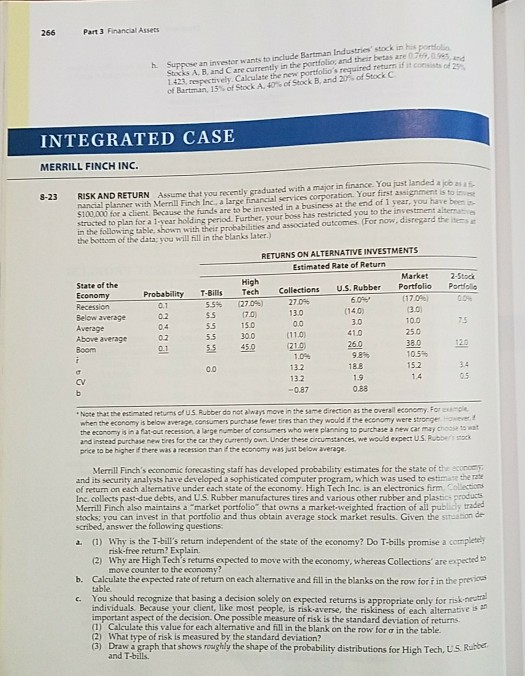

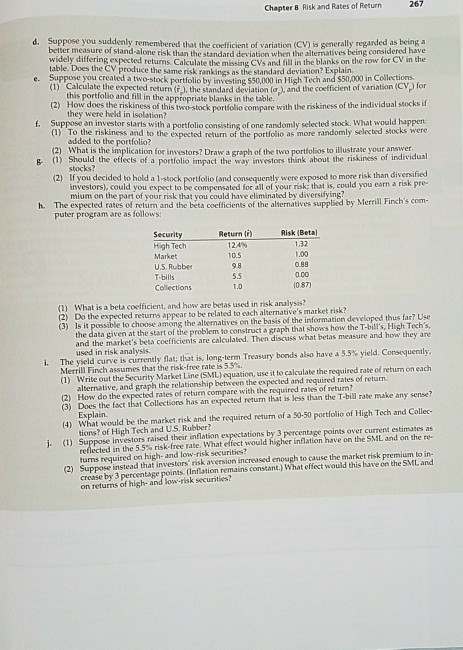

266 Part 3 Financial Assets 1 423, repectively Calculate the new portfolio's required return if is Of Bartman, 15% of Stock A, 40% ofStock B, and 20% of Stock C h Suppose an investor wants to include Bartman Industries stock in his A. B, and Care currently in the portfolio; and their betas are 0769.g INTEGRATED CASE MERRILL FINCH INC 8-23 R?SK AND RETURN Assume that you recently graduated with a myonninace Youst landed arent nancial planner with Merrill Finch Inc, a large financial services corporation. Your first assignment is to $100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have bees structed to plan for a 1 vear holding period. Further, your boss has restricted you to the investment alternat in the following table, shown with their probabilities and associated outcomes (For now, disregard the itens a the bottorm of the data; you will fill in the blanks later.) RETURNS ON ALTERNATIVE INVESTMENTS Estimated Rate of Return Market 2-Stod State of the Economy Probability T-Bills Tech Collections US. Rubber Portfolio Portolie (2709) (7.0) 15.0 30.0 0.1 0.2 0.4 55% 5.5 (14.0) 3.0 41.0 13.0 Below average 75 250 38.0 105 15.2 1.4 5.5 (11.0 Above average Boom 55 450 9.8% 1.0 132 13.2 1.9 3.5 CV 0.87 Note that the estimated returns of US Rubber do not always move in the same direction as the overall economy. Forsnge when the economy is below average. consumers purchase fewer tires than they would if the ecenomy were stronger the economy is in a fat -out recession a large number of consumers who were planning to purchase a new car may choase to wat and instead purchase new Dires for the car they currently own. Under these circumstances, we would expect U.S Ruibbes imocx price so be higher ifthere was a recession than #the economy was just below average. Merrill Finch's economic forecasting staff has developed probability estimates for the state of the econcey and its security analysts have developed a sophisticated computer program, which was used to estimate the rate of return on each altermative under each state of the economy. High Tech Inc. is an electronics firm. Collections Inc. collects past-due debts, and US Rubber manufactures tires and various other rubber and plastics producs Merrill Finch also maintains a "market portfolio" that owns a market-weighted fraction of all publicy stocks; you can invest in that portfolio and thus obtain average stock market results. Given the situation de scribed, answer the following questions ) Why is the T-bill's return independent of the state of the economy? Do T-bills promise a compleel risk-free return? Explain. (2) Why are High Tech's returns expected to move with the economy, whereas Collections' are expected move counter to the economy? b. Calculate the expected rate of return on each alternative and fill in the blanks on the row for f in the previces able You should recognize that basing a decision solely on expected returns is appropriate only for rik netra individuals. Because your client, like most people, is risk-averse, the riskiness of each alternative is important aspect of the decision. One possible measure of risk is the standard deviation of returns ) Calculate this value for each alternative and fill in the blank on the row for a in the table (2) What type of risk is measured by the standard deviation? 3) Draw a gaph that shows reughly he shape of the probability distributions for High Tech, U.S Ruskbe and T-balls

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts