Question: i need solutions as i can copy it LGO b. Which company has the lower ROA? Lower ROE? Complete ratio analysis, recognizing significant differences The

i need solutions as i can copy it

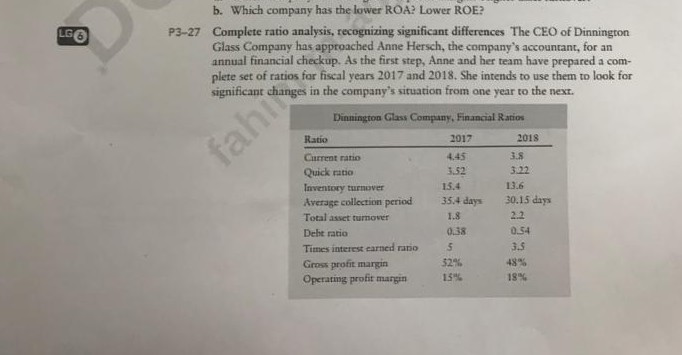

LGO b. Which company has the lower ROA? Lower ROE? Complete ratio analysis, recognizing significant differences The CEO of Dinnington Glass Company has approached Anne Hersch, the company's accountant, for an annual financial checkup. As the first step, Anne and her team have prepared a com- plete set of ratios for fiscal years 2017 and 2018. She intends to use them to look for significant changes in the company's situation from one year to the next Dinnington Glass Company, Financial Ratios Ratio 2017 2018 Current ratio Quick ratio 3.52 3.22 Inventory turnover 15.4 13.6 Average collection period 35.4 days 30.15 days Total asset turnover 1.8 Deht ratio 0.38 0.54 Times interest earned ratio Gross profit margin 32% Operating profit margin 18% 38 22 3.5 15% LGO b. Which company has the lower ROA? Lower ROE? Complete ratio analysis, recognizing significant differences The CEO of Dinnington Glass Company has approached Anne Hersch, the company's accountant, for an annual financial checkup. As the first step, Anne and her team have prepared a com- plete set of ratios for fiscal years 2017 and 2018. She intends to use them to look for significant changes in the company's situation from one year to the next Dinnington Glass Company, Financial Ratios Ratio 2017 2018 Current ratio Quick ratio 3.52 3.22 Inventory turnover 15.4 13.6 Average collection period 35.4 days 30.15 days Total asset turnover 1.8 Deht ratio 0.38 0.54 Times interest earned ratio Gross profit margin 32% Operating profit margin 18% 38 22 3.5 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts