Question: I need some help for this question, plz be specific so I can learn from it. 5. (30 pts) Suppose you can invest in asset

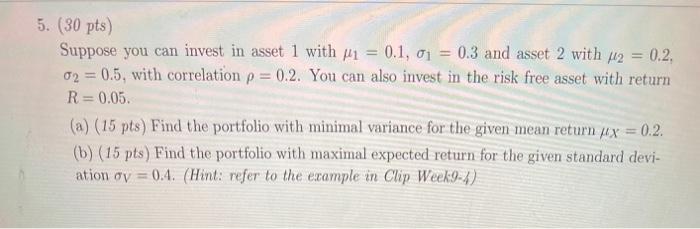

5. (30 pts) Suppose you can invest in asset 1 with M1 = 0.1, 01 = 0.3 and asset 2 with p2 = 0.2, 02 = 0.5, with correlation p = 0.2. You can also invest in the risk free asset with return R = 0.05. (a) (15 pts) Find the portfolio with minimal variance for the given mean return wex = 0.2. (b) (15 pts) Find the portfolio with maximal expected return for the given standard devi- ation av = 0.4. (Hint: refer to the example in Clip Week9-x) 5. (30 pts) Suppose you can invest in asset 1 with M1 = 0.1, 01 = 0.3 and asset 2 with p2 = 0.2, 02 = 0.5, with correlation p = 0.2. You can also invest in the risk free asset with return R = 0.05. (a) (15 pts) Find the portfolio with minimal variance for the given mean return wex = 0.2. (b) (15 pts) Find the portfolio with maximal expected return for the given standard devi- ation av = 0.4. (Hint: refer to the example in Clip Week9-x)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts