Question: i need some help Jax incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses

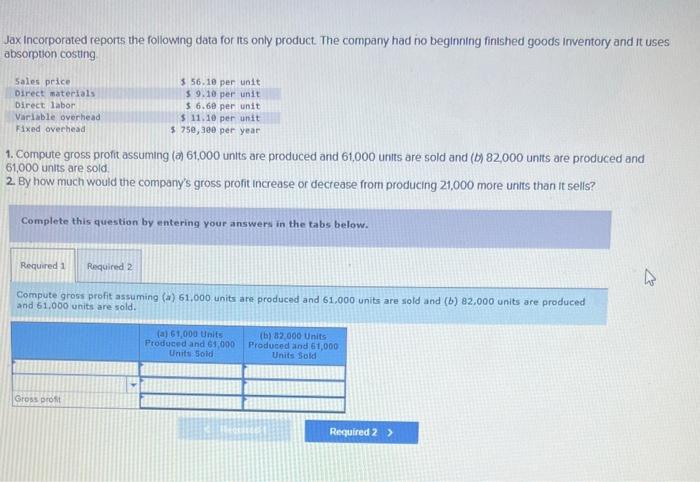

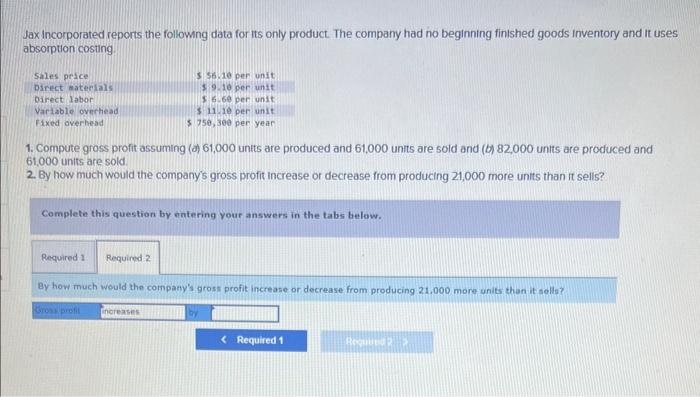

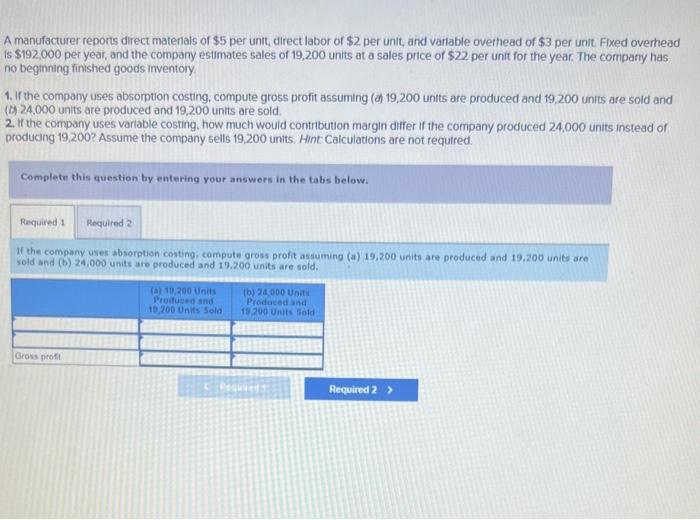

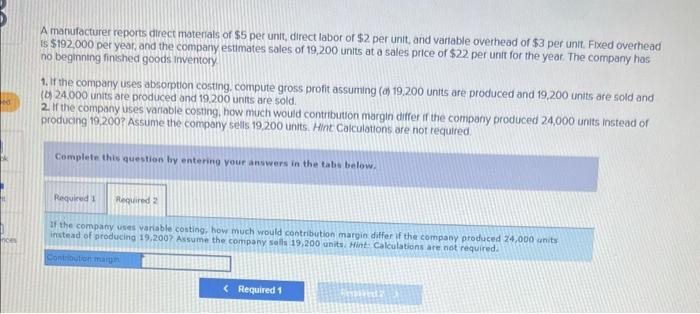

Jax incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing 1. Compute gross profit assuming (a) 61,000 units are produced and 61,000 units are sold and (b)82,000 units are produced and 61,000 units are sold. 2. By how much would the compary's gross profit increase or decrease from producing 21,000 more units than it sells? Complete this question by entering your answers in the tabs below. Compute gross profit assuming (a) 61,000 units are produced and 61,000 units are sold and (b)82,000 units are produced and 61,000 units are sold. Jax Incorporated reports the followng data for its only product. The company had no beginning finished goods inventory and it uses absorption costing 1. Compute gross profit assuming (d) 61,000 units are produced and 61,000 unts are sold and (b)82,000 units are produced and 61,000 units are sold. 2. By how much would the company's gross profit increase or decrease from producing 21,000 more units than it sells? Complete this question by nitering your answers in the tabs betow. By how much would the company's grosi profit increase or decrease from producing 21,000 more units than it solle? A manufacturer reports direct materials of $5 per unit, direct labor of $2 per unit, and variable overhead of $3 per unit. Fixed overhead is $192,000 per year, and the company estimates sales of 19,200 units at a sales price of $22 per unit for the year. The company has no beginning finished goods inventory. 1. If the company uses absorption costing, compute gross profit assuming (a) 19,200 units are produced and 19,200 units are sold and (b) 24,000 units are produced and 19,200 units are sold. 2. If the company uses variable costing. how much would contribution margin differ if the company produced 24,000 units instead of producing 19,200? Assume the company sells 19,200 units. Hint Calculations are not required. Complete this question by entering your answers in the tabs below. If the company uses absorption costing; compute oross profit assuming (a) 19,200 units are produced and 19,200 units are sold and (b) 24,000 units are produced and 19.200 units are sold. A manufacturer reports direct materials of $5 per unit, direct labor of $2 per unit, and vanable overhead of $3 per unit. Fixed overhead is $192,000 per year, and the company estimates sales of 19,200 units at a sales price of $22 per unit for the year. The company has. no beginning finished goods inventory 1. If the company uses absomption costing, compute gross profit assuming (o) 19.200 units are produced and 19,200 units are sold and (b) 24,000 units are produced and 19.200 units are sold. 2. If the compony uses varable costing, how much would contribution margin differ if the company produced 24,000 units instead of producing 19,200? Assume the company sells 19,200 untts. Hint Calculations are not required. Complete this quevtion by entering your answers in the tabs below. If the compary uses vanable costing, hove much would contribution margin differ if the company produced 24,000 units instead of producing 19,2007 Assume the company sols 19,200 units. Hint Calculations are not required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts