Question: I need some help on this assignment, thanks! Continued from previous question. Assume the yield curve is flat and the T-bill rate is 5%. The

I need some help on this assignment, thanks!

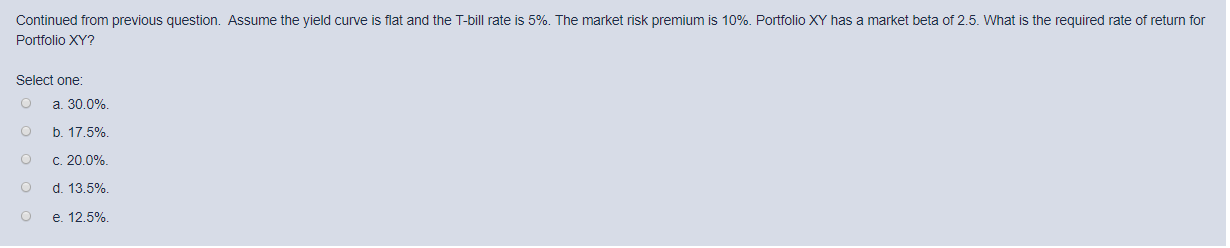

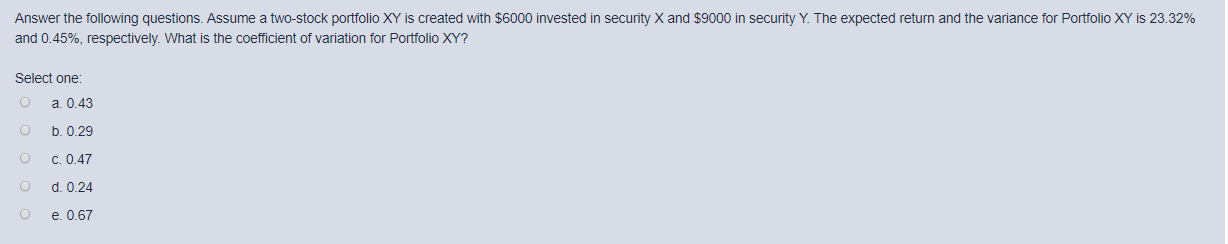

Continued from previous question. Assume the yield curve is flat and the T-bill rate is 5%. The market risk premium is 10%. Portfolio XY has a market beta of 2.5. What is the required rate of return for Portfolio XY? Select one: a. 30.0%. b. 17.5%. O C. 20.0% O d. 13.5% O e. 12.5%. Answer the following questions. Assume a two-stock portfolio XY is created with $6000 invested in security X and $9000 in security Y. The expected return and the variance for Portfolio XY is 23.32% and 0.45%, respectively. What is the coefficient of variation for Portfolio XY? Select one: a. 0.43 O b.0.29 o c.0.47 O d. 0.24 0 0.0.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts