Question: I need some help with this problem please. Thanks in advance. Also included the data table Amount Sustained Probability $14,000 30 % 12,000 20 %

I need some help with this problem please.

Thanks in advance. Also included the data table

| Amount Sustained | Probability | ||

| $14,000 |

| 30 | % |

| 12,000 | 20 | % | |

| 10,000 | 15 | % | |

| 6,000 | 35 | % | |

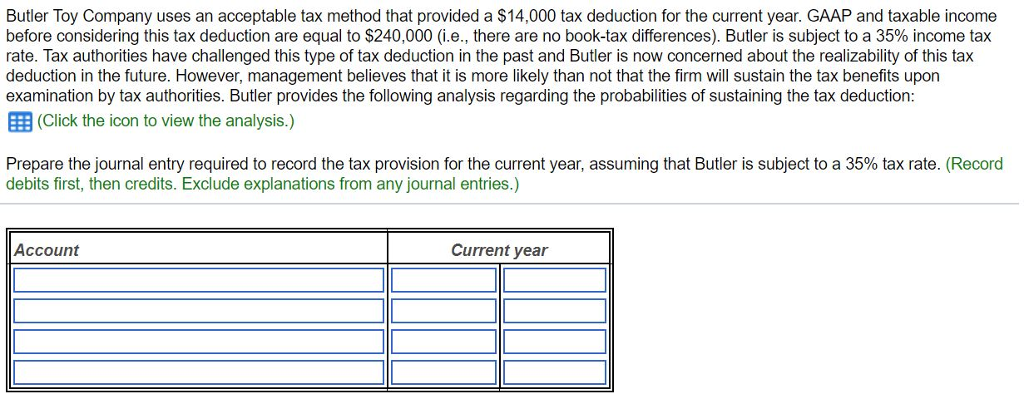

Butler Toy Company uses an acceptable tax method that provided a $14,000 tax deduction for the current year. GAAP and taxable income before considering this tax deduction are equal to $240,000 (ie., there are no book-tax differences). Butler is subject to a 35% income tax rate. Tax authorities have challenged this type of tax deduction in the past and Butler is now concerned about the realizability of this tax deduction in the future. However, management believes that it is more likely than not that the firm will sustain the tax benefits upon examination by tax authorities. Butler provides the following analysis regarding the probabilities of sustaining the tax deduction: (Click the icon to view the analysis.) Prepare the journal entry required to record the tax provision for the current year, assuming that Butler is subject to a 35% tax rate. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts