Question: I need some one to give me explicit solutions for these problems Problem 1 (40 points) (Portfolios) There are five assets in Utopia, with the

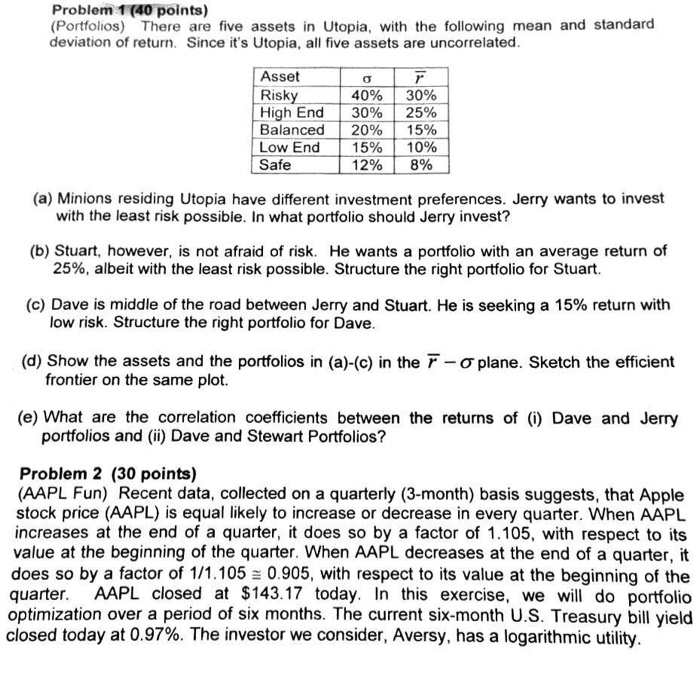

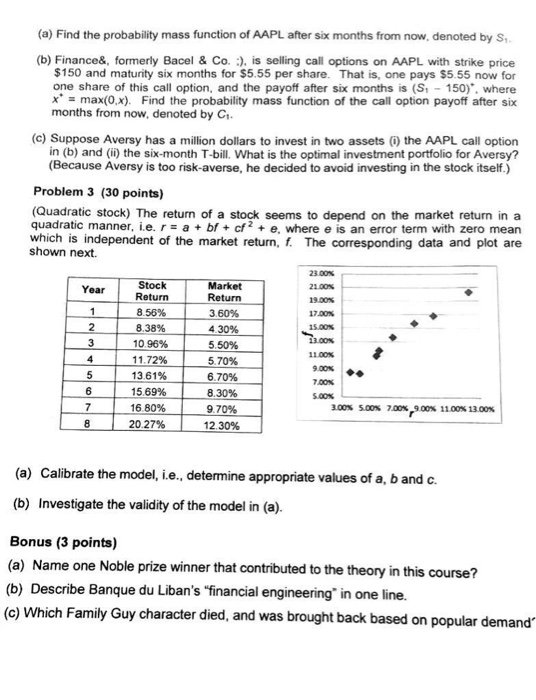

Problem 1 (40 points) (Portfolios) There are five assets in Utopia, with the following mean and standard deviation of return. Since it's Utopia, all five assets are uncorrelated Asset Risky High End | 30% | 25% Balanced | 20% | 15% Low End | 15% | 10% Safe 40% | 30% 12% | 8% (a) Minions residing Utopia have different investment preferences. Jerry wants to invest (b) Stuart, however, is not afraid of risk. He wants a portfolio with an average return of (c) Dave is middle of the road between Jerry and Stuart. He is seeking a 15% return with with the least risk possible. In what portfolio should Jerry invest? 25%, albeit with the least risk possible. Structure the right portfolio for Stuart. low risk. Structure the right portfolio for Dave (d) Show the assets and the portfolios in (a)-(c) in the r- plane. Sketch the efficient frontier on the same plot. (e) What are the correlation coefficients between the returns of (i) Dave and Jerry portfolios and (ii) Dave and Stewart Portfolios? Problem 2 (30 points) (AAPL Fun) Recent data, collected on a quarterly (3-month) basis suggests, that Apple stock price (AAPL) is equal likely to increase or decrease in every quarter. When AAPL increases at the end of a quarter, it does so by a factor of 1.105, with respect to its value at the beginning of the quarter. When AAPL decreases at the end of a quarter, it does so by a factor of 1/1.105 a 0.905, with respect to its value at the beginning of the quarter. AAPL closed at $143.17 today. In this exercise, we will do portfolio optimization over a period of six months. The current six-month U.S. Treasury bill yield closed today at 0.97%. The investor we consider, Aversy, has a logarithmic utility (a) Find the probability mass function of AAPL after six months from now, denoted by S (b) Finance&, formerly Bacel & Co. ), is selling call options on AAPL with strike price $150 and maturity six months for $5.55 per share. That is, one pays $5.55 now for one share of this call option, and the payoff after six months is (S 150). where xmax(0Ox). Find the probability mass function of the call option payoff after six months from now, denoted by C (c) Suppose Aversy has a million dollars to invest in two assets () the AAPL call option in (b) and (ii) the six-month T-bill. What is the optimal investment portfolio for Aversy? (Because Aversy is too risk-averse, he decided to avoid investing in the stock itself.) Problem 3 (30 points) (Quadratic stock) The return of a stock seems to depend on the market return in a quadratic manner, i.e. r a bfcfe, where e is an error term with zero mean which is independent of the market return, . The corresponding data and plot are shown next. 2300% 2100% 19.00% 17.00% Stock Return 856% 8.38% 10 96% 11 72% 13 61% 15 69% 16 80% 20.27% Market Return 360% 430% 550% 570% 6.70% 8.30% 9 70% 1230% Year 1100% 7.00% 6 300% % 7.00%900% 11.00% 1300% , (a) Calibrate the model, i.e., determine appropriate values of a, b and c. (b) Investigate the validity of the model in (a) Bonus (3 points) (a) Name one Noble prize winner that contributed to the theory in this course? (b) Describe Banque du Liban's "financial engineering in one line. (c) Which Family Guy character died, and was brought back based on popular dema

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts