Question: I need step by step explanation and answer for the following question attached as image: You own a portfolio of two stocks, Alpha and Beta.

I need step by step explanation and answer for the following question attached as image:

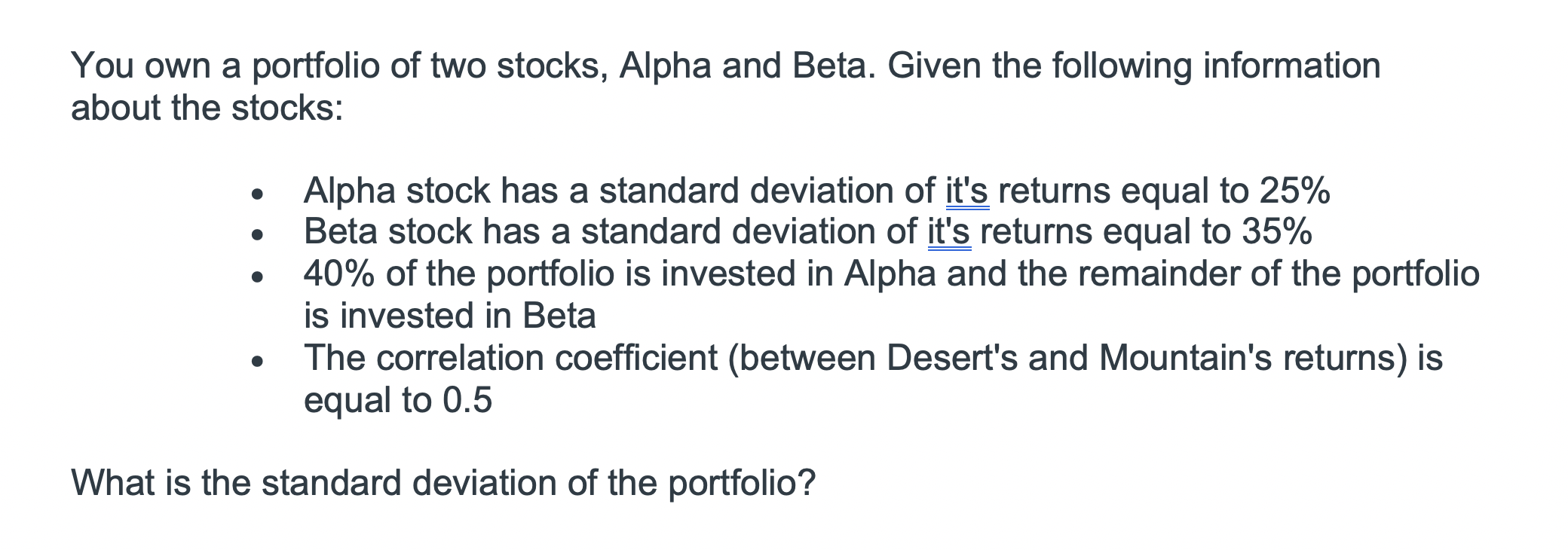

You own a portfolio of two stocks, Alpha and Beta. Given the following information about the stocks: 0 Alpha stock has a standard deviation of E returns equal to 25% . Beta stock has a standard deviation of b returns equal to 35% . 40% of the portfolio is invested in Alpha and the remainder of the portfolio is invested in Beta . The correlation coefficient (between Desert's and Mountain's returns) is equal to 0.5 What is the standard deviation of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts