Question: I need the answer as soon as possible 2. Consider that Microsoft stocks closed at $90.375 per share in the New York Stock Exchange on

I need the answer as soon as possible

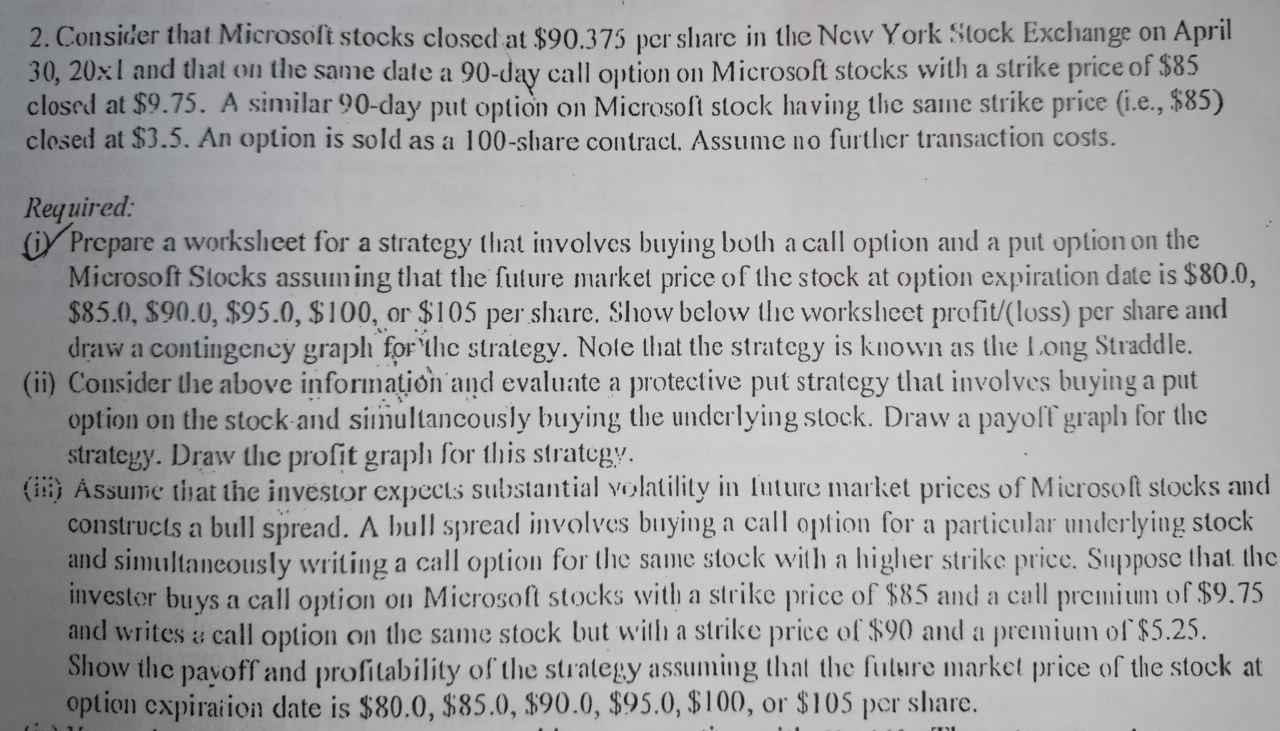

2. Consider that Microsoft stocks closed at $90.375 per share in the New York Stock Exchange on April 30, 20xl and that on the same date a 90-day call option on Microsoft stocks with a strike price of $85 closed at $9.75. A similar 90-day put option on Microsoft stock having the same strike price (i.e., $85) closed at $3.5. An option is sold as a 100-share contract. Assume no further transaction costs. Required: Prepare a worksheet for a strategy that involves buying both a call option and a put option on the Microsoft Stocks assuming that the future market price of the stock at option expiration date is $80.0, $85.0, $90.0, $95.0, $100, or $105 per share. Show below the worksheet profit/(loss) per share and draw a contingency graph for the strategy. Note that the strategy is known as the Long Straddle. (ii) Consider the above infornaion and evaluate a protective put strategy that involves buying a puit option on the stock and simultancously buying the underlying stock. Draw a payoff graph for the strategy. Draw the profit grapl for this strategy. (II) Assume that the investor expects substantial volatility in Buture market prices of Microsoft stocks and constructs a bull spread. A bull spread involves buying a call option for a particular underlying stock and simultaneously writing a call option for the same stock with a higher strike price. Suppose that the invester buys a call option on Microsoft stocks with a strike price of $85 and a call premium of $9.75 and writes a call option on the same stock but with a strike price of $90 and a premium of $5.25. Show the payoff and profitability of the strategy assuming that the future market price of the stock at option expiraiion date is $80.0, $85.0, $90.0, $95.0, $100, or $105 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts