Question: I need the answer as soon as possible Junior Ltd had a tax loss of $500,000 from previous years. On 1 July of the current

I need the answer as soon as possible

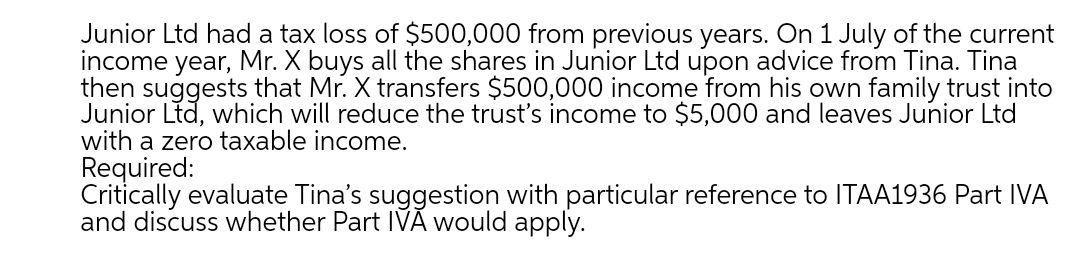

Junior Ltd had a tax loss of $500,000 from previous years. On 1 July of the current income year, Mr. X buys all the shares in Junior Ltd upon advice from Tina. Tina then suggests that Mr.X transfers $500,000 income from his own family trust into Junior Ltd, which will reduce the trust's income to $5,000 and leaves Junior Ltd with a zero taxable income. Required: Critically evaluate Tina's suggestion with particular reference to ITAA1936 Part IVA and discuss whether Part IVA would apply

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock