Question: I need the answer as soon as possible net tax Votron Enterprises is considering whether to lease or buy some special manufacturing equipment to be

I need the answer as soon as possible

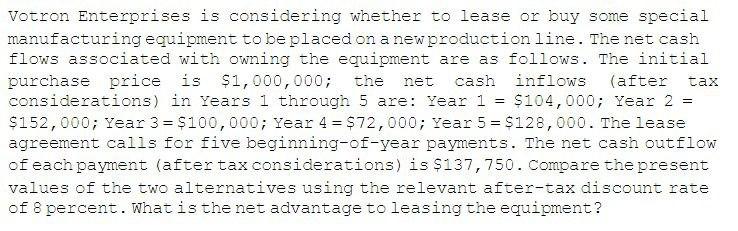

net tax Votron Enterprises is considering whether to lease or buy some special manufacturing equipment to be placed on a new production line. The net cash flows associated with owning the equipment are as follows. The initial purchase price is $1,000,000; the cash inflows (after considerations) in Years 1 through 5 are: Year 1 = $104,000; Year 2 = $152,000; Year 3 = $100,000; Year 4 = $72,000; Year 5 = $128,000. The lease agreement calls for five beginning-of-year payments. The net cash outflow of each payment (after tax considerations) is $137,750. Compare the present values of the two alternatives using the relevant after-tax discount rate of 8 percent. What is the net advantage to leasing the equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts