Question: I need the answer as soon as possible Q3: NPV versus IRR: Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow

I need the answer as soon as possible

I need the answer as soon as possible

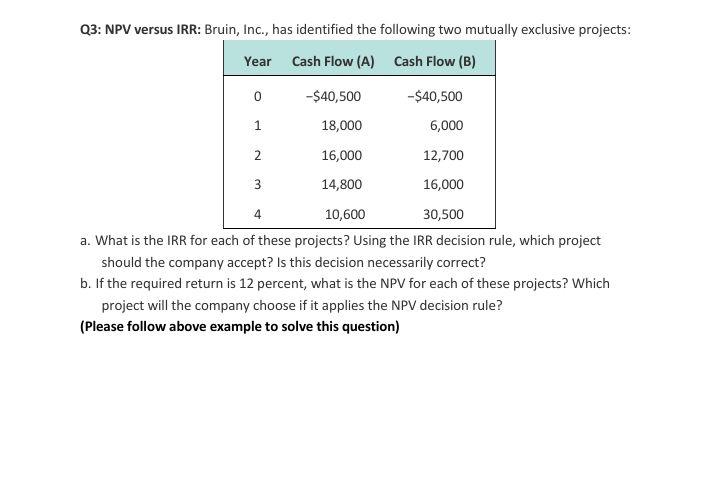

Q3: NPV versus IRR: Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$40,500 -$40,500 18,000 1 6,000 3 2 16,000 12,700 14,800 16,000 4 10,600 30,500 a. What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? b. If the required return is 12 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule? (Please follow above example to solve this question)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock