Question: I need the answer as soon as possible TABLE 3.2 Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by

I need the answer as soon as possible

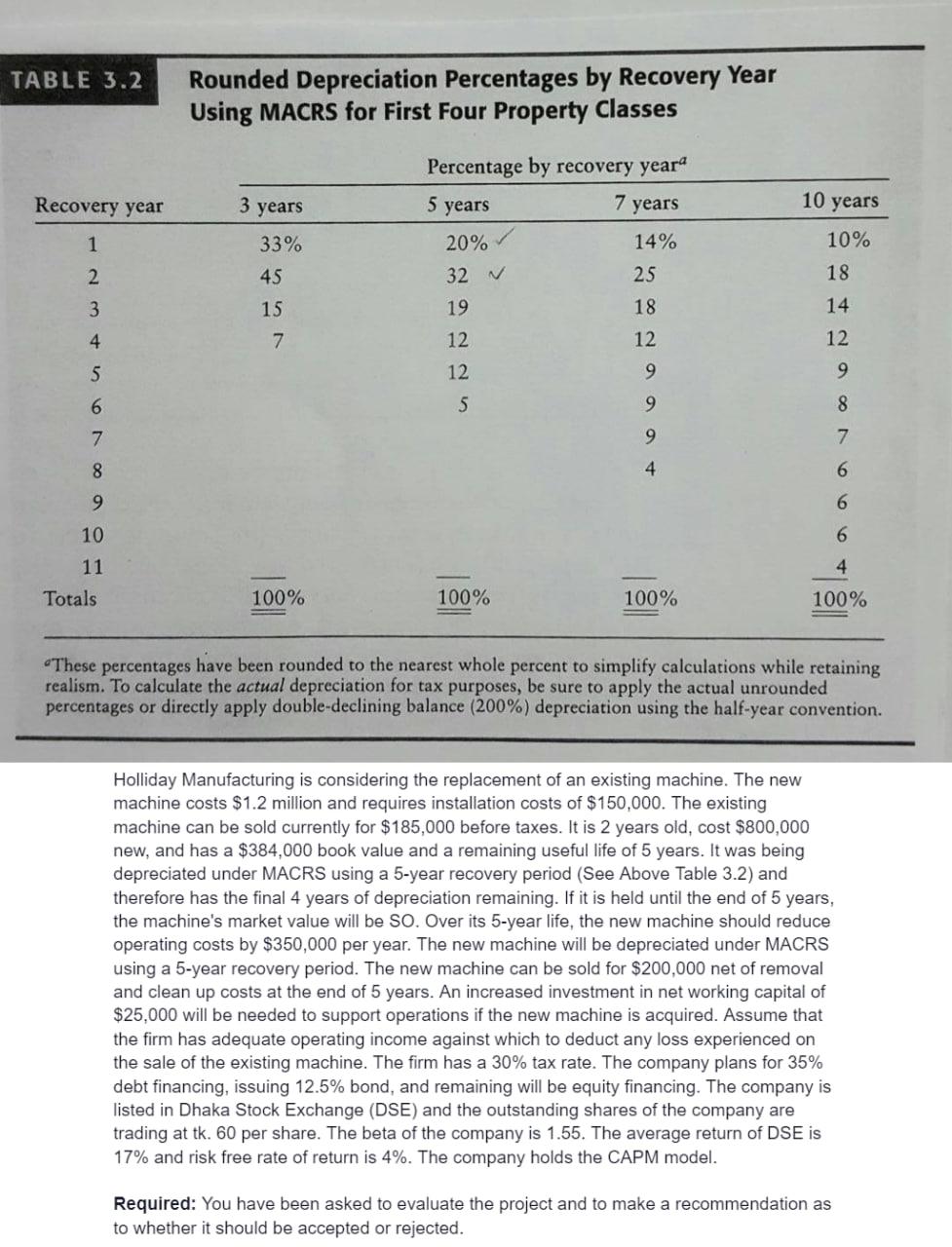

TABLE 3.2 Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year 7 years Recovery year 3 years 5 years 10 years 1 33% 20% 10% 14% 25 2 45 32 v 18 3 15 19 18 14 4 7 12 12 12 12 5 6 8299 9 4 9 5 8 7 7 8 6 6 9 10 6 4 11 Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. Holliday Manufacturing is considering the replacement of an existing machine. The new machine costs $1.2 million and requires installation costs of $150,000. The existing machine can be sold currently for $185,000 before taxes. It is 2 years old, cost $800,000 new, and has a $384,000 book value and a remaining useful life of 5 years. It was being depreciated under MACRS using a 5-year recovery period (See Above Table 3.2) and therefore has the final 4 years of depreciation remaining. If it is held until the end of 5 years, the machine's market value will be SO. Over its 5-year life, the new machine should reduce operating costs by $350,000 per year. The new machine will be depreciated under MACRS using a 5-year recovery period. The new machine can be sold for $200,000 net of removal and clean up costs at the end of 5 years. An increased investment in net working capital of $25,000 will be needed to support operations if the new machine is acquired. Assume that the firm has adequate operating income against which to deduct any loss experienced on the sale of the existing machine. The firm has a 30% tax rate. The company plans for 35% debt financing, issuing 12.5% bond, and remaining will be equity financing. The company is listed in Dhaka Stock Exchange (DSE) and the outstanding shares of the company are trading at tk. 60 per share. The beta of the company is 1.55. The average return of DSE is 17% and risk free rate of return is 4%. The company holds the CAPM model. Required: You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. TABLE 3.2 Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year 7 years Recovery year 3 years 5 years 10 years 1 33% 20% 10% 14% 25 2 45 32 v 18 3 15 19 18 14 4 7 12 12 12 12 5 6 8299 9 4 9 5 8 7 7 8 6 6 9 10 6 4 11 Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. Holliday Manufacturing is considering the replacement of an existing machine. The new machine costs $1.2 million and requires installation costs of $150,000. The existing machine can be sold currently for $185,000 before taxes. It is 2 years old, cost $800,000 new, and has a $384,000 book value and a remaining useful life of 5 years. It was being depreciated under MACRS using a 5-year recovery period (See Above Table 3.2) and therefore has the final 4 years of depreciation remaining. If it is held until the end of 5 years, the machine's market value will be SO. Over its 5-year life, the new machine should reduce operating costs by $350,000 per year. The new machine will be depreciated under MACRS using a 5-year recovery period. The new machine can be sold for $200,000 net of removal and clean up costs at the end of 5 years. An increased investment in net working capital of $25,000 will be needed to support operations if the new machine is acquired. Assume that the firm has adequate operating income against which to deduct any loss experienced on the sale of the existing machine. The firm has a 30% tax rate. The company plans for 35% debt financing, issuing 12.5% bond, and remaining will be equity financing. The company is listed in Dhaka Stock Exchange (DSE) and the outstanding shares of the company are trading at tk. 60 per share. The beta of the company is 1.55. The average return of DSE is 17% and risk free rate of return is 4%. The company holds the CAPM model. Required: You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts