Question: I need the answer as soon as possible This approach compares the carrying amount of assets and liabilities in the financial statements to their tax

I need the answer as soon as possible

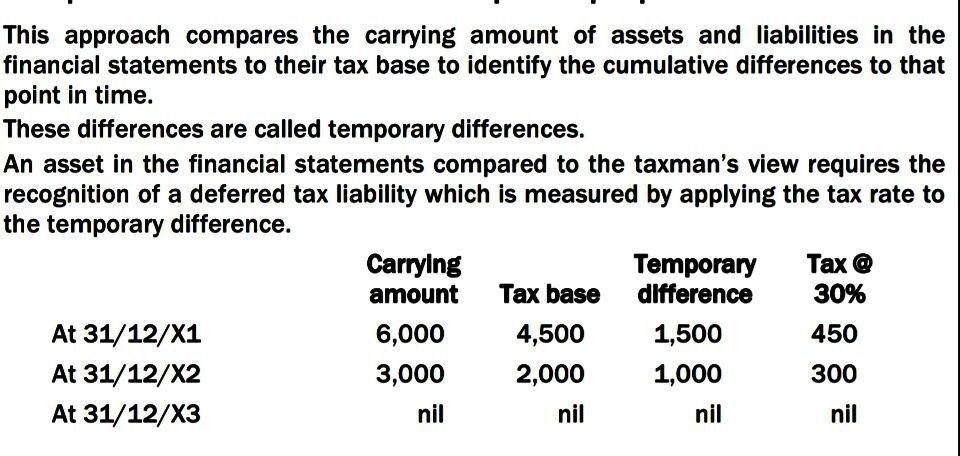

This approach compares the carrying amount of assets and liabilities in the financial statements to their tax base to identify the cumulative differences to that point in time. These differences are called temporary differences. An asset in the financial statements compared to the taxman's view requires the recognition of a deferred tax liability which is measured by applying the tax rate to the temporary difference. Carrying Temporary Tax @ amount Tax base difference 30% At 31/12/X1 6,000 4,500 1,500 450 At 31/12/X2 3,000 2,000 1,000 300 At 31/12/X3 nil nil nil nil This approach compares the carrying amount of assets and liabilities in the financial statements to their tax base to identify the cumulative differences to that point in time. These differences are called temporary differences. An asset in the financial statements compared to the taxman's view requires the recognition of a deferred tax liability which is measured by applying the tax rate to the temporary difference. Carrying Temporary Tax @ amount Tax base difference 30% At 31/12/X1 6,000 4,500 1,500 450 At 31/12/X2 3,000 2,000 1,000 300 At 31/12/X3 nil nil nil nil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts