Question: I need the answer for these two questions what about it? 14. What price would you pay for a 21 May 2023 bond on 1

I need the answer for these two questions

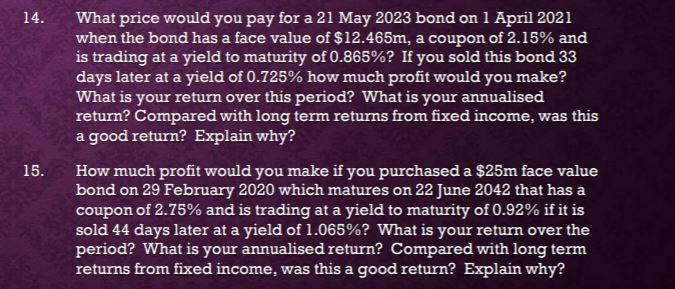

14. What price would you pay for a 21 May 2023 bond on 1 April 2021 when the bond has a face value of $12.465m, a coupon of 2.15% and is trading at a yield to maturity of 0.865%? If you sold this bond 33 days later at a yield of 0.725% how much profit would you make? What is your return over this period? What is your annualised return? Compared with long term returns from fixed income, was this a good return? Explain why? How much profit would you make if you purchased a $25m face value bond on 29 February 2020 which matures on 22 June 2042 that has a coupon of 2.75% and is trading at a yield to maturity of 0.92% if it is sold 44 days later at a yie of 1.065%? What is your return over the period? What is your annualised return? Compared with long term returns from fixed income, was this a good return? Explain why? 15. 14. What price would you pay for a 21 May 2023 bond on 1 April 2021 when the bond has a face value of $12.465m, a coupon of 2.15% and is trading at a yield to maturity of 0.865%? If you sold this bond 33 days later at a yield of 0.725% how much profit would you make? What is your return over this period? What is your annualised return? Compared with long term returns from fixed income, was this a good return? Explain why? How much profit would you make if you purchased a $25m face value bond on 29 February 2020 which matures on 22 June 2042 that has a coupon of 2.75% and is trading at a yield to maturity of 0.92% if it is sold 44 days later at a yie of 1.065%? What is your return over the period? What is your annualised return? Compared with long term returns from fixed income, was this a good return? Explain why? 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts