Question: Once started, this test must be completed in one sitting Do not leave the test before clicking Save and Submit. mpletion Remaining Time: 1 hour,

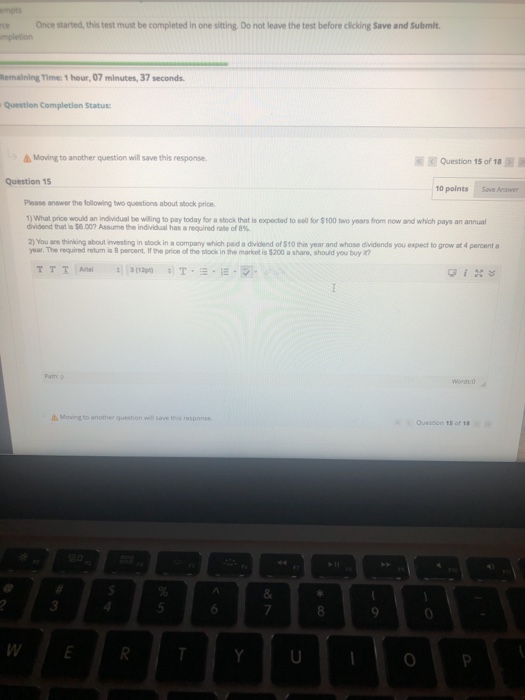

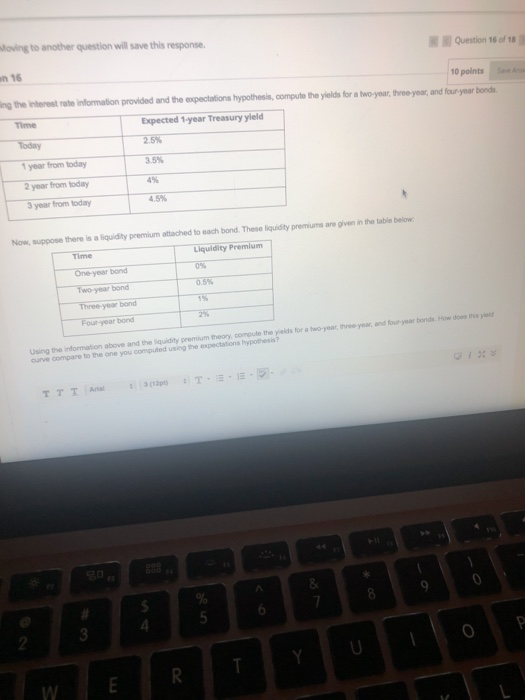

Once started, this test must be completed in one sitting Do not leave the test before clicking Save and Submit. mpletion Remaining Time: 1 hour, 07 minutes, 37 seconds. Question Completion Status: Moving to another question will save this response. Question 15 of 18 Question 15 10 points Save Answer Please answer the following two questions about stock prio 1) What price would an individual be willing to pay today for a stock that is expected to sell for $100 two years from now and which pays an annual dividend that is $8.007 Assume the individual has a required rate of 8% 2) You are thinking about investing in stock in a company which paid a dividend of S10 this year and whose dividends you expect to grow at 4 percenta year. The required retum is 8 percent. If the price of the stock in the market is $200 a shame, should you buy i 30 Words Moving to another question will saves response Quo 15 of 18 3 & 7 8 E Moving to another question will save this response Question 16 of 18 16 10 points ing the interest rate Information provided and the expectations hypothesis, compute the yields for a two-year, three year, and four year bonds Time Expected 1-year Treasury yleld Today 2.5% 1 year from today 2 year from today 45 45 year from today Now suppose there is a liquidity premium attached to each bond. These liquidity premiums are given in the table below Time Liquidity Premium One year bond O Two year bond 059 Three year bond Four year bond Using the formation above and the liquidity premium theory, comote the yoks for a two-year theyear, and bondsHow does this une compare to the one you computed using the expectations hypothes TTTA 8 7 5 3 0 U R W E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts