Question: I need the answer from u , if u dont do , pls dont summit ur answer , thank CULMINATING ACTIVITY (10% of the course

I need the answer from u , if u dont do , pls dont summit ur answer , thank

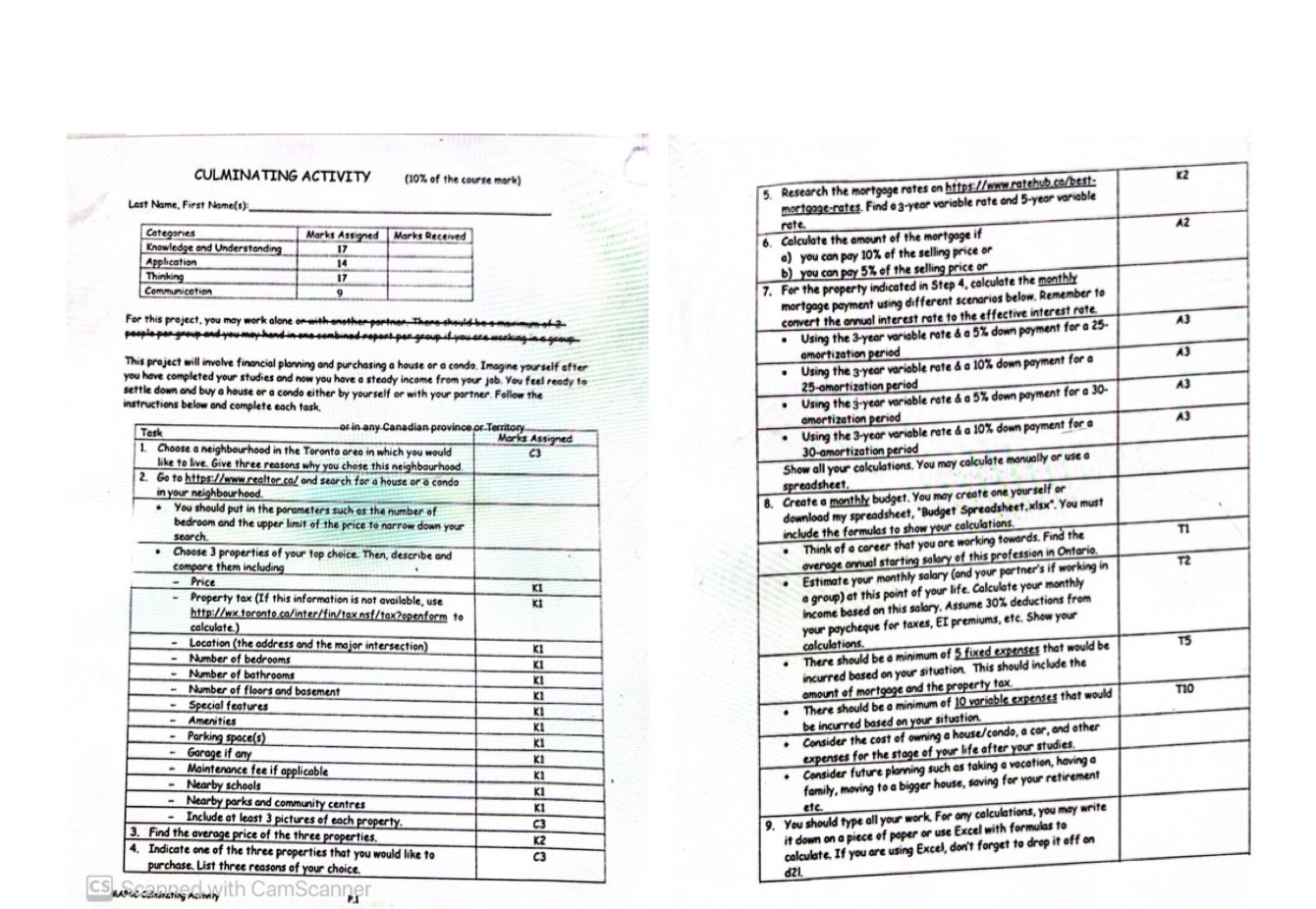

CULMINATING ACTIVITY (10% of the course mark) K2 Research the mortgage rates on https://www.ratehub.co/best- Last Name, First Name(s) mortgage rates. Find a 3-year variable rate and 5-year variable rate Categories Marks Assigned Marks Received 6. Calculate the amount of the mortgage if Knowledge and Understanding 17 Application a) you can pay 10% of the selling price or Thinking b) you can pay 5% of the selling price or Communication 7. For the property indicated in Step 4, calculate the monthly mortgage payment using different scenarios below, Remember to For this project, you may work alone or convert the annual interest rate to the effective interest rate. up and you may hand in e Using the 3-year variable rate & a 5% down payment for a 25- amortization period 43 This project will involve financial planning and purchasing a house or a condo. Imagine yourself after Using the 3-year variable rate & a 10% down payment for a you have completed your studies and now you have a steady income from your job, You feel ready to settle down and buy a house or a condo either by yourself or with your partner. Follow the 25-amortization period 43 instructions below and complete each task. Using the 3-year variable rate & a 5% down payment for a 30- amortization period 43 Task or in any Canadian province or Territory Marks Assigned Using the 3-year variable rate & a 10% down payment for a Choose a neighbourhood in the Toronto area in which you would 30-amortization period like to live. Give three reasons why you chose this neighbourhood. Show all your calculations. You may calculate manually or use a Go to https:/ /www.realtor.ca/ and search for a house or a condo in your neighbour hood. spreadsheet 8. Create a monthly budget. You may create one yourself or You should put in the parameters such as the number of download my spreadsheet, "Budget Spreadsheet.xlsx". You must bedroom and the upper limit of the price to narrow down your search. include the formulas to show your calculations. TI Think of a career that you are working towards. Find the Choose 3 properties of your top choice. Then, describe and average annual starting salary of this profession in Ontario. T2 compare them including Price Estimate your monthly salary (and your partner's if working in a group) at this point of your life. Calculate your monthly Property tax (If this information is not available, use KI income based on this salary, Assume 30% deductions from http://wx toronto ca/inter/fin/tax.nsf/tax?openform to calculate.) your paycheque for taxes, EI premiums, etc. Show your Location (the address and the major intersection) calculations. T5 - Number of bedrooms There should be a minimum of 5 fixed expenses that would be - Number of bathrooms incurred based on your situation. This should include the - Number of floors and basement amount of mortgage and the property tax. T10 Special features There should be a minimum of 10 variable expenses that would - Amenities be incurred based on your situation. - Parking space(s) Consider the cost of owning a house/condo, a car, and other Garage if any expenses for the stage of your life after your studies - Maintenance fee if applicable Consider future planning such as taking a vacation, having a - Nearby schools family, moving to a bigger house, saving for your retirement - Nearby parks and community centres etc. - Include at least 3 pictures of each property 9. You should type all your work. For any calculations, you may write 3. Find the average price of the three properties, it down on a piece of paper or use Excel with formulas to 4. Indicate one of the three properties that you would like to calculate. If you are using Excel, don't forget to drop it off on purchase. List three reasons of your choice. d21 csuscannedwith CamScanner