Question: i need the answer quickly . 15. A portfolio has the following position Greeks: delta = -300, gamma = -150, and vega = - 3,000.

i need the answer quickly

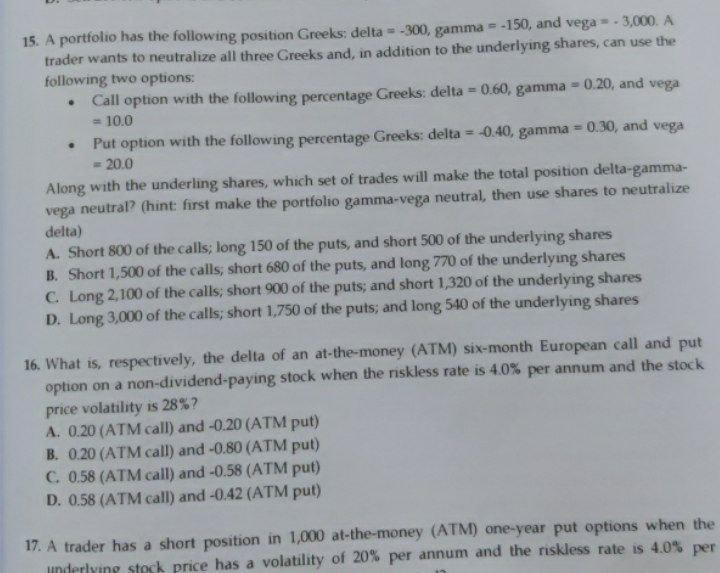

. 15. A portfolio has the following position Greeks: delta = -300, gamma = -150, and vega = - 3,000. A trader wants to neutralize all three Greeks and, in addition to the underlying shares, can use the following two options: Call option with the following percentage Greeks: delta = 0.60. gamma = 0.20, and vega - 10.0 Put option with the following percentage Greeks: delta = -0.40, gamma = 0.30, and vega = 20.0 Along with the underling shares, which set of trades will make the total position delta-gamma- vega neutral? (hint first make the portfolio gamma-vega neutral, then use shares to neutralize delta) A. Short 800 of the calls; long 150 of the puts, and short 500 of the underlying shares B. Short 1,500 of the calls, short 680 of the puts, and long 770 of the underlying shares C Long 2,100 of the calls; short 900 of the puts, and short 1,320 of the underlying shares D. Long 3,000 of the calls; short 1,750 of the puts; and long 540 of the underlying shares 16. What is, respectively, the delta of an at-the-money (ATM) six-month European call and put option on a non-dividend-paying stock when the riskless rate is 4.0% per annum and the stock price volatility is 28%? A. 0.20 (ATM call) and -0.20 (ATM put) B. 0.20 (ATM call) and -0.80 (ATM put) C. 0.58 (ATM call) and -0.58 (ATM put) D. 0.58 (ATM call) and -0.42 (ATM put) 17. A trader has a short position in 1,000 at-the-money (ATM) one-year put options when the underlying stock price has a volatility of 20% per annum and the riskless rate is 4.0% per

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts