Question: please explain how I can get the number in the green circle and what formula that is needed to be used to solve this. Thanks

please explain how I can get the number in the green circle and what formula that is needed to be used to solve this. Thanks a lot. I will uovote if the answer is correct.

please explain how I can get the number in the green circle and what formula that is needed to be used to solve this. Thanks a lot. I will uovote if the answer is correct.

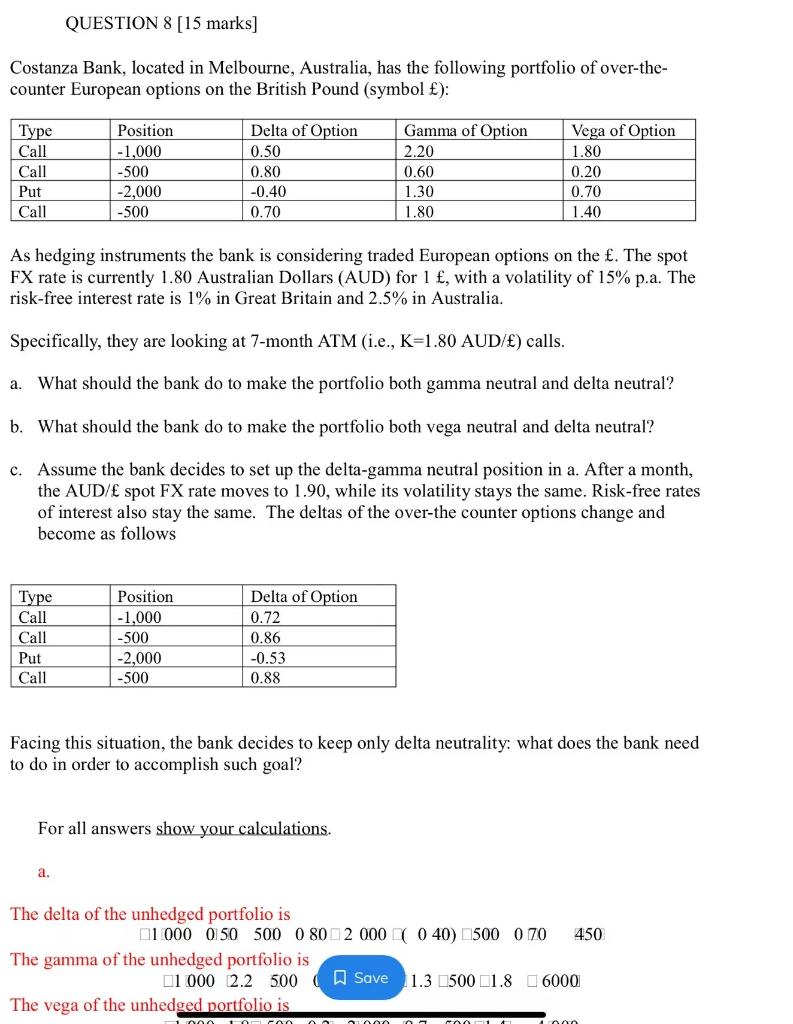

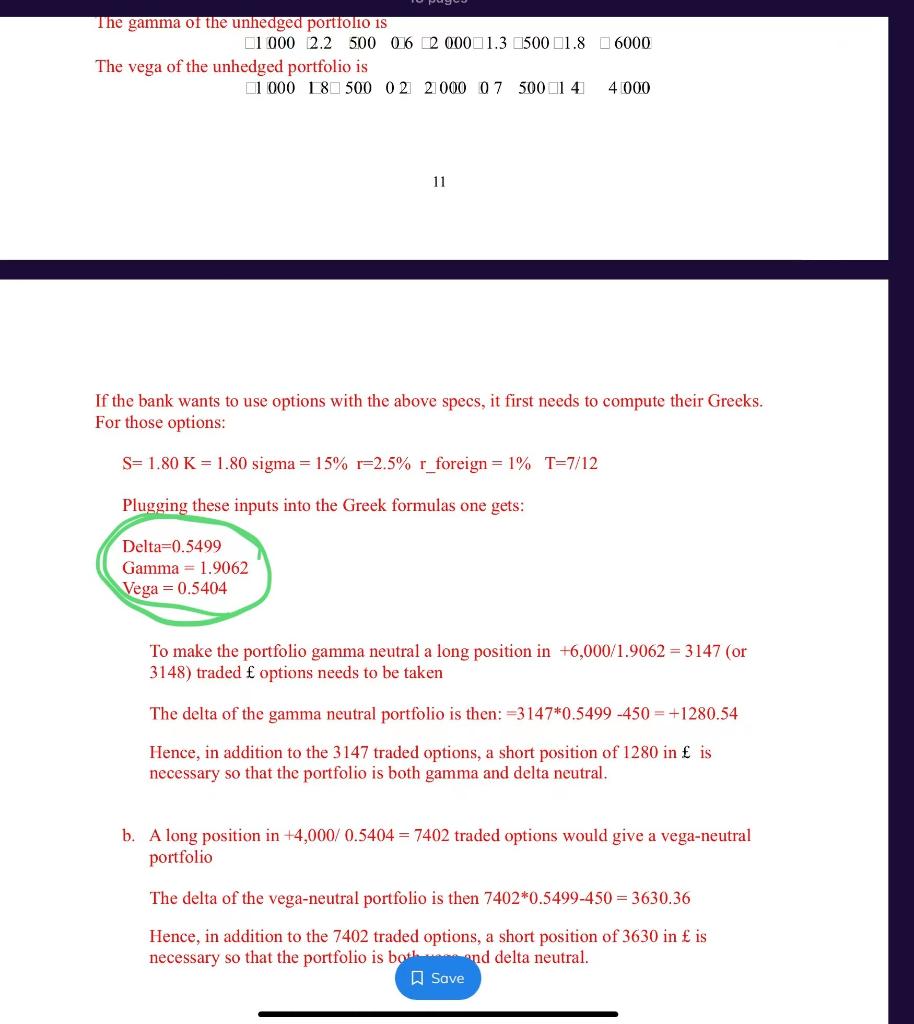

QUESTION 8 [15 marks] Costanza Bank, located in Melbourne, Australia, has the following portfolio of over-the- counter European options on the British Pound (symbol ): Type Position Delta of Option Gamma of Option 2.20 Vega of Option 1.80 Call -1,000 0.50 Call -500 0.80 0.60 0.20 Put -2,000 -0.40 1.30 0.70 Call -500 0.70 1.80 1.40 As hedging instruments the bank is considering traded European options on the . The spot FX rate is currently 1.80 Australian Dollars (AUD) for 1 , with a volatility of 15% p.a. The risk-free interest rate is 1% in Great Britain and 2.5% in Australia. Specifically, they are looking at 7-month ATM (i.e., K=1.80 AUD/) calls. a. What should the bank do to make the portfolio both gamma neutral and delta neutral? b. What should the bank do to make the portfolio both vega neutral and delta neutral? c. Assume the bank decides to set up the delta-gamma neutral position in a. After a month, the AUD/ spot FX rate moves to 1.90, while its volatility stays the same. Risk-free rates of interest also stay the same. The deltas of the over-the counter options change and become as follows Type Position Delta of Option Call -1,000 0.72 Call -500 0.86 Put -2,000 -0.53 Call -500 0.88 Facing this situation, the bank decides to keep only delta neutrality: what does the bank need to do in order to accomplish such goal? For all answers show your calculations. a. The delta of the unhedged portfolio is 1 000 050 500 0 80 2 000(040) 500 0 70 450 The gamma of the unhedged portfolio is 1000 2.2 500Save 11.3500 1.8 6000 The vega of the unhedged portfolio is 1.000 1020000 30000 500-14 4.000 The gamma of the unhedged portfolio is 1000 2.2 500 06 2 000 1.3500 1.86000 The vega of the unhedged portfolio is 1000 18 500 0 2 2000 0 7 50014] 4 000 11 If the bank wants to use options with the above specs, it first needs to compute their Greeks. For those options: S= 1.80 K = 1.80 sigma = 15% r-2.5% r_foreign = 1% [=7/12 Plugging these inputs into the Greek formulas one gets: Delta=0.5499 Gamma 1.9062 Vega=0.5404 To make the portfolio gamma neutral a long position in +6,000/1.9062-3147 (or 3148) traded options needs to be taken The delta of the gamma neutral portfolio is then: -3147*0.5499 -450=+1280.54 Hence, in addition to the 3147 traded options, a short position of 1280 in is necessary so that the portfolio is both gamma and delta neutral. b. A long position in +4,000/ 0.5404 = 7402 traded options would give a vega-neutral portfolio The delta of the vega-neutral portfolio is then 7402*0.5499-450=3630.36 Hence, in addition to the 7402 traded options, a short position of 3630 in is necessary so that the portfolio is both and delta neutral. Save QUESTION 8 [15 marks] Costanza Bank, located in Melbourne, Australia, has the following portfolio of over-the- counter European options on the British Pound (symbol ): Type Position Delta of Option Gamma of Option 2.20 Vega of Option 1.80 Call -1,000 0.50 Call -500 0.80 0.60 0.20 Put -2,000 -0.40 1.30 0.70 Call -500 0.70 1.80 1.40 As hedging instruments the bank is considering traded European options on the . The spot FX rate is currently 1.80 Australian Dollars (AUD) for 1 , with a volatility of 15% p.a. The risk-free interest rate is 1% in Great Britain and 2.5% in Australia. Specifically, they are looking at 7-month ATM (i.e., K=1.80 AUD/) calls. a. What should the bank do to make the portfolio both gamma neutral and delta neutral? b. What should the bank do to make the portfolio both vega neutral and delta neutral? c. Assume the bank decides to set up the delta-gamma neutral position in a. After a month, the AUD/ spot FX rate moves to 1.90, while its volatility stays the same. Risk-free rates of interest also stay the same. The deltas of the over-the counter options change and become as follows Type Position Delta of Option Call -1,000 0.72 Call -500 0.86 Put -2,000 -0.53 Call -500 0.88 Facing this situation, the bank decides to keep only delta neutrality: what does the bank need to do in order to accomplish such goal? For all answers show your calculations. a. The delta of the unhedged portfolio is 1 000 050 500 0 80 2 000(040) 500 0 70 450 The gamma of the unhedged portfolio is 1000 2.2 500Save 11.3500 1.8 6000 The vega of the unhedged portfolio is 1.000 1020000 30000 500-14 4.000 The gamma of the unhedged portfolio is 1000 2.2 500 06 2 000 1.3500 1.86000 The vega of the unhedged portfolio is 1000 18 500 0 2 2000 0 7 50014] 4 000 11 If the bank wants to use options with the above specs, it first needs to compute their Greeks. For those options: S= 1.80 K = 1.80 sigma = 15% r-2.5% r_foreign = 1% [=7/12 Plugging these inputs into the Greek formulas one gets: Delta=0.5499 Gamma 1.9062 Vega=0.5404 To make the portfolio gamma neutral a long position in +6,000/1.9062-3147 (or 3148) traded options needs to be taken The delta of the gamma neutral portfolio is then: -3147*0.5499 -450=+1280.54 Hence, in addition to the 3147 traded options, a short position of 1280 in is necessary so that the portfolio is both gamma and delta neutral. b. A long position in +4,000/ 0.5404 = 7402 traded options would give a vega-neutral portfolio The delta of the vega-neutral portfolio is then 7402*0.5499-450=3630.36 Hence, in addition to the 7402 traded options, a short position of 3630 in is necessary so that the portfolio is both and delta neutral. Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts