Question: i need the answer quickly year 2020 a Use the information provided in Table A and Table B to answer questions (1) to (11). (NOTE:

i need the answer quickly

i need the answer quickly

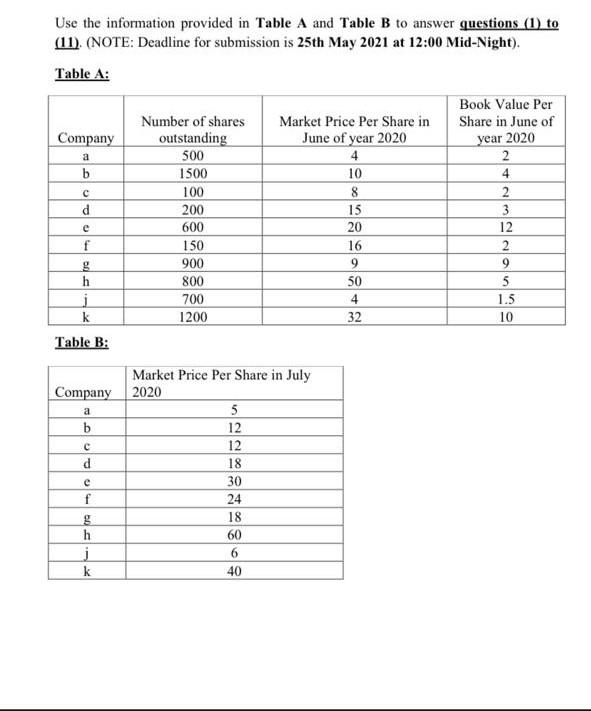

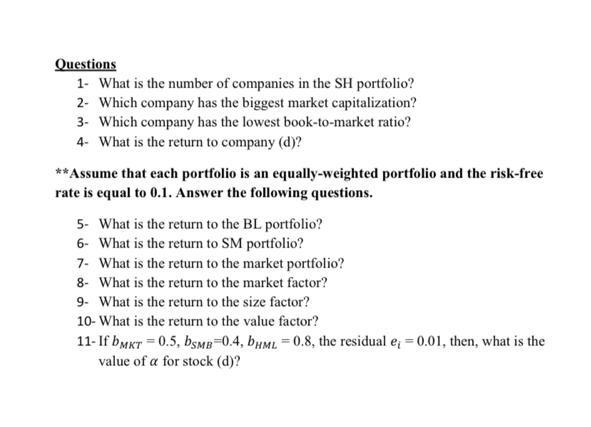

year 2020 a Use the information provided in Table A and Table B to answer questions (1) to (11). (NOTE: Deadline for submission is 25th May 2021 at 12:00 Mid-Night). Table A: Book Value Per Number of shares Market Price Per Share in Share in June of Company outstanding June of year 2020 500 4 2 b 1500 10 4 2 d 200 15 600 20 12 f 150 16 2 900 9 9 800 50 5 i 700 1.5 k 1200 32 10 Table B: 100 8 3 e g h 4 Company a b d Market Price Per Share in July 2020 5 12 12 18 30 24 18 60 6 40 e f g h j k Questions 1- What is the number of companies in the SH portfolio? 2. Which company has the biggest market capitalization? 3. Which company has the lowest book-to-market ratio? 4- What is the return to company (d)? **Assume that each portfolio is an equally-weighted portfolio and the risk-free rate is equal to 0.1. Answer the following questions. 5. What is the return to the BL portfolio? 6- What is the return to SM portfolio? 7. What is the return to the market portfolio? 8. What is the return to the market factor? 9. What is the return to the size factor? 10- What is the return to the value factor? 11- If bmkt = 0.5, bsme =0.4, bnmL = 0.8, the residual e; = 0.01, then, what is the value of a for stock (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts