Question: i need the answer you can see which is wrong 57% of available points - For transactions 13, review the unadjusted balance and prepare the

i need the answer you can see which is wrong

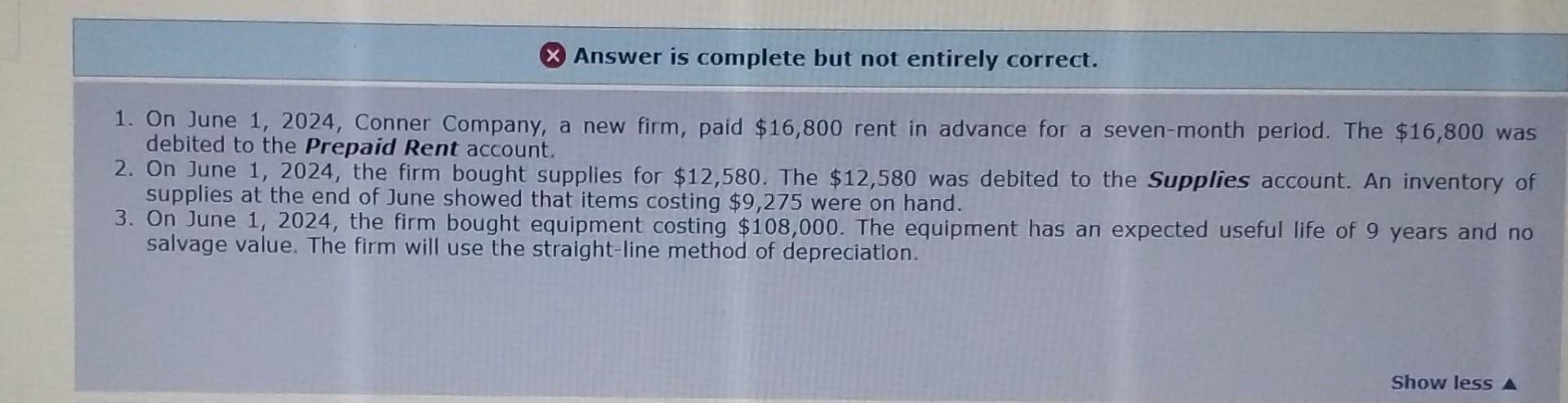

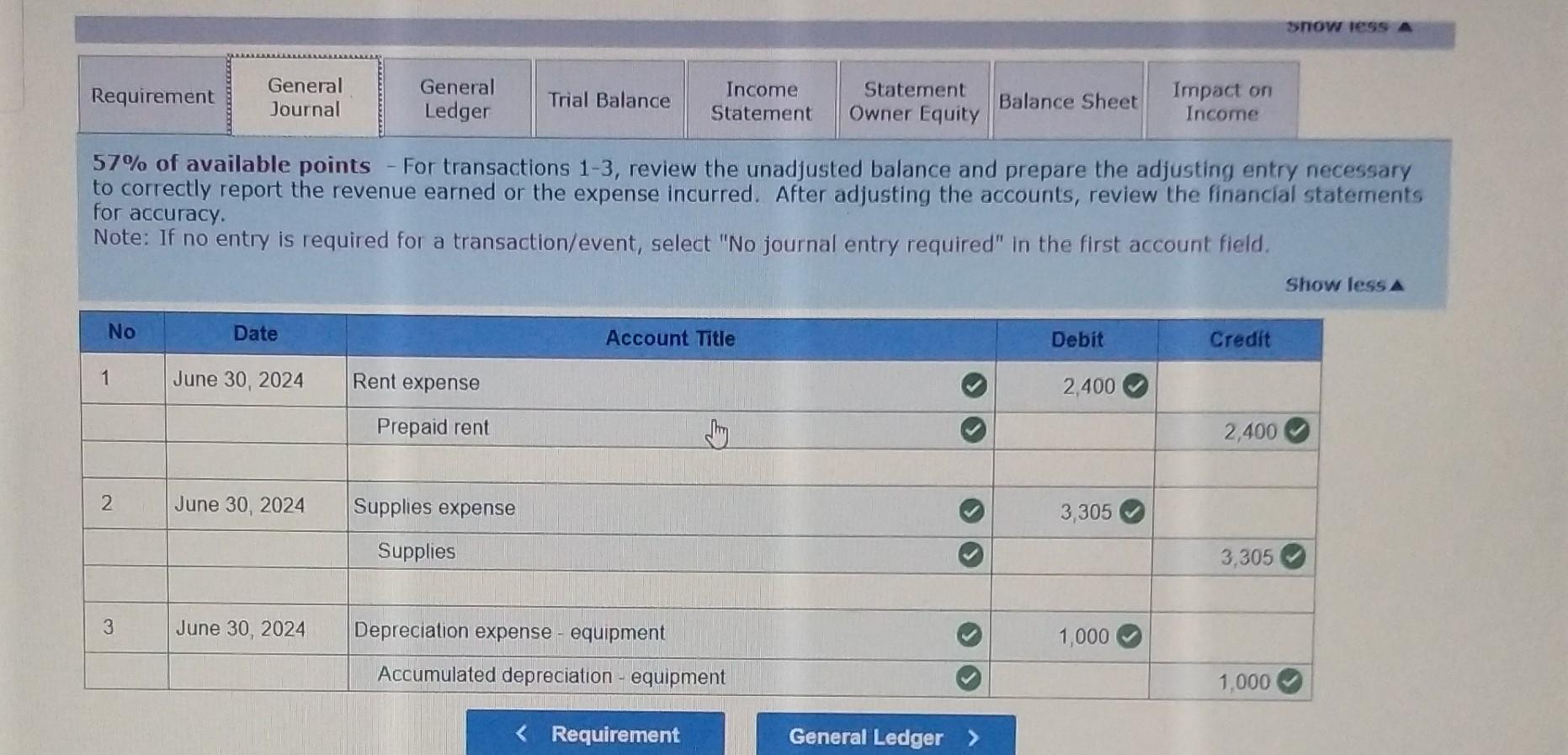

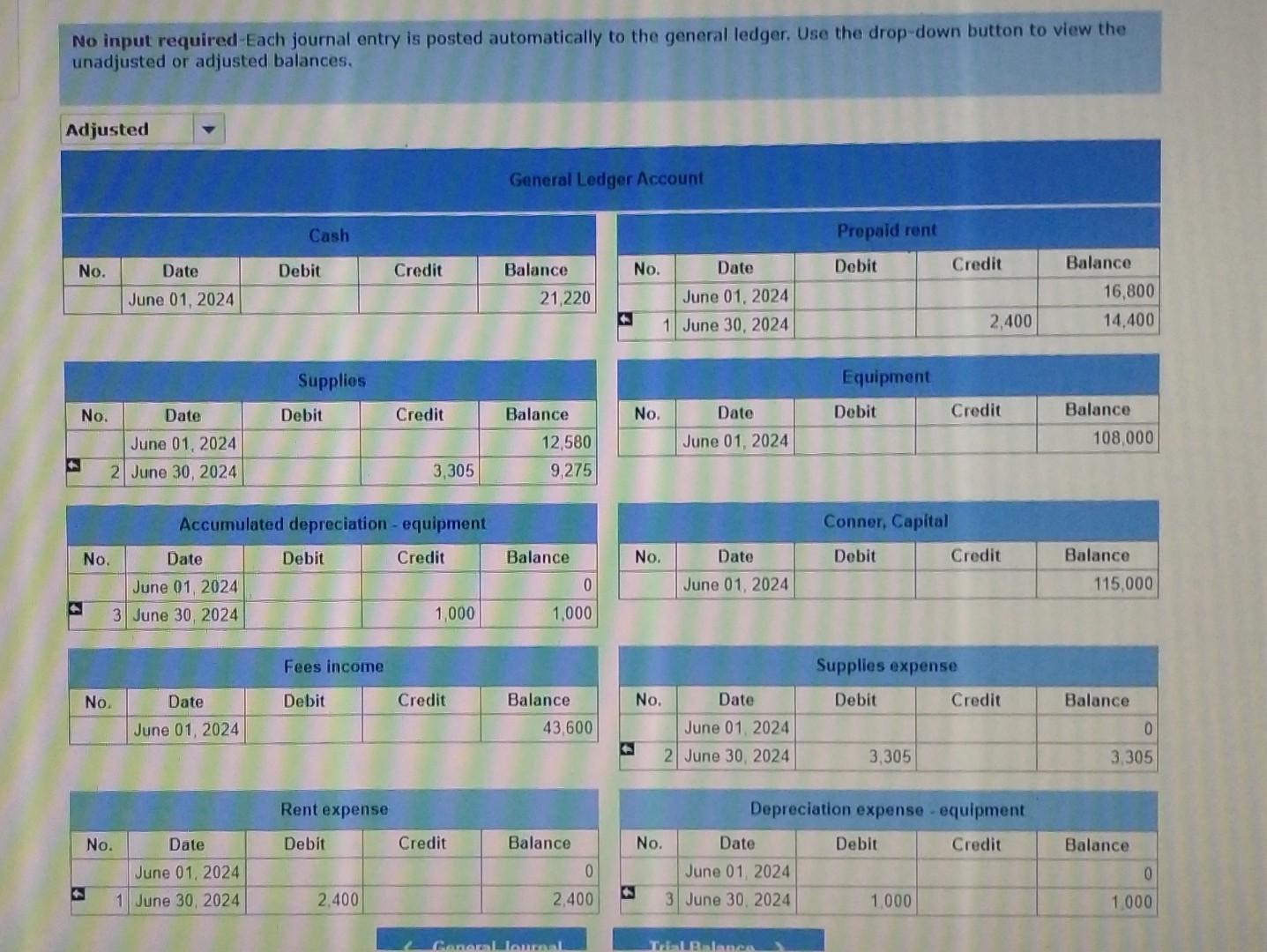

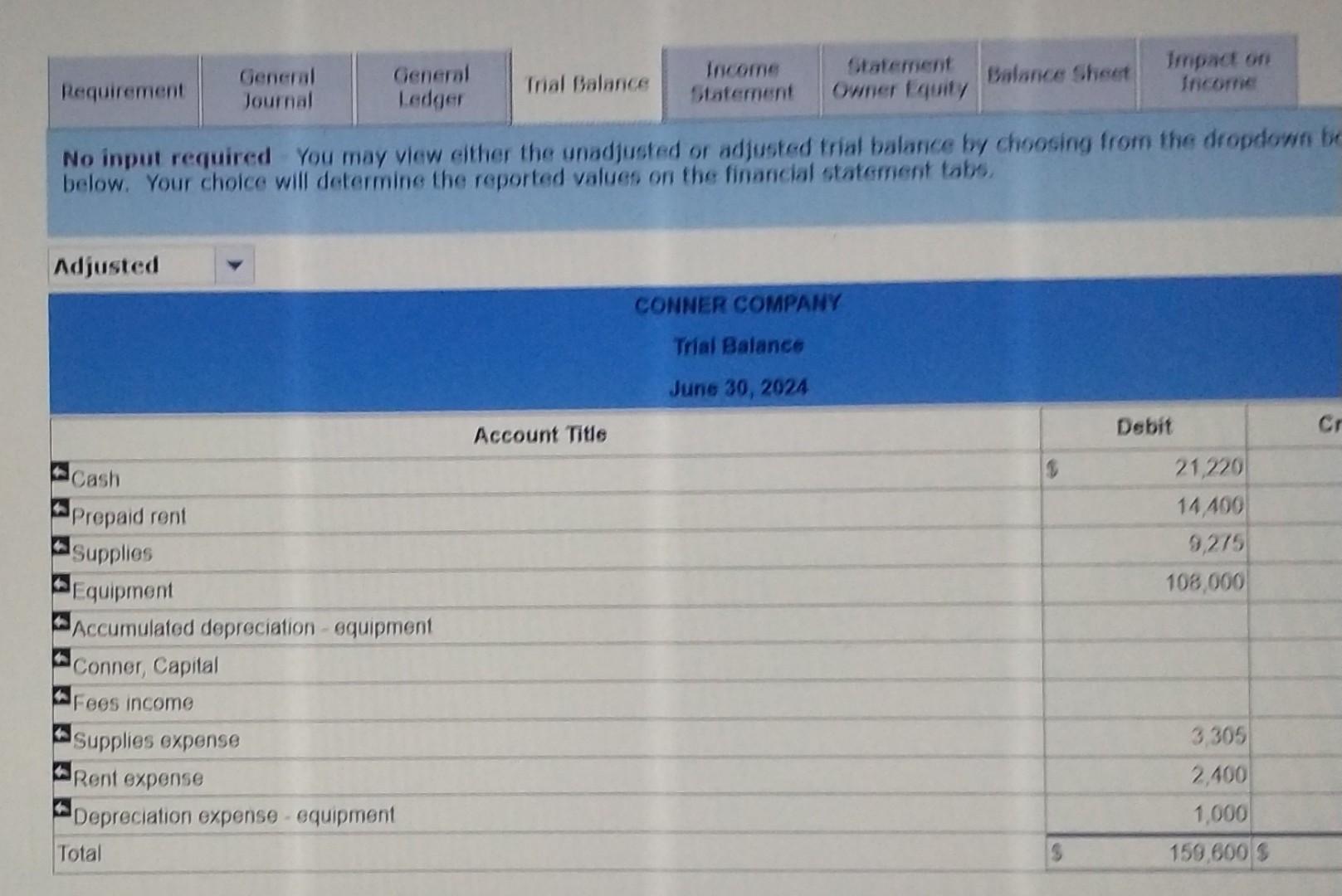

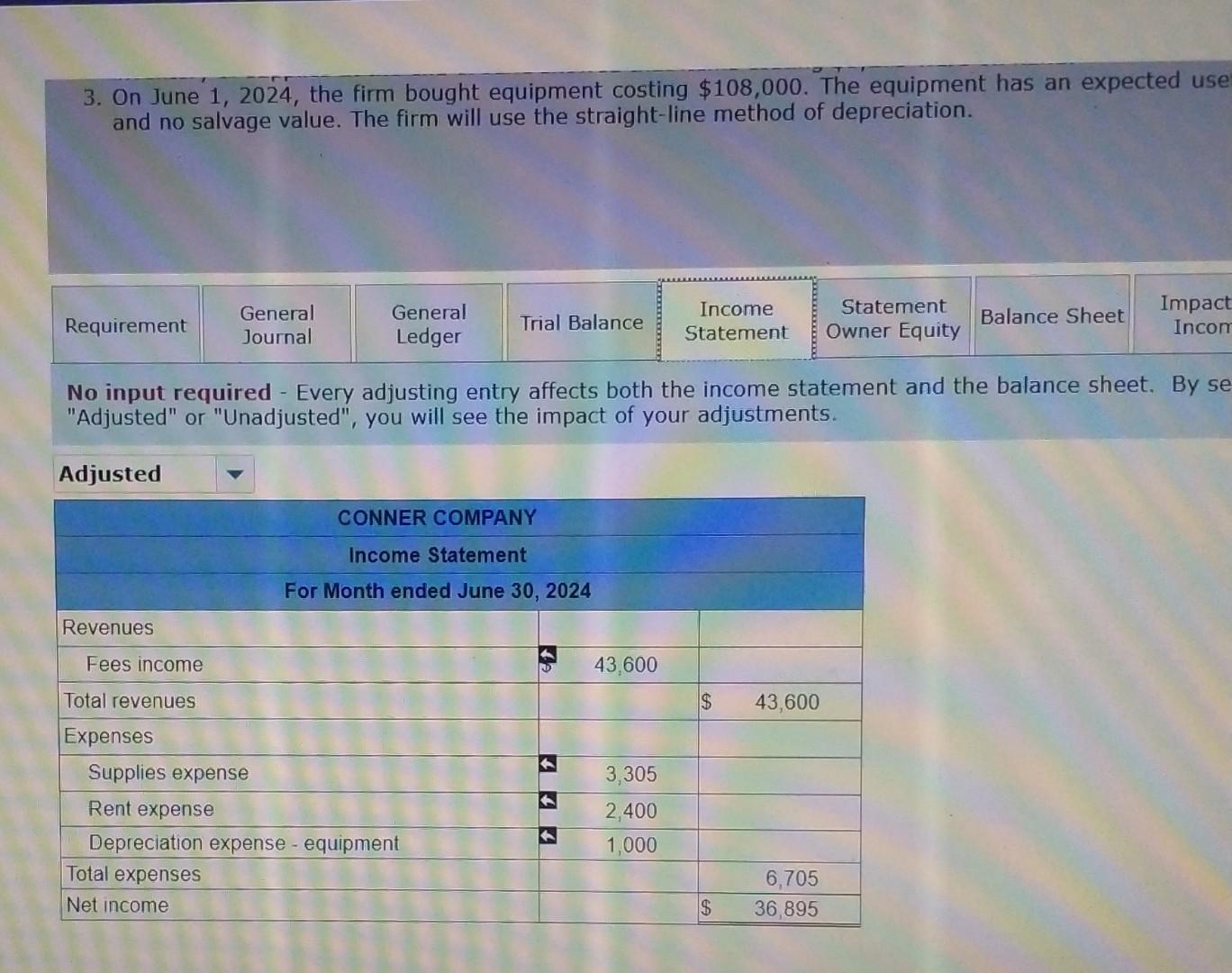

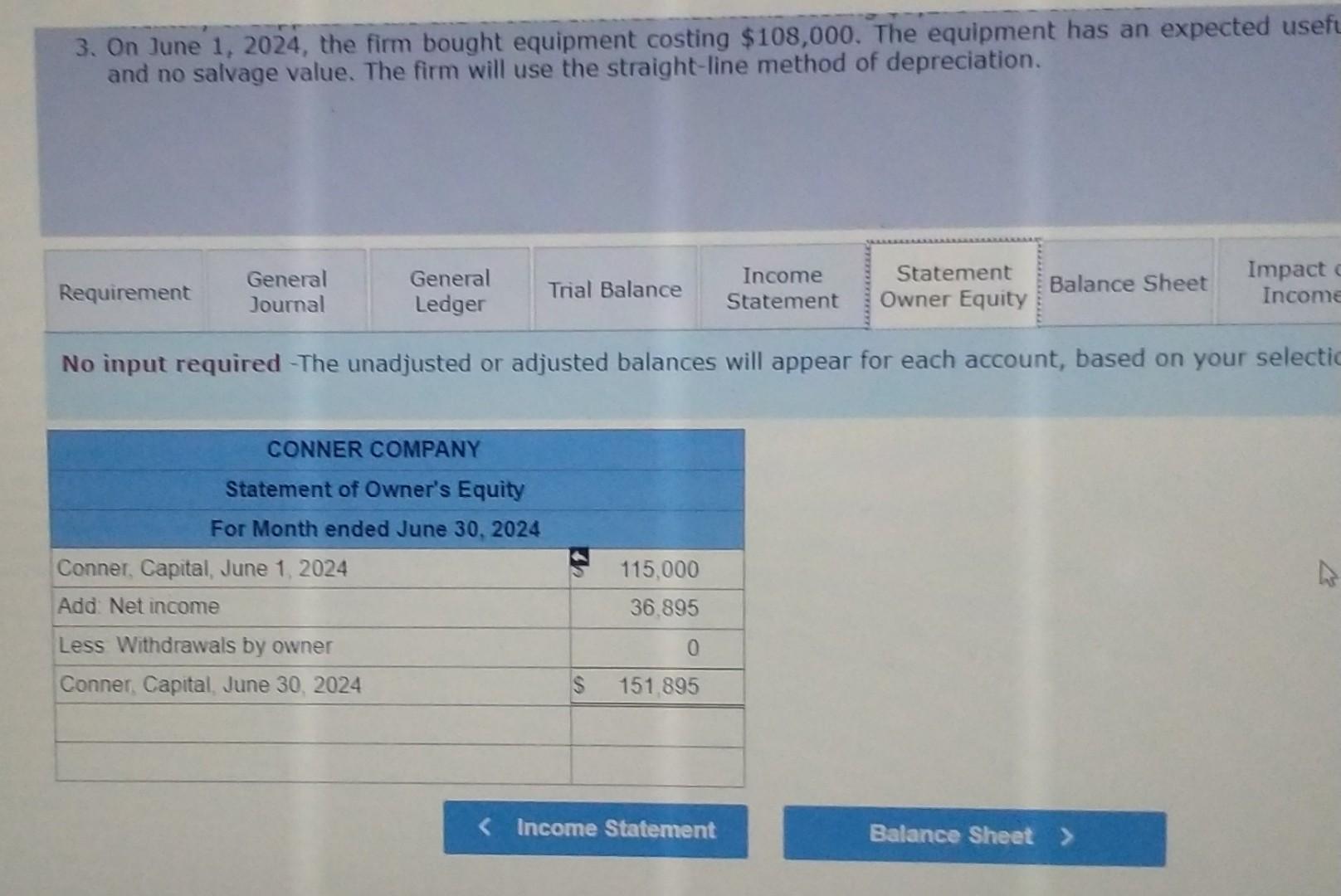

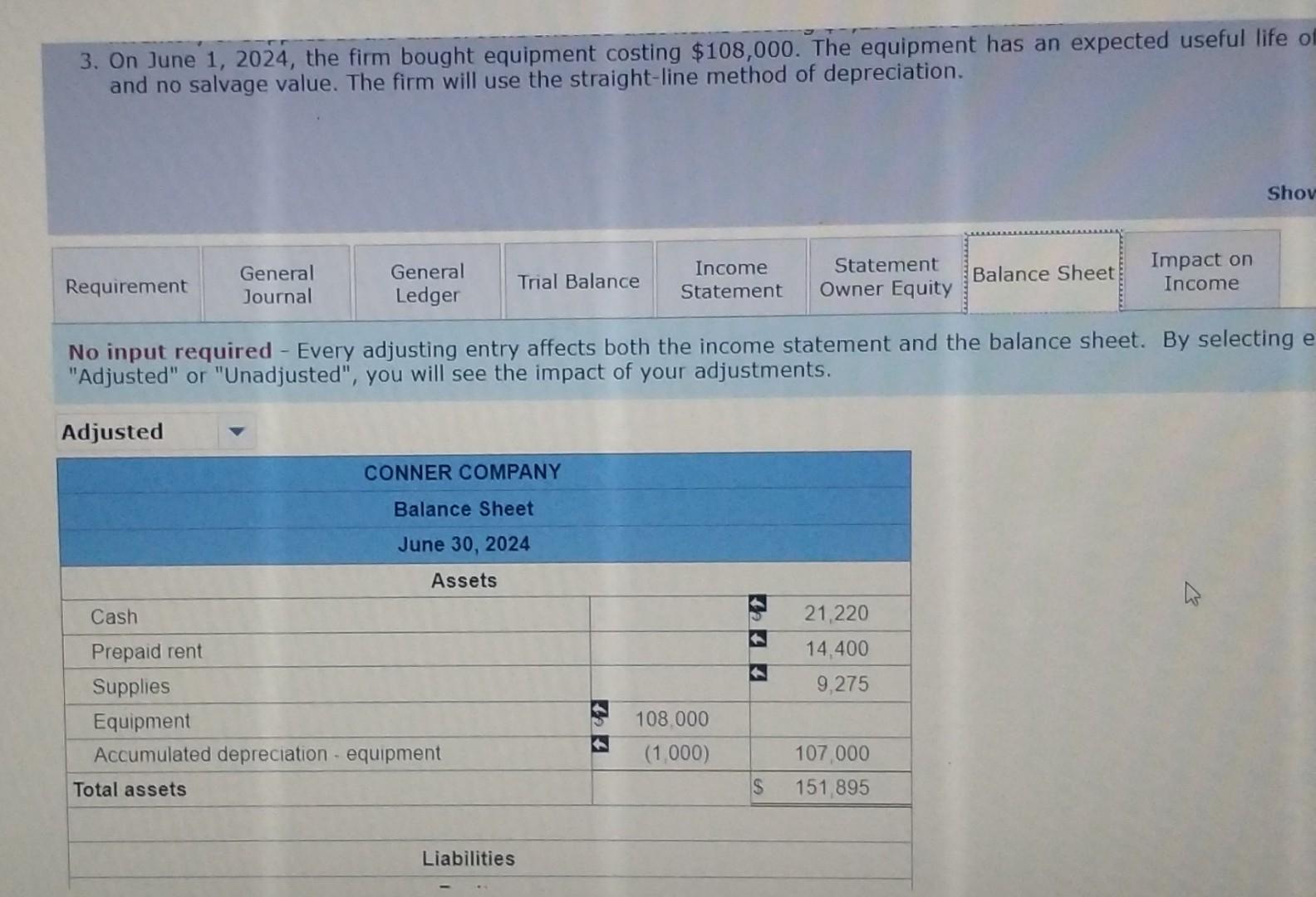

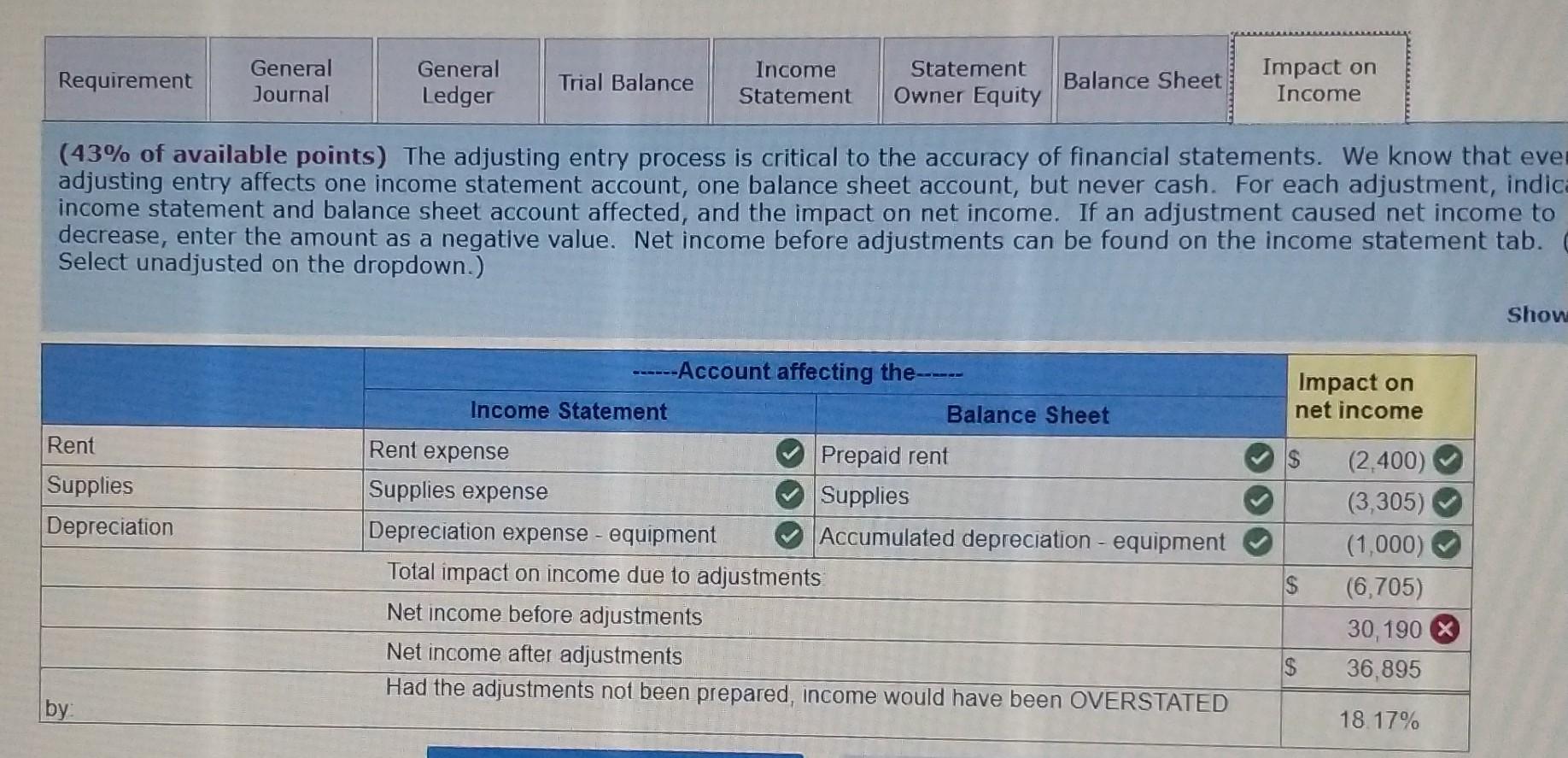

57% of available points - For transactions 13, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurred. After adjusting the accounts, review the financial statements for accuracy. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. (43\% of available points) The adjusting entry process is critical to the accuracy of financial statements. We know that eve adjusting entry affects one income statement account, one balance sheet account, but never cash. For each adjustment, indic income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. Select unadjusted on the dropdown.) 3. On June 1 , 2024, the firm bought equipment costing $108,000. The equipment has an expected use and no salvage value. The firm will use the straight-line method of depreciation. No input required - Every adjusting entry affects both the income statement and the balance sheet. By se "Adjusted" or "Unadjusted", you will see the impact of your adjustments. Answer is complete but not entirely correct. 1. On June 1,2024 , Conner Company, a new firm, paid $16,800 rent in advance for a seven-month period. The $16,800 was debited to the Prepaid Rent account. 2. On June 1,2024 , the firm bought supplies for $12,580. The $12,580 was debited to the Supplies account. An inventory of supplies at the end of June showed that items costing $9,275 were on hand. 3. On June 1,2024 , the firm bought equipment costing $108,000. The equipment has an expected useful life of 9 years and no salvage value. The firm will use the straight-line method of depreciation. No input required You may vicw either the unadjusted or adjusted trial balance by choosing from the dropdown below. Your choice will determine the reported values on the financial statement tabs. 3. On June 1,2024 , the firm bought equipment costing $108,000. The equipment has an expected usef and no salvage value. The firm will use the straight-line method of depreciation. No input required -The unadjusted or adjusted balances will appear for each account, based on your selecti No input required-Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted or adjusted balances. 3. On June 1,2024 , the firm bought equipment costing $108,000. The equipment has an expected useful life of and no salvage value. The firm will use the straight-line method of depreciation. No input required - Every adjusting entry affects both the income statement and the balance sheet. By selecting e "Adjusted" or "Unadjusted", you will see the impact of your adjustments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts