Question: i need the calculation process Please practice the following problems carefully as well: 1 Bond Valuation. Callaghan Motor's bonds have 10 years remaining to maturity.

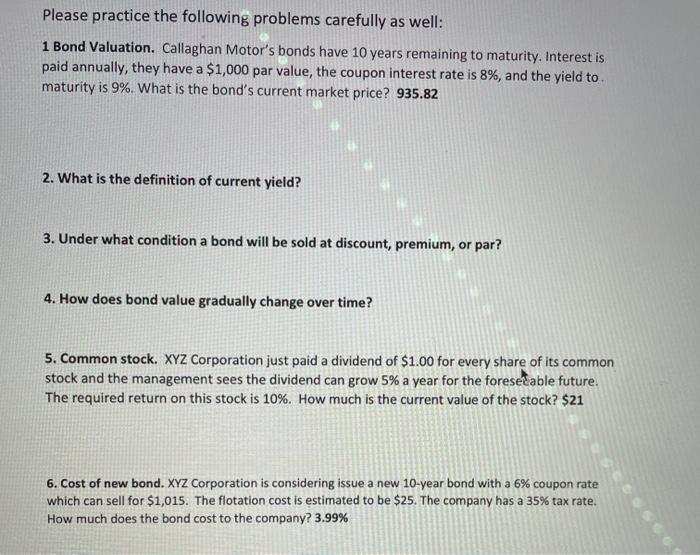

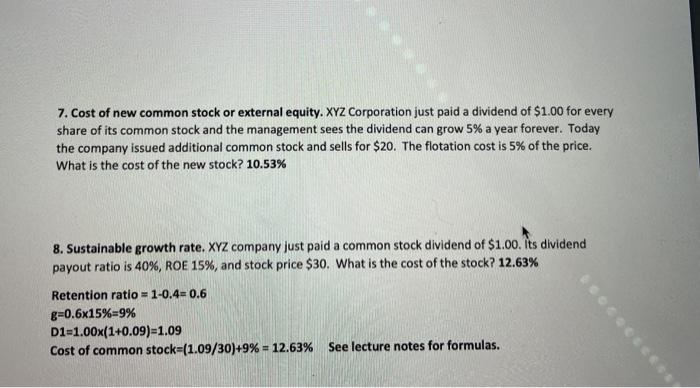

Please practice the following problems carefully as well: 1 Bond Valuation. Callaghan Motor's bonds have 10 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 8%, and the yield to maturity is 9%. What is the bond's current market price? 935.82 2. What is the definition of current yield? 3. Under what condition a bond will be sold at discount, premium, or par? 4. How does bond value gradually change over time? 5. Common stock. XYZ Corporation just paid a dividend of $1.00 for every share of its common stock and the management sees the dividend can grow 5% a year for the foresetable future. The required return on this stock is 10%. How much is the current value of the stock? $21 6. Cost of new bond. XYZ Corporation is considering issue a new 10-year bond with a 6% coupon rate which can sell for $1,015. The flotation cost is estimated to be $25. The company has a 35% tax rate. How much does the bond cost to the company? 3.99% 7. Cost of new common stock or external equity.XYZ Corporation just paid a dividend of $1.00 for every share of its common stock and the management sees the dividend can grow 5% a year forever. Today the company issued additional common stock and sells for $20. The flotation cost is 5% of the price. What is the cost of the new stock? 10.53% 8. Sustainable growth rate. XYZ company just paid a common stock dividend of $1.00. Its dividend payout ratio is 40%, ROE 15%, and stock price $30. What is the cost of the stock? 12.63% Retention ratio=1-0.4= 0.6 g=0.6x15%=9% D1=1.00x(1+0.09)=1.09 Cost of common stock=(1.09/30)+9% = 12.63% See lecture notes for formulas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts