Question: i need the easier answer steps thank you that's all what I have 5) YIELD CURVE FOR ZERO COUPON BONDS RATED AA Maturity 1 YTM

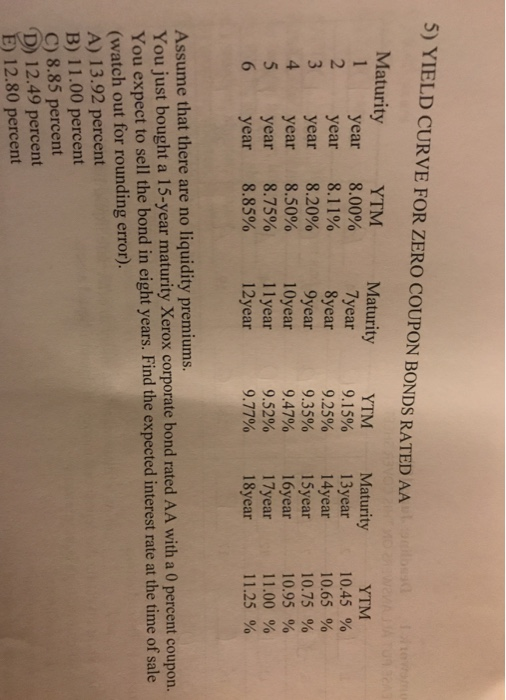

5) YIELD CURVE FOR ZERO COUPON BONDS RATED AA Maturity 1 YTM Maturity YTM 7year 8year 9year 10year 11year 12year Maturity 13year 14year 15year 16year 17year 18year YTM year 8.00% 9.15% 9.25% 9.35% 10.45 % 2 8.11% 8.20% year 10.65 % 3 year 10.75 % 10.95 % 4 8.50% 8.75% 8.85% year 9.47% 5 11.00% 9.52% 9.77% year 6 year 11.25 % Assume that there are no liquidity premiums. You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error). A) 13.92 percent B) 11.00 percent C) 8.85 percent D) 12.49 percent E) 12.80 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts